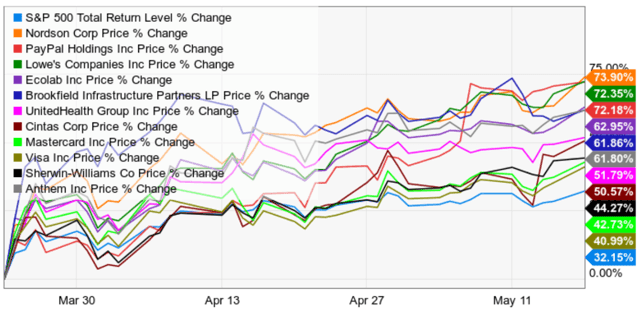

S&P 500 and Dividend Kings Phoenix Portfolio Companies Since March 23rd

(Source: Ycharts)

The red hot market rally off March 23rds lows continues with no signs of slowing down.

The S&P 500 is now up 32% in six weeks and individual companies, such as those that the Dividend Kings Phoenix Portfolio was buying aggressively in late March, are up far more.

After the fastest bear market in history, and the most volatile month for stocks ever (March) it sure feels good to see our portfolios leaping higher, sometimes by 12% in a single week.

But one of the best investment teams in America just sounded the warning about this rally ending relatively soon. In fact, Bank of America is now officially tactically bearish on stocks in the short-term.

Let’s look at why, and what you should and shouldn’t do to protect your portfolio in the coming weeks.

The 4 Reasons Why Bank of America is Bearish on Stocks

On May 15 Bank of America’s Research Committee has officially become “tactically bearish” on stocks citing four reasons they think a 10% correction might be coming soon.

- “A second wave of coronavirus outbreaks is a real risk, and the markets are not pricing in that risk.”

- “Investors are “flying blind,” given that more than 30% of S&P 500 companies have withdrawn forward-looking earnings guidance…the ratio of positive vs. negative sentiment on corporate earnings calls is the worst since 2012, making valuation and fundamental investing harder than ever.”

- “There’s a growing disconnect between Main Street and Wall Street, evidenced by the S&P 500 rallying 30% as more than 36 million Americans lost their jobs. This disconnect will only fuel a rise in populist politics ahead of the November election.”

- “The greatest risk” to equities, according to the analysts, is Congress being too slow to pass additional stimulus measures, especially with the congressional budget coming into focus this spring. More stimulus is necessary because “when companies and households are saving, only public spending can end a recession.” If Congress stalls, “a big market correction to 2,650 may be necessary to focus” its mind.”

It’s hard to argue with BAC Investment committees facts or reasoning, especially that stocks appear to be ignoring some of the worst economic data in history.

Why They Are Probably Correct… But Why They Could Also Be Wrong in the Short-Term

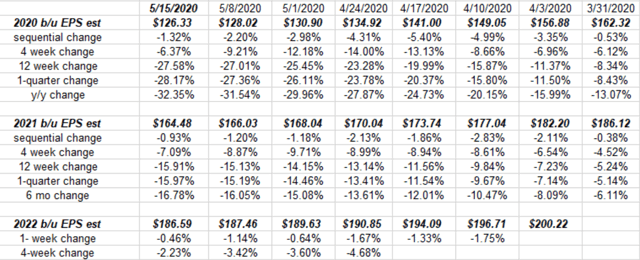

Earnings expectations have been on a none-stop slide for months now, precisely the same time that the market has commenced its face-ripping rally.

(Sources: Brian Gilmartin, Refinitiv/Reuters/Lipper Financial)

| Year | EPS Consensus | YOY Growth | Forward PE | Historical Overvaluation |

| 2020 | $126.33 | -23% | 23.4 | 43% |

| 2021 | $164.48 | 30% | 18.0 | 10% |

| 2022 | $186.59 | 13% | 15.8 | -3% |

(Sources: Brian Gilmartin, Refinitiv/Reuters/Lipper Financial)

Even if you assume the market is ignoring 2020’s horrific earnings and pricing in 2021 and 2022’s strong recovery earnings (whose estimates are falling steadily each week) the market has basically priced in all the good news for the next 2.5 years.

In fact, we’re approaching tech bubble valuations (27 forward PE was the 2000 peak) on a forward PE basis. And BAC is 100% correct that we still face the same fundamental risk factors that sent stocks crashing 34% in just four weeks.

However, BAC’s investment committee points out one reason why stocks might, at least for the next few weeks still go higher.

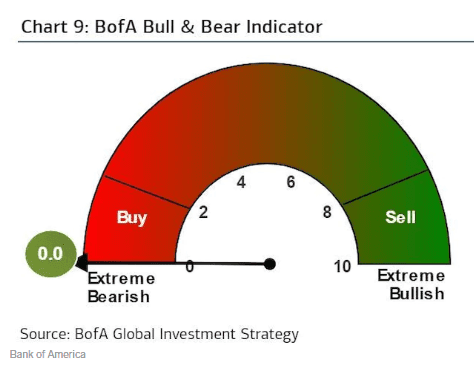

BAC’s own bull/bear sentiment indicator is at its most bearish since April 2013.

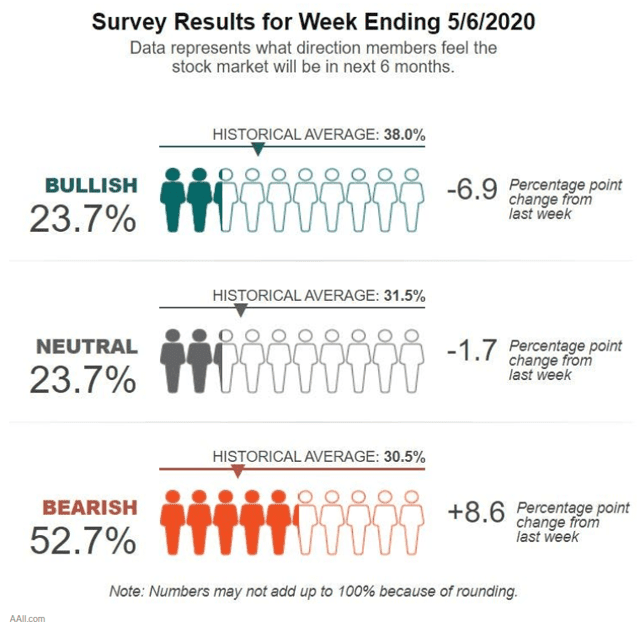

The American Association of Independent Investors or AAII’s survey in early May showed 53% of its members were bearish on stocks for the next six months.

The historical average for that bearish reading is 30.5%, and it’s now screaming “contrarian buying signal”.

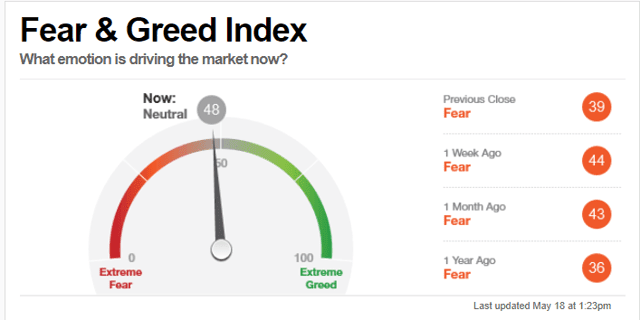

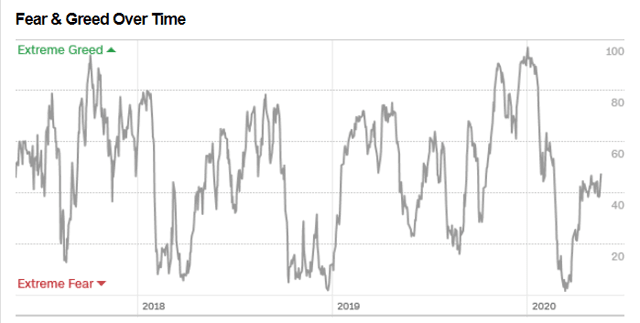

(Source: CNN)

CNN’s fear and greed index, composed of seven technical indicators, is not as bullish, basically at neutral.

But the point is that technical indicators are not necessarily warning that stocks can’t go much higher in the short-term.

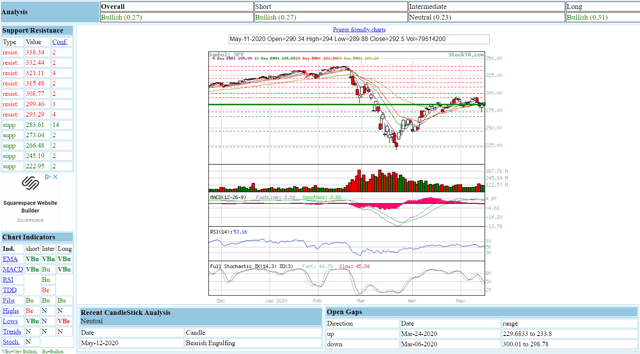

(Source: StockTA.com)

In fact, several popular technical metrics are still highly bullish on the broader market and there is minimal resistance all the way back to about 3384, basically the February 19th, an all-time high.

Is that actually possible? Could stocks defy gravity long enough to set a new record high and end the bear market after just a few months? During the worst recession in 75 years?

(Source: Imgflip)

They absolutely could. And here’s why.

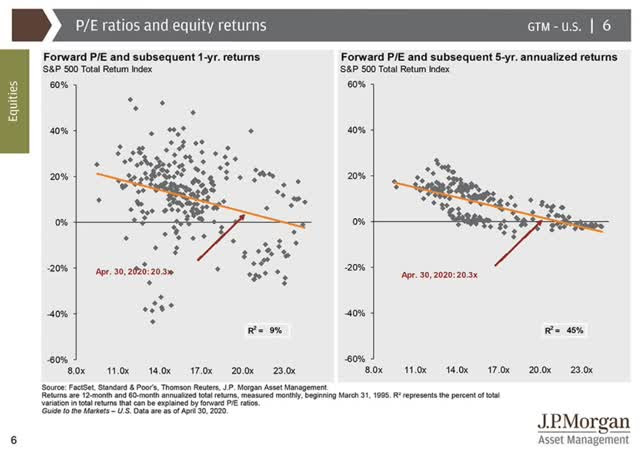

According to Research from JPMorgan, Bank of America and Princeton

- Just 9% of 12-month total returns are explained by valuation/fundamentals

- 45% of 5-year total returns are explained by valuations/fundamentals

- 90% of 10-30 year total returns are explained by valuations/fundamentals

In the short-term fundamentals and valuations have little to do with stock prices.

Sentiment rules and right now there are still enough people refusing to believe that stocks can’t keep going up…that it might allow them to continue melting up.

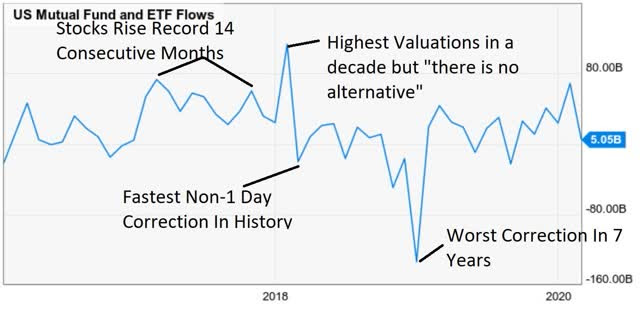

(Source: Ycharts)

Retail investors are famous for being absolutely horrible at market timing, and institutional fund flows driven by those investors clearly show that right now, there is a fair bit of skepticism about this rally being real vs a “dead cat bounce”.

What You Should… And Should NOT Do About It

(Source: Imgflip)

Is the broader market overvalued? If you look at just one metric, the forward PE ratio, then the answer is “yes and a huge crash appears imminent.”

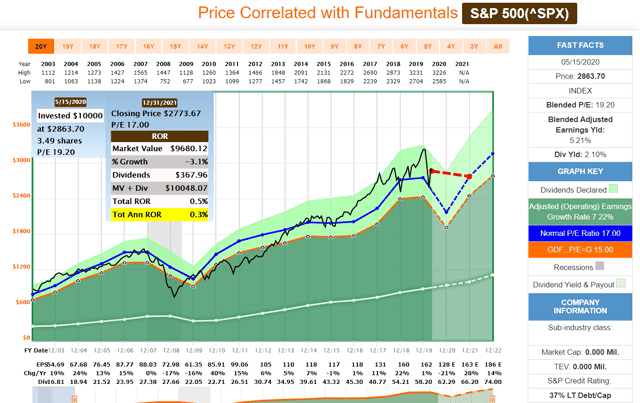

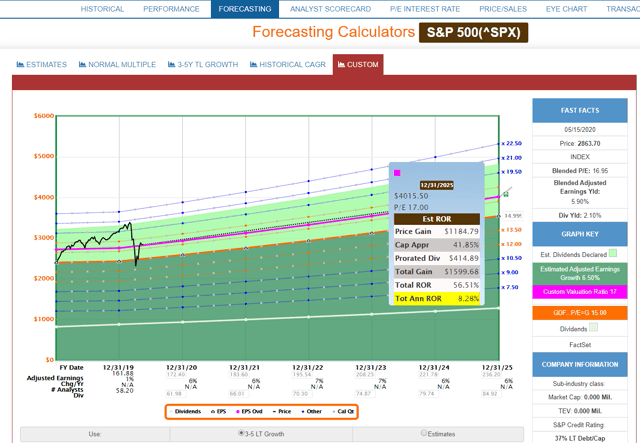

S&P 500 2020 Consensus Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

In reality, if the market were to return to its historical 17 blended PE by the end of the year, then stocks could be expected to fall about 24% in the coming seven months. That equates to about -34% CAGR total returns.

Not a “huge crash” but a mild bear market. It might FEEL like a huge crash, as anyone invested in December 2018 can attest to.

But here’s the relatively good news.

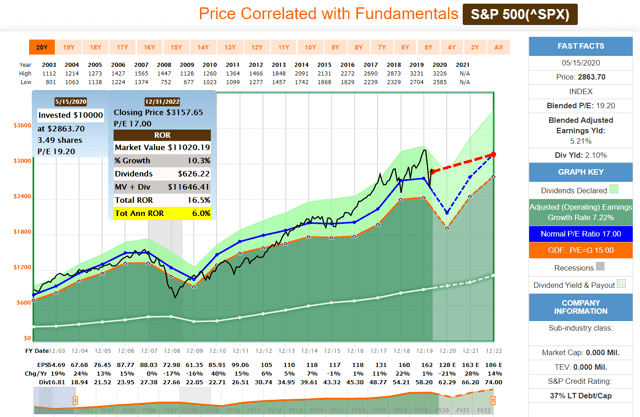

S&P 500 2021 Consensus Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

The consensus return potential for stocks over the coming 18 months is about zero.

That might not be great news if you’re a pure index investor and hoping that the last month’s rally could continue for the next year. But it also shows that the market hasn’t necessarily been wrong to rally off the March lows.

We’re merely pricing in all the expected good earnings fundamentals news for next year, right now.

S&P 500 2022 Consensus Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

Through 2022 the consensus return potential is about 6% CAGR, a comparatively paltry 16.5% total return over 2.5 years.

However, the S&P 500’s historical returns are 7% to 9% CAGR, and so those fearing a “lost decade” don’t have that much to worry about.

S&P 500 Adjusted 5-year consensus Total Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

According to FactSet’s John Butters, the average 20-year overshoot for analyst consensus estimates is about 2% annually, outside of recessionary years.

Assuming we don’t get another recession in the next five years, that means S&P 500 earnings would likely grow about 6.5% CAGR (6% to 7% is the historical growth rate over time). Thus stocks returning to historical fair value could deliver about 8% CAGR total returns.

That happens to be exactly in the middle of their historical range.

I present this good long-term news to make two points.

First, even with valuations currently extremely overvalued on a forward PE basis, no epic market crash is inevitable, nor is a “lost decade” likely.

In the short and medium-term buying, the broader market is likely to result in lackluster returns, especially compared to the last month.

Second, who says you have to buy the broader market at all?

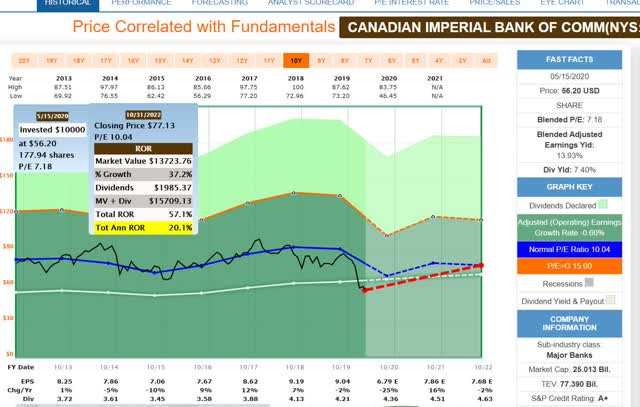

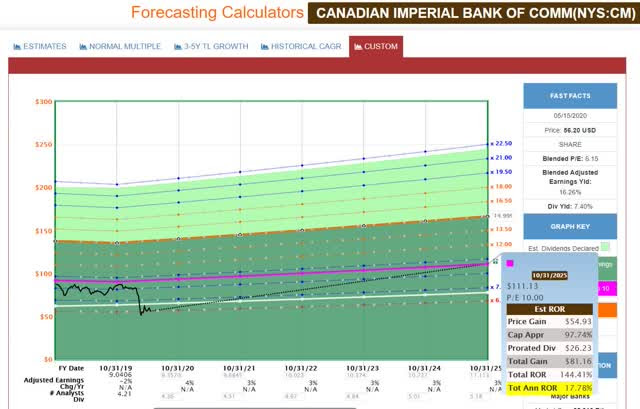

(Source: F.A.S.T Graphs, FactSet Research)

Canadian Imperial Bank of Commerce (CM) is one of the two Phoenix watchlist companies I just highlighted in “2 Safe High-Yield Blue Chips Retirees Can Trust.”

In that article, I explain in detail why CM’s nearly 8% yield is safe (about 5% cut risk in this recession). I also explain why buying it at the best valuations in 12 years could result in 20% CAGR medium-term total returns and close to 18% CAGR total returns over the next five years.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

REVISED 2020 Stock Market Outlook– Discover why there is more downside ahead and the Top 10 picks for the bear market.

9 Simple Strategies to REGROW Your Portfolio – Learn the 9 strategies employed by Steve Reitmeister to generate consistent outperformance…even during bear markets.

SPY shares fell $0.38 (-0.13%) in premarket trading Tuesday. Year-to-date, SPY has declined -7.97%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |