ArcelorMittal ADR (MT): Price and Financial Metrics

MT Price/Volume Stats

| Current price | $22.72 | 52-week high | $29.15 |

| Prev. close | $22.51 | 52-week low | $21.30 |

| Day low | $22.49 | Volume | 1,262,400 |

| Day high | $22.79 | Avg. volume | 1,583,318 |

| 50-day MA | $24.15 | Dividend yield | 1.89% |

| 200-day MA | $25.43 | Market Cap | 18.30B |

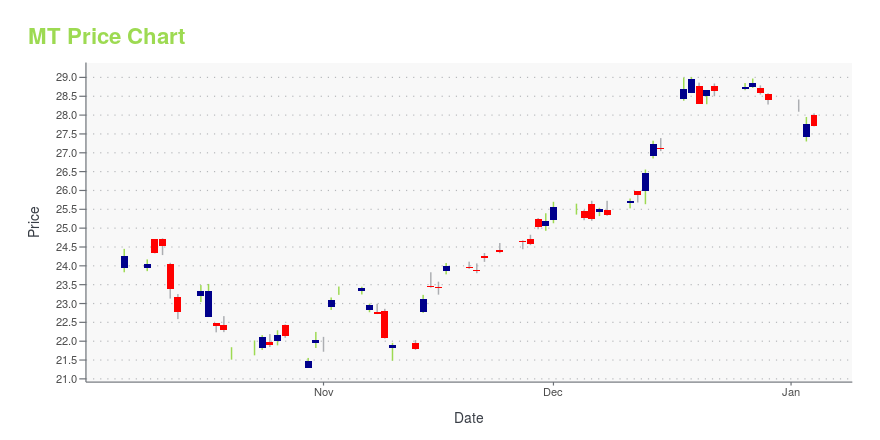

MT Stock Price Chart Interactive Chart >

ArcelorMittal ADR (MT) Company Bio

ArcelorMittal S.A. is a Luxembourgian multinational steel manufacturing corporation headquartered in Luxembourg City. It was formed in 2006 from the takeover and merger of Arcelor by Indian-owned Mittal Steel. ArcelorMittal is the second largest steel producer in the world, with an annual crude steel production of 88 million metric tonnes as of 2022. It is ranked 197th in the 2022 Fortune Global 500 ranking of the world's largest corporations. Its employees directly and indirectly 200,000 market capital is $25 billion. Total assets $100 billion. (Source:Wikipedia)

Latest MT News From Around the Web

Below are the latest news stories about ARCELORMITTAL that investors may wish to consider to help them evaluate MT as an investment opportunity.

ArcelorMittal engages dss+ to conduct group-wide safety audit22 December 2023, 08:00 CET ArcelorMittal (‘the Company’) today announces that it has engaged dss+, a leading provider of sustainable operations management consulting services, to conduct a company-wide audit of its safety practices. Alongside the publication of its third quarter financial results on 9 November 2023, the Company said it would commission a comprehensive independent third-party safety audit of its operations to identify gaps and strengthen its safety actions, processes and culture |

Designated Person Notification21 December 2023, 18:00 CET With reference to Article 19(3) of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (Market Abuse Regulations), ArcelorMittal announces that notifications of share transactions by a Designated Person (i.e. Directors or Executive Officers) are available in the Luxembourg Stock Exchange’s electronic database OAM on www.bourse.lu and on ArcelorMittal’s web site www.arcelormittal.com under Investors > Share Transac |

ArcelorMittal's (MT) Torero Plant Powers Up With Bio-CoalArcelorMittal's (MT) Torero plant in Belgium converts waste wood into bio-coal, reducing annual carbon emissions by 112,500 tons. |

UPDATE 1-Steelmaker ArcelorMittal inks Mexico natgas supply deal worth $2.7 blnArcelorMittal has renewed a contract with Mexico's state power utility CFE to be supplied with natural gas for 10 years, in a deal worth $2.7 billion, the steelmaker said. ArcelorMittal, which called itself the largest natural gas consumer in Mexico, said in a statement that the contract would feed ArcelorMittal's operations at Lazaro Cardenas in the state of Michoacan with gas from Waha, Texas. |

Steelmaker ArcelorMittal inks Mexico natgas supply deal worth $2.7 blnArcelorMittal has renewed a contract with Mexico's state power utility CFE to be supplied with natural gas for 10 years, in a deal worth $2.7 billion, the steelmaker said. The contract would feed ArcelorMittal's operations at the port of Lazaro Cardenas in the state of Michoacan with gas from Waha, in Texas, ArcelorMittal said in a statement. |

MT Price Returns

| 1-mo | 0.00% |

| 3-mo | -9.70% |

| 6-mo | -17.03% |

| 1-year | -17.77% |

| 3-year | -31.32% |

| 5-year | 41.55% |

| YTD | -19.31% |

| 2023 | 9.98% |

| 2022 | -16.62% |

| 2021 | 40.10% |

| 2020 | 30.56% |

| 2019 | -14.29% |

MT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MT

Want to do more research on ArcelorMittal's stock and its price? Try the links below:ArcelorMittal (MT) Stock Price | Nasdaq

ArcelorMittal (MT) Stock Quote, History and News - Yahoo Finance

ArcelorMittal (MT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...