The tide that lifted all stocks, historically low interest rates, is now a distant memory. The recent sharp pullback in the equity market has made it even more vital to pick the right stocks, not just any stocks. In this context, I thought it would be useful to show how I go about picking which stocks to add to the POWR Options Portfolio.

POWR Ratings

The POWR Ratings are at the core of my trade selection process. There are 118 different factors in the POWR Ratings methodology which has led to dramatic outperformance of nearly 4x over the past twenty plus years. Using the POWR ratings gives me a quantifiable edge in my trading-plus most of the heavy lifting has already been done for me.

The POWR Stocks Screener is another invaluable tool. It has the ability to sort by ratings on both an individual stock and Industry group basis along with some very unique and powerful screens (news, volume. peer group) found only on POWR Stocks.

Let’s walk through a recent trade done in the POWR Options portfolio to give a better insight into the overall trade selection process. The actual trade is shown below. It was a bullish call trade on Ternium (TX) -buying the August $38 calls at $4.90 and closing those calls out 16 days later at $7.90 for a gain of $300 (61%).

| Entry Date | Exit Date | Option | Entry | Exit | Gain | % Gain | Days Held |

| 5/10/2022 | 5/26/2022 | TX August $38 calls | $4.90 | $7.90 | $300 | 61.22% | 16 |

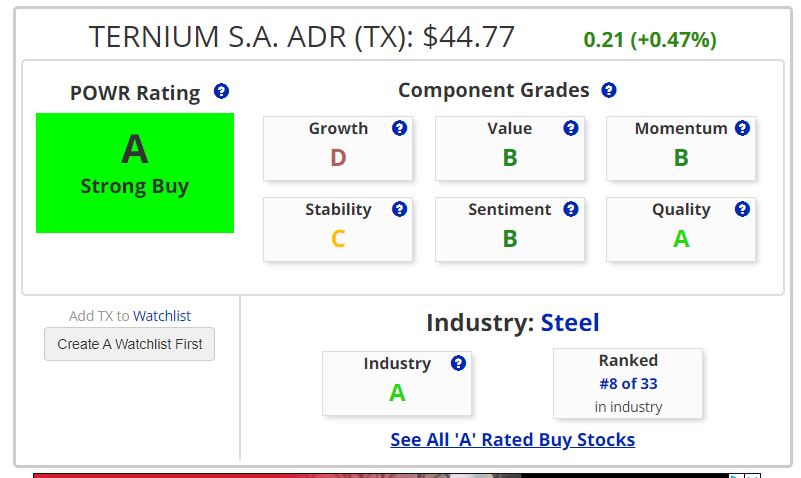

First, I screened for A rated stocks in A rated industries in the upper 30% of the peer group. One name that popped out was Ternium (TX).

Ternium (TX) is an A Rated -Strong Buy- stock. It also is in the A rated Steel Industry and sits number 8 out of 33 within the Industry. So, a Strong Buy stock in a strong position within a Strong Buy Industry.

Technical Analysis

Next, I looked at the technicals on TX. Ternium had once again traded down to the major support area at $38 and held. Shares were oversold on a 9-day RSI basis but were improving. Bollinger Percent B had gone negative then regained positive territory. MACD reached extremes but was turning higher. Ternium was trading at a deep discount to the 20-day moving average. The previous times all these indicators aligned in a similar fashion marked a significant short-term low in TX stock (highlighted in aqua in the chart below).

The actual entry and exit for the trade we did in the POWR Options Portfolio is shown in pink. I like to use technicals to help gauge when it is a prudent time to take exit the trade. In this instance, TX stock was nearing major overhead resistance and approaching overbought readings-polar opposite of the technical basis for the original buy.

Fundamentals

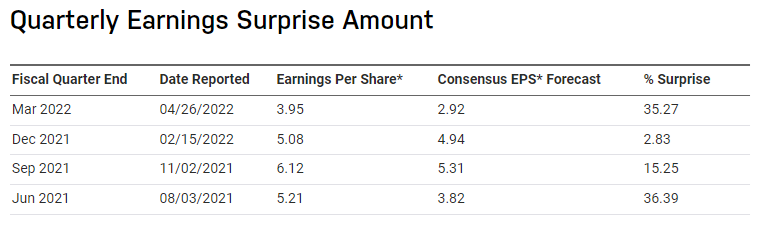

A look at the recent earnings shows that TX had beaten consensus forecasts soundly over the past 4 quarters, yet shares were actually lower in that same time frame. The combination of a lower price (P) and better earnings (E) means that the P/E ratio has become decidedly more attractive.

Implied Volatility

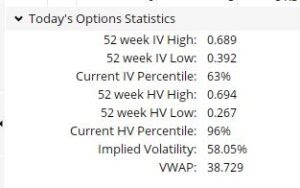

As an options guy, I always consider implied volatility (IV) in the trade selection process. Lower IV means option prices are cheaper, higher IV makes options more expensive. IV also needs to be viewed on a comparative basis.

TX was trading at the 63rd percentile of IV at the time of the initial trade on May 10. Just slightly about the average over the past year, but definitely cheap given how implied volatility for stocks generally had exploded (VIX was near the highest levels of the year). Implied volatility (IV) was also cheap when compared to the actual, or historic volatility (HV), at the 96th percentile. This favors long option strategies when constructing trades.

The POWR Options Portfolio used the same methodology on several occassions for another steel stock, Arcelor Mittal (MT), with the results shown below.

| Entry Date | Exit Date | Stock | Strategy | P/L |

| 4/11/2022 | 4/22/2022 | MT | Bull Call | ($10) |

| 2/28/2022 | 3/25/2022 | MT | Bull Call | $160 |

| 1/31/2022 | 2/9/2022 | MT | Bull Call | $300 |

| 11/24/2021 | 12/14/2021 | MT | Bull Call | $150 |

Trading is all about probability and not certainty. That has certainly been proven true over the past several months. Now that markets have stopped going straight up, stock selection has become even more important.

The combination of the power of the POWR ratings along with additional technical, fundamental, and implied volatility analysis can provide a significant edge and put the odds in your favor when looking at what trades to pull the trigger on.

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

TX shares were trading at $44.77 per share on Monday morning, up $0.21 (+0.47%). Year-to-date, TX has gained 7.09%, versus a -12.30% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TX | Get Rating | Get Rating | Get Rating |

| MT | Get Rating | Get Rating | Get Rating |