The bond market has had a volatile two months as it went from an inverted yield curve and rates on the 10-year sinking below 1.5% in September to a normalized curve and yield on the 10-year filing with a 2% level.

This has been a welcome relief for both stock investors and savers who need income for retirement funds, as the inverted curve is often a precursor to a recession and the near-zero yields forcing people into dividend-yielding stocks such as utilities at increasingly uncomfortable valuations.

Now, with the Federal Reserve, having delivered the expected third rate cut of the year, but also made it clear barring an exogenous event planned to be on hold for the foreseeable future. Today’s testimony from Chairman Powell reaffirmed that stance as Powell cited solid economic data and the fact that the amount of global debt with negative yields had retreated, making him comfortable with the current policy.

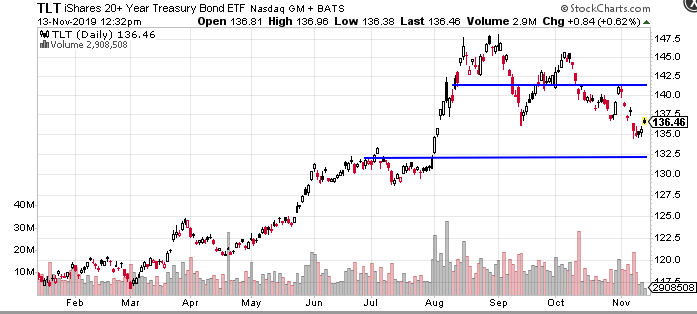

I think the Barclays iShares Long-Term Bond ETF (TLT), which stands a good proxy for the 10-Year Treasury, will be bound by the $132.50 and $141 level, which corresponds to about 2.15% and 1.65% on the 10-year.

This creates a great opportunity for an iron condor. An iron condor is an options strategy created with four options, consisting of two puts (one long and one short), two calls (one long and one short), and four strike prices all with the same expiration date. The goal is to profit from a decline in volatility and a range-bound price in the underlying asset.

In other words, the iron condor earns the maximum profit when the underlying asset closes between the middle strike prices at expiration.

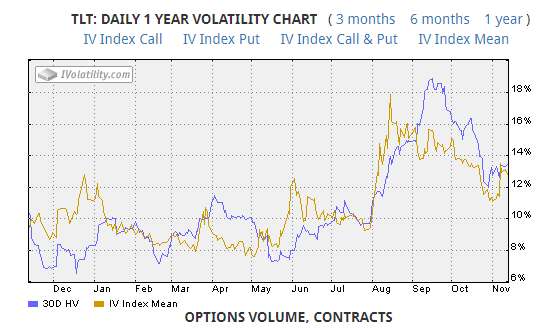

As you can see, both realized and implied volatility for TLT surged in September/October and took another upturn during the last week. I expect IV to retreat back below 10% in the coming weeks.

Source:Ivolatility.com

Many traders that use iron condors and credit spreads as an ongoing strategy, tend to enter their trades every first or second week of the month, or they have established a hard number of days before expiration where they force themselves to enter their positions mechanically.

In my experience, this is not the best way to trade these strategies. This doesn’t mean you cannot be profitable trading that way, merely that I personally think there are better ways.

The problem with iron Condors and credit spreads is that you are usually risking a lot to win a little. So, entering a position is not something you should take lightly. It is my personal belief that they should only be traded when odds are clearly in your favor. If the conditions are not given, then staying put is the best decision.

Right now, with the TLT trading at $136.50 both the bull and bear spreads meet the criteria of having a good probability of delivering a profit and, as mentioned, IV is still elevated making it a perfect set up for the iron condor.

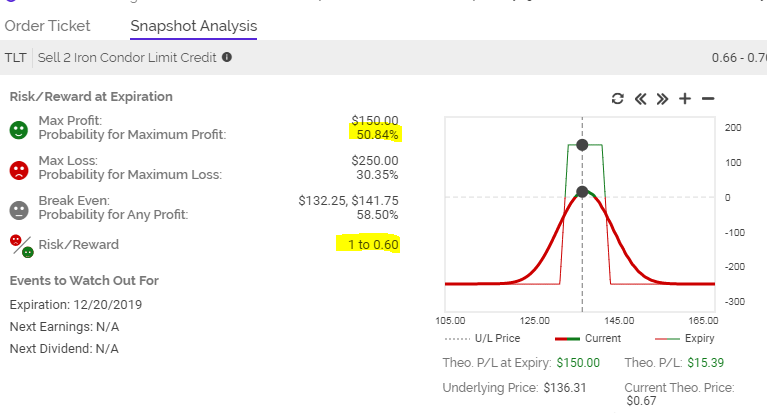

The trade I’m looking at is the December 131/133-141/143 for a $0.75 net credit.

As the risk graph above shows, this position has a near 60% probability of delivering a profit of 60% return on your risk. That is a great profit for a position that needs nothing but time and stable prices over the next month.

TLT shares were trading at $136.31 per share on Wednesday afternoon, up $0.69 (+0.51%). Year-to-date, TLT has gained 14.44%, versus a 25.50% rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TLT | Get Rating | Get Rating | Get Rating |