Recent market volatility has both put traders on edge and pumped up the volatility in options. Those two usually go hand in hand and they create a great opportunity for longer term investors with a cooler demeanor to capitalize on the current dislocation.

One of the best, and most popular approaches, especially among investors that don’t consider themselves ‘option traders,’ is the covered call strategy.

The other day I wrote how people are piling into funds that employ option premium selling strategies, particularly covered calls or buy-writes.

I figure it’s a good time to drill down into exactly what these strategies entail.

It’s a way for owners, especially for buy and hold types, to generate income from the stocks they own while also providing a bit of a hedge for their portfolio.

When a trader writes a covered call, usually they are looking to sell theta decay, which is a component of premium. Selling premium can mean many things, but we mean selling extrinsic value.

Extrinsic value is the component of an option price most influenced by time passing by, the underlying symbol price changes, and the buying and selling pressures of the option itself. Intrinsic value, the other component of an option price, is that actual value of the option at expiration; the real tangible value. The intrinsic value is only a function of the underlying symbol price and the option type (call or put). The intrinsic value of an at-the-money or out-of-the-money option is zero.

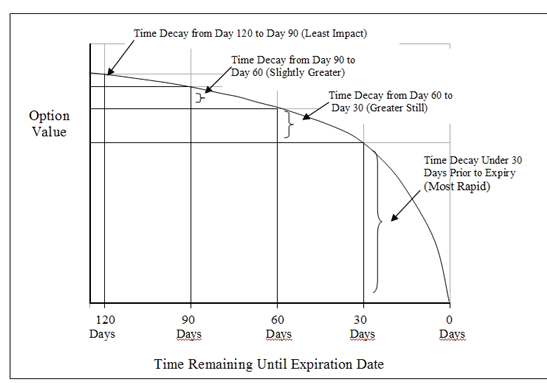

Near term premium is what is most often sold. Below is a graph showing how the value of premium is not linear with time. An option will lose much less value over a day passing, when it is 60 days from expiring than when it is five days.  The risk with covered call writing is that the underlying symbol will appreciate, causing the buyer of the option to exercise it, or worse, depreciate, leaving the seller with a premium against a devalued underlying symbol.

The risk with covered call writing is that the underlying symbol will appreciate, causing the buyer of the option to exercise it, or worse, depreciate, leaving the seller with a premium against a devalued underlying symbol.

Selling near term premium optimizes the highest selling price with the least amount of time to wait for that price to decay. Our intention is to buy our call option back at a much lower price or let it expire worthless.

The intention is to sell multiple cycles of premium against the underlying symbol. One reason is the amount of research and familiarity that goes into picking an underlying symbol is long and arduous. It is not something a trader wants to spend their time doing often. Once you find an underlying symbol to write premium against, you would like to stick with it for a while. Another reason is simply the calculation of return on invested capital.

Every cycle you sell premium against an underlying, and it expires worthless, lowers your investment cost (The profit of the previous cycle is subtracted from your investment cost). The profit of the current cycle over the lowered investment, exponentially increases your return on invested capital. Each subsequent cycle, you have profit on a lowered investment.

I sell monthly premium. There’s ample liquidity in the monthly options. On average, I am in a covered call for four to five months, four to five cycles. My record is 14 months, 14 cycles. On that trade, my initial investment was reduced to zero.

Creating a free position means there is no longer and downside which makes it a whole lot easier to take a multi-year long term outlook for much larger profits.

SPY shares were trading at $329.28 per share on Tuesday afternoon, up $5.16 (+1.59%). Year-to-date, SPY has gained 2.31%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |