In studying charts yesterday, I noticed that a descending triangle has formed in Westlake Chemical Corp. (WLK - Get Rating) that could result in a winning trade.

Westlake Chemical manufactures and markets petrochemicals, polymers and fabricated building products. It operates through the Olefins and Vinyls segments.

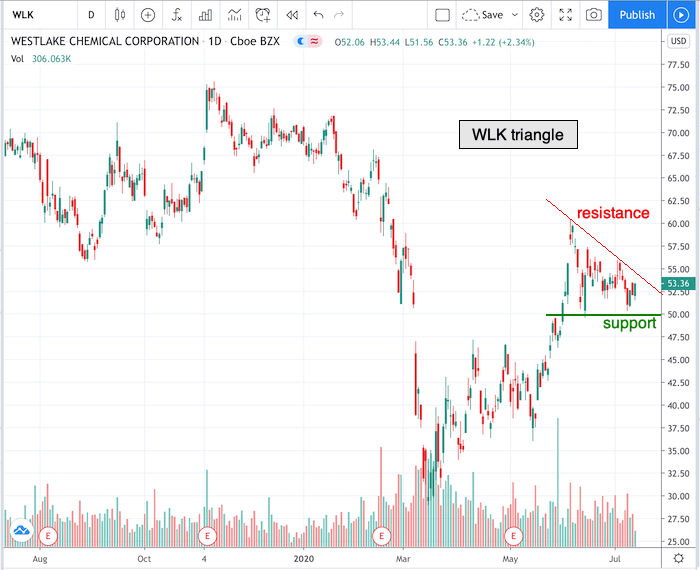

Though it’s well off its $75.65 52-week high, WLK has seen a substantial rebound from its March lows when it reached $28.99. At yesterday’s close the company was trading at $53.36.

Over the past month, WLK has tested $50 two times and this a support level as formed (green). Also, a trendline of resistance (red) has formed.

Together, these two lines have formed a descending triangle. Take a look at the 1-year chart of Westlake below with my added notations:

Chart of WLK provided by TradingView

A descending triangle is a bearish chart pattern that forms during a downtrend as a continuation pattern.

So, if/when WLK breaches $50 to the downside, a trader could enter a short position under that level with the assumption that there will be continued momentum to the downside.

Have a good trading day!

Christian Tharp, CMT

Follow me on Twitter: @cmtstockcoach

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Top 5 WINNING Stock Chart Patterns

7 “Safe-Haven” Dividend Stocks for Turbulent Times

WLK shares were trading at $54.97 per share on Wednesday morning, up $1.61 (+3.02%). Year-to-date, WLK has declined -20.83%, versus a 1.00% rise in the benchmark S&P 500 index during the same period.

About the Author: christian

Christian is an expert stock market coach at the Adam Mesh Trading Group who has mentored more than 4,000 traders and investors. He is a professional technical analyst that is a certified Chartered Market Technician (CMT), which is a designation awarded by the CMT Association. Christian is also the author of the daily online newsletter Todays Big Stock. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| WLK | Get Rating | Get Rating | Get Rating |