- Free money for financial institutions

- Rising long-term rates favor their matchbooks

- A lesson from 2008

- The trend is your friend- A digital economy supports the leaders for three reasons

- XLF diversifies exposure- Attractive dividend and sustained earnings for the portfolio

Too big to fail became a mantra following the 2008 global financial crisis. Lehman Brothers failure, the forced takeover of Bear Stearns by JP Morgan, and government bailouts of the leading financial institutions was a watershed event. It led to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Stress testing, a whistleblower program, and limitations on speculative trading were the hallmarks of the Act. The Trump administration rolled back some of the Dodd-Frank Act, but many pieces remain in force. Banks profit from deposit base and preferential borrowing rates versus lending.

While the COVID-19 global pandemic created problems for the global economy, central bank liquidity and government stimulus created a bonanza of profits for the leading financial institutions. The Financial Select Sector SPDR Fund (XLF - Get Rating) holds a portfolio of the top U.S. companies involved in financial services, insurance, banking, capital markets, mortgage real estate investment trusts, consumer finance, thrifts, and mortgage finance. The XLF fell to a long-term low in March 2020, but it recovered to a higher all-time high over the following year.

Free money for financial institutions

At zero percent to 25 basis points, the Fed Funds rate creates a bonanza for banks and financial institutions that can borrow from the Fed’s window. The Fed Funds rate is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight on an uncollateralized basis. Banks and financial institutions are in the business of lending money to borrowers. Those loans are individualized based on creditworthiness, amounts, and many other factors. The bottom line is they lend at far higher rates than they pay depositors or borrow from the central bank or each other.

At its latest FOMC meeting on April 28, the central bank told markets that the short-term Fed Funds rates will remain at zero to 25 basis points and it will continue to purchase $120 billion in debt securities each month. Chairman Powell said it is not time to think about tapering purchases or increasing rates.

Rising long-term rates favor their matchbooks

Many financial institutions take a least two levels of lending risk. Fractional-reserve banking is where commercial banks accepting deposits from customers and making loans to borrowers hold only a fraction of the bank’s deposit liabilities. In other words, they lend more dollars than their deposits.

Banks also run matchbooks where they borrow for short periods to fund longer-term loans. The longer maturities are at higher rates than the short-term borrowing. Fractional-reserve banking and matchbook lending create substantial profits for financial institutions.

A Fed Funds rate between zero and 25 basis points and quantitative easing that pushed rates lower further out along the yield curve creates a bonanza of profitable opportunities for the financial sector.

A lesson from 2008

In 2008, the U.S. housing crisis caused markets to collapse across all asset classes. The root cause was lending to homebuyers in the subprime market, where creditworthiness was weak. Financial institutions packaged the loans as collateralized mortgage obligations to remove them from their books, selling them to investors and other market participants looking for yields. Refinancing properties in a rising real estate market delayed the inevitable, but as defaults began to rise, losses mounted.

Financial institutions suffered systemic risks from other derivatives such as credit default swaps, causing the need for bailouts, forced mergers, and the failure of Lehman Brothers and Savings and Loan companies. Leverage caused the crisis and led to the Dodd-Frank Act.

Today, financial institutions undergo stress testing on their balance sheets and follow stricter regulations than before the 2008 crisis to prevent a reoccurrence.

The trend is your friend—A digital economy supports the leaders for three reasons

The world has changed dramatically since the 2008 financial crisis because of technology. The most substantial changes in the financial area are just getting underway. Blockchain technology, the child of Bitcoin, improves efficiency and speed in executing transactions.

Meanwhile, cryptocurrencies have been gaining popularity as the younger generation is adept at technology. We have seen Bitcoin’s value move from six cents in 2010 to an incredible $65,520 per token at its latest high on April 14. It will not be long before digital currencies replace paper money in circulation. China is already well on its way to issuing a digital yuan. The U.S. and Europe are likely to roll out digital dollars and euros over the coming years as it is a matter of national security to keep up with technological advances in the financial world. The leading banks and financial institutions are likely to benefit from the digital economy for three reasons:

- They are all investing heavily in blockchain innovations to improve efficiency and lower costs

- The regulated institutions could receive beneficial treatment from government regulators because of familiarity and control

- The digital economy opens a new suite of products for financial institutions and banks.

Government regulations in the fintech arena are coming sooner rather than later. While complaining that Fintech is an “enormous competitive” threat to banks, JP Morgan CEO Jamie Dimon was laying out his case for regulations that create a level playing field for banks, financial institutions, and Fintech companies. Dimon argued that “banks are playing an increasingly smaller role in the financial system” with the growth at companies like Stripe, Robinhood, PayPal (PYPL), Square (SQ), and others as Ethereum becomes more mainstream and DeFi, or decentralized finance, gains steam in markets.

Meanwhile, Dimon is likely steering regulators and legislators towards clamping down on the unregulated market and allowing JP Morgan Chase and other institutions to participate in the markets. It appears the goal is to loosen some regulations on the traditional banking community while tightening it on the Fintech community.

Meanwhile, the leading financial institutions in the U.S. mostly survived and thrived in the 13 years following the 2008 crisis. On April 14, JP Morgan Chase (JPM) reported a first-quarter profit of $4.50 per share, including a $1.28 benefit from its reserve release. Analysts had expected EPS of $3.10 per share. The bank had a $455.7 billion market cap at $150.19 per share on April 29 after trading to a new all-time high at $161.69 in March.

Jamie Dimon is likely the brightest and most influential banker in the U.S., if not the world. He is positioning his institution for a favorable position in a world that is shifting towards Fintech.

XLF diversifies exposure—Attractive dividend and sustained earnings for the portfolio

I would continue to bet on a diversified portfolio of financial stocks. The low interest rate environment will continue to fuel earnings. Favorable treatment for business expansion into Fintech could turbocharge profits.

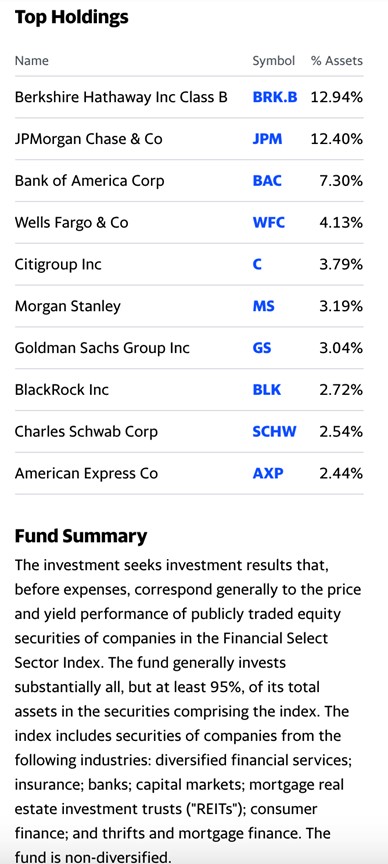

The Financial Select Sector SPDR Fund (XLF) holds a diversified portfolio of the leading companies in the sector. XLF’s top holdings and fund summary include:

Source: Yahoo Finance

XLF has net assets of $40.416 billion, trades an average of over 42.2 million shares each day, and charges a 0.12% management fee. According to Yahoo Finance, the ETF pays a blended yield of 1.85%.

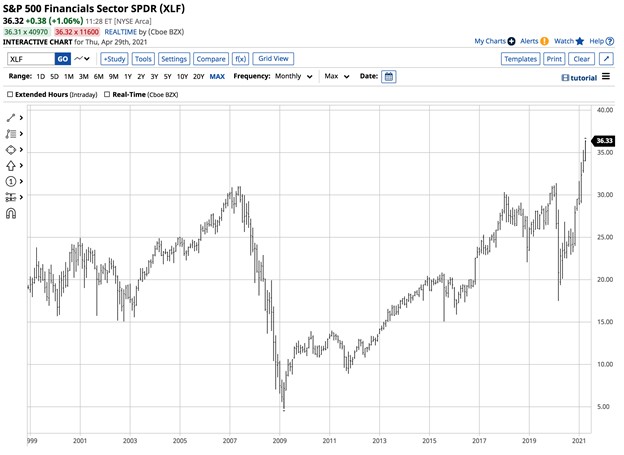

Source: Barchart

The chart highlights a pattern of higher lows and higher highs since the 2008 financial crisis. In March 2020, during the height of the global pandemic’s impact on the economy, XLF fell to a low of $17.49 per share. Since then, it has more than doubled to a high of $36.42 on April 29.

The Fed policy will continue to fuel the XLF, making it an ETF of growth stocks. Moreover, Fintech regulation is likely to favor the financial institutions that regulators know the best. JP Morgan’s Jamie Dimon will make sure he reminds the regulators who is the real boss in the U.S. economy.

Want More Great Investing Ideas?

XLF shares fell $0.03 (-0.08%) in after-hours trading Thursday. Year-to-date, XLF has gained 24.63%, versus a 12.72% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| XLF | Get Rating | Get Rating | Get Rating |