Vestas Wind Systems A/S (VWDRY - Get Rating) is a Denmark-headquartered developer, manufacturer, installer and servicer of wind turbines generating utility-scale electrical power. Founded in 1945 following the end of World War II, it is the world’s largest wind turbine company, employing a workforce of more than 25,000 and operates manufacturing plants in 16 countries spread across four continents.

VWDRY has installed more wind turbines than any other company in the renewable energy space, with over 122 GW of wind turbines in 82 countries. Last month, the company announced orders for a 504 MW installation in Colombia, a 51 MW order in Italy that included the installation of 11 wind turbines, and a 17 MW project in India.

Last October, VWDRY acquired the 50% stake of its joint venture partner Mitsubishi Heavy Industries (MHI) in their offshore business via an all-stock deal estimated at $832 million. In exchange, MHI gained a 2.5% stake in Vestas and will be awarded a seat on its board of directors. VWDRY President and CEO Henrik Anderson explained the transaction was designed to position the company as the offshore wind leader by 2025.

“When we’re sitting with two entities, we’re not going to maximize the value creation,” Anderson insisted. “Vestas is the leader in onshore wind, but to accelerate the energy transition and achieve our vision we must play a larger role in offshore.”

Here’s how our proprietary POWR Ratings system evaluates VWDRY:

Trade Grade: A

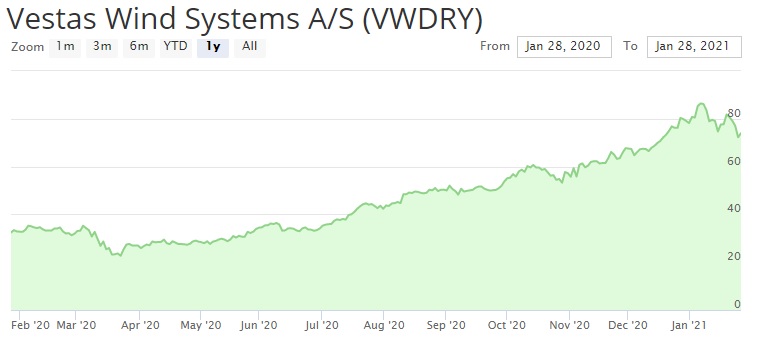

VWDRY is trading at $72.30, which is much closer to its 52-week high of $87.34 than its52-week low of $22.50. The stock joined the rest of the market in the steep decline in March when the coronavirus pandemic took root, but it began to regain its vibrancy as 2020 progressed and came into 2021 soaring with the anticipation of a new U.S. presidential administration that was staking its future on cleantech.

Buy & Hold Grade: B

This grade is determined by a stock’s proximity to its 52-week high level, and VWDRY is coasting within view of that point.

Investors put a great deal of faith in the stock during the latter part of 2020, and perhaps a bit more than it deserved. VWDRY reported its Q3 earnings in early November with a profit of reported profit of $350.9 million, or roughly $3.00 per share, down from $366.6 million, or $4.68 per share, in the same period one year earlier. Q3 revenue totaled approximately $5.77 billion, compared to $4.41 billion from the previous year, while operating profit was $505.9 million, down from $519.2 million one year earlier.

The company’s firm and unconditional wind turbine orders amounted to 4,232 MW in Q3, down from 4,738 MW one year earlier, while deliveries increased to 5,991 MW from 4,150 MW over the same period.

“Our momentum towards the end of the year continued to grow, which contributed to an EBIT margin before special items of 8.4%,” said Andersen.

Peer Grade: D

VWDRY ranks #26 out of 54 stocks in the Technology – Hardware category. However, this is a hodgepodge category of computer software and hardware companies and telecommunications firms, and weighing VWDRY’s utility-scale energy technology against consumer-facing tech device competitors creates the ultimate chalk-and-cheese comparison.

Industry Rank: A

The Technology – Hardware Category ranks #3 out of 123 stock categories and has an average POWR Rating of A.

Overall POWR Rating: B

Despite a Peer Grade that does not reflect its vitality, the stock earns a B (for buy) grade.

Bottom Line

With the launch of the Biden Administration’s green energy focus, wind power is poised to become a major factor in the U.S. market. To date, U.S. wind power consists of a five-turbine installation off the Rhode Island coast that generates 30 MW for the state’s tiny Block Island tourist destination. However, the U.S. Department of Energy estimated that offshore wind could potentially create more than 2,000 GW of capacity per year, and the arrival of a presidency that is willing to leverage cleantech at the expense of fossil fuels puts VWDRY in an excellent position to take the lead in a huge market that is very much a work in progress.

This year could be a make-or-break time for VWDRY if it wants to gain dominance in the U.S. offshore wind sector. Now is an excellent time to gain an early berth in VWDRY as it prepares to stake its claim along the U.S. coastlines.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

#1 Ingredient for Picking Winning Stocks

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

VWDRY shares were trading at $73.71 per share on Thursday morning, up $1.41 (+1.95%). Year-to-date, VWDRY has declined -5.78%, versus a 1.69% rise in the benchmark S&P 500 index during the same period.

About the Author: Phil Hall

Phil is an experienced financial journalist responsible for generating original content on the weekly Fairfield County Business Journal and Westchester County Business Journal, plus their respective daily online news sites, podcasts and video interview series. He is the winner of 2018, 2019 and 2020 Connecticut Press Club Awards and 2019 and 2020 Connecticut Society of Professional Journalists Award for editorial output. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| VWDRY | Get Rating | Get Rating | Get Rating |