For good or ill, there are two main drivers that determine what the stock market does in the short-term, the trade war, and what the Fed is expected to do with short-term interest rates.

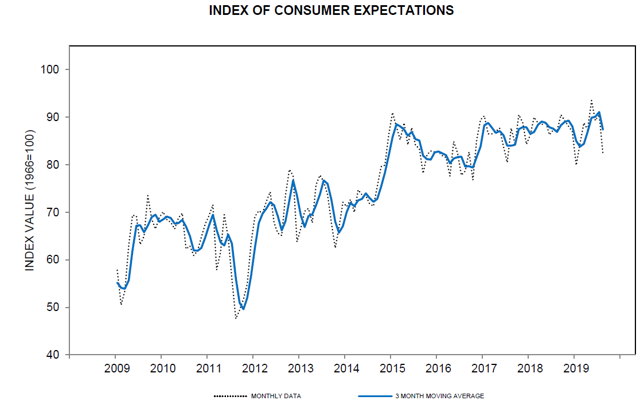

Over the past year, the S&P 500 has had some major swings over these two issues, including the largest correction in a decade, and the strongest start to the year since 1987.

(Source: Ycharts)

Both of these extreme swings in stock prices were the result of the trade war and interest rate sentiment shifting rapidly, from positive to negative, and back again (several times).

On Friday morning, Fed Chairman Jerome Powell is scheduled to speak at the annual Jackson Hole economic symposium, which the stock (and bond) markets will be eagerly watching. So let’s take a look at what the financial markets want the Fed to say, what Powell is likely to actually say, and what investors should do ahead of this make or break speech, at least as far as short-term market movements are concerned.

Here is What Wall Street Is Hoping The Fed Will Say

What upset the market about the Fed’s last press conference (resulting in about a 2% intraday swing to the negative), was Powell’s statement that the 25 basis point rate cut was just a “mid-cycle correction”. That means the Fed isn’t changing its long-term outlook on the economy, for roughly 2% growth each year and 2% core inflation.

The market was hoping for a January style pivot, in which the Fed went from expecting up to three rate hikes in 2019 to none. Specifically, the bond market is now signaling that financial markets are VERY concerned about recession risk and want the Fed to signal that it’s entering a long-term rate cutting cycle.

For example, James Bianco, President of Bianco Research, recently warned that if Powell doesn’t ameliorate the market’s fears over insufficient easing

“We could see another plunge in (treasury interest) rates. We could see further movement down in yields and the yield curve and more volatility and problems in the (stock) markets. He should move aggressively.”

What’s more, Mr. Bianco thinks that Powell should telegraph that the Fed is open to a 50 bp cut in September, purely because US rates are now so much higher than in other developed countries.

“We’re the only place on the planet now you can get more than a 2% yield among developed countries…Powell should probably open the door for the possibility of a 50 basis point cut at the September meeting… If he does move more aggressively with a 50 basis point cut, I think the market will respond most positively to that.”

And as Quincy Krosby, chief market strategist at Prudential Financial, explains

“What the market wants is clearly that he moves away from the ‘midcycle adjustment’ commentary and transition toward an easing cycle.”

But what the market wants and what Powell is actually likely to say might be very different things.

Here is What Powell is Likely To Say and What it Means For Stocks

While it’s impossible to know in advance what Powell will do, or how stocks will react, we can look to recent precedent for a reasonable high-probability guide.

In January the Fed responded to high financial stress during the December correction with a massive dovish shift. Specifically, the Fed emphasized rising risks in conference calls and official statements, and Powell stated specifically the Fed would be monitoring economic data closely and cut rates as many times (and buy bonds if the FFR hit zero) to keep the longest economic expansion in US history going.

I fully expect the Fed will try to appease the market’s concerns with Powell

- taking a dovish tone, emphasizing that while the economy is decently strong for now, risks are rising and the Fed is monitoring financial conditions closely

- reiterating that it will follow the data but do WHATEVER is necessary to avert recession (including deep rate cuts and as much bond buying as is required should fundamentals deteriorate).

How will the market react? Well, most such speeches have seen the market “hear what it wants to hear”. The Fed hasn’t actually changed its policy, which is to follow the data and shift short-term rates as the facts say is reasonable and prudent to meet its dual mandate.

Various Fed officials have merely changed what they emphasize based on a reasonable goal of avoiding panicking Americans (that the “economic sky is falling”) but making sure the stock and bond markets understand the Fed isn’t ignoring risks like the inverted yield curve.

As Pramod Alturi, fixed income portfolio manager at Capital Group explains

“They don’t want to signal they’re worried about the economy because the economy is doing okay…I think they can do it. It’s going to be a tough communications challenge. The worry is when they try to tow the line, they end up being more hawkish than the market is looking for.”

Michelle Meyer, head of U.S. economics at Bank of America Merrill Lynch wants to hear Powell address the inverted yield curve, which actually occurred on May 23rd and has remained negative since then (the 10y-3m curve bankers keep close track of).

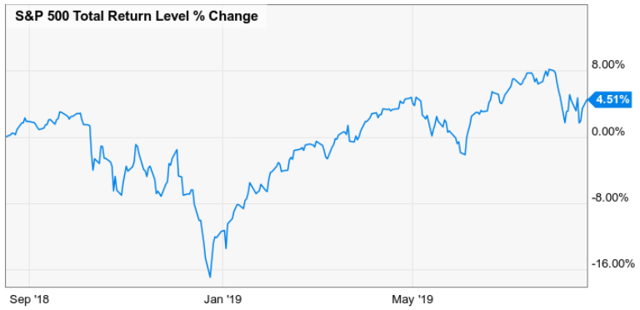

Bond Futures Rate Probabilities

(Source: CME Group)

As you can see the bond futures market is currently pricing in 100% probabilities that rates will go lower, which is supported by the current global and US economic data. It’s also what various Fed speakers have hinted at in previous weeks (two to three total insurance cuts).

The good news is as of August 19th the bond market (bond yields crashing now drag stocks down with it), is pricing in just 5% chance of a 50 bp cut in September (Fed Funds Rate is 200 to 225 bp right now). This minimizes the risk of a major stock and bond yield crash should Powell say a 50 bp cut isn’t warranted (it’s not).

The bad news is that the bond market is also pricing in an 80% chance of more than three insurance cuts (a total of 4), which is NOT supported by the economic data so far.

What’s more rate cuts, while stimulatory to the economy by about 0.1% to 0.15% within 12 months (in terms of GDP growth according to Moody’s), can also have negative effects on consumer sentiment.

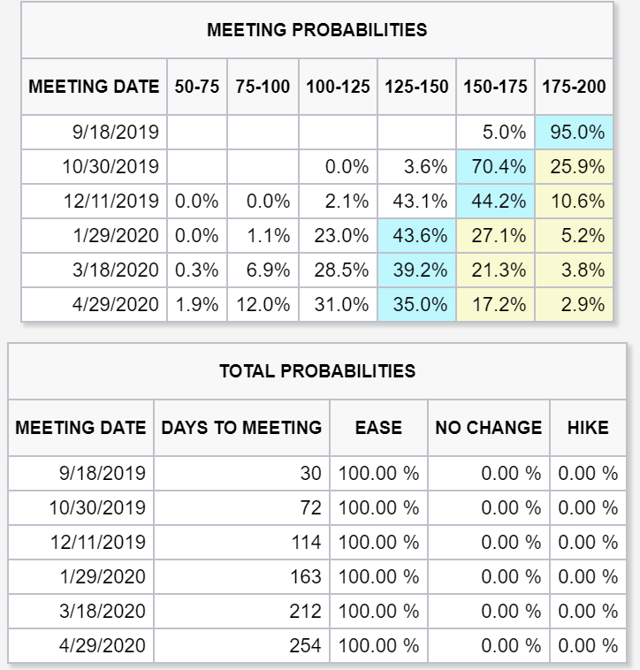

(Source: University Of Michigan)

The University of Michigan’s July consumer confidence survey, specifically the expectation index (which tracks how people think the economy will do in the future) suffered a major decline in July. According to Richard Curtin, chief economist of the survey, it was both increased trade war fears AND the first Fed rate cut in 10 years, that contributed to this decline in consumer confidence. Specifically, the media’s coverage of that cut which it spun to insinuate a recession is now far more likely than it actually is.

The good news is that current consumer spending (66% to 70% of US GDP growth) remains strong (retail sales growing nearly 5% YOY). The bad news is that a 50 bp rate cut in September would signal the Fed’s outlook is shifting from “the economy is generally strong and we’ll probably be OK” to “the time for emergency measures has arrived because without rapid and deep cuts recession is likely.”

“We have nothing to fear about a recession right now except for the fear of recession.” – Brian Moynihan, CEO Bank of America

As Bank of America’s CEO recently pointed out, the biggest risk of a recession isn’t that the trade war will hurt manufacturing/industrial sectors (just 25% of the economy), but rather that the media might spin recession risks out of proportion. A self-fulfilling prophecy in which we scare ourselves into recession is the biggest recession risk we face.

Which is why I expect Powell to attempt to walk a fine line, explaining that a recession is currently not the highest probability outcome (about 42% 12-month recession risk if yield curve persists at today’s levels), but that the Fed is willing to cut at a steady pace if needed.

Barring a major downturn in fundamentals that would mean a 25 bp cut every 6 to 12 weeks, potentially taking the Fed Funds rate to zero within a year (July 2020).

Here is What Prudent Investors Should Do

It’s important to remember that, despite what the recent “there is no alternative” or TINA/rate cut euphoria rally (through the end of July) might have you believe, stronger economic growth is actually good for stocks.

Other than producing income, stocks and bonds are NOTHING alike. They are totally separate asset classes, and their long-term prices are determined by a complex combination of factors. Bonds are very rate sensitive but ultimately priced by their own financial market where future growth prospects and inflation expectations dominate their long-term value.

In the long-term, stock prices are a function of earnings, cash flow, and dividend growth, all of which do better during periods of solid and consistent economic growth.

Fortunately, despite what its critics say, the Fed is a non-partisan group of economic policy wonks and data-driven nerds, who strive to make consistently prudent and reasonable evidence-based decisions about short-term interest rates.

Powell is likely to reiterate the exact same things he’s been saying for the last few months, but with an emphasis on rising global risks. The market will likely interpret this to mean more rate cuts on the way, possibly even a large 50 bp cut in September (which would NOT be a good thing).

Such an aggressive cut is likely to be uncalled for by the current economic data, and thus unlikely to actually happen. However, the good news for both stocks and the economy is that the Fed will carefully watch the incoming data, and likely if economic growth appears to be trending at sub 2%, keep cutting rates by 25 bp every 6 to 12 weeks.

That’s likely sufficient to avoid a recession, though we may be in for a weak 2020, both in terms of GDP growth and two years of flat corporate earnings growth.

So what’s a prudent long-term investor to do in today’s uncertain economic/policy climate?

- avoid the temptation to “do something” just because stocks are swinging wildly

- trust your long-term financial plan, which incorporates proper asset allocation, and stock risk management (focus on quality and the diversification, position sizing and sector weighting that’s best for your needs).

- Never fall for the media’s sucker game of hyping “huge” 3+% single-day swings or “the Dow’s 4th biggest point loss in history.” Since 1920 we’ve averaged a 3+% single-day decline once every 3 months (they are totally normal).

I am personally following the Fed’s lead and watching the economic data as it comes in on a weekly basis. Every two weeks I look at the aggregate data (on 19 leading indicators), and where they are relative to their historical baseline.

Based on that I tweak my monthly savings between stocks and bonds and determine whether to buy more cyclical or defensive deep value names. But I never touch what I already own, as long as the fundamental reason I bought each company remains intact.

This is certainly not a perfect investing system (no such thing exists), merely a reasonable and prudent one that fits my personal goal of maximizing safe and rising dividend income over time.

It’s also one that’s built off the Dividend Kings motto of “quality first, valuation second and proper risk management always.” This is how I’ve built my retirement portfolio, where I keep 100% of my life savings, into a bunker, which can ride out anything the economy or stock market throws at it over time.

SPY shares were trading at $292.23 per share on Wednesday morning, up $2.14 (+0.74%). Year-to-date, SPY has gained 18.02%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |