Accel Entertainment, Inc. (ACEL): Price and Financial Metrics

ACEL Price/Volume Stats

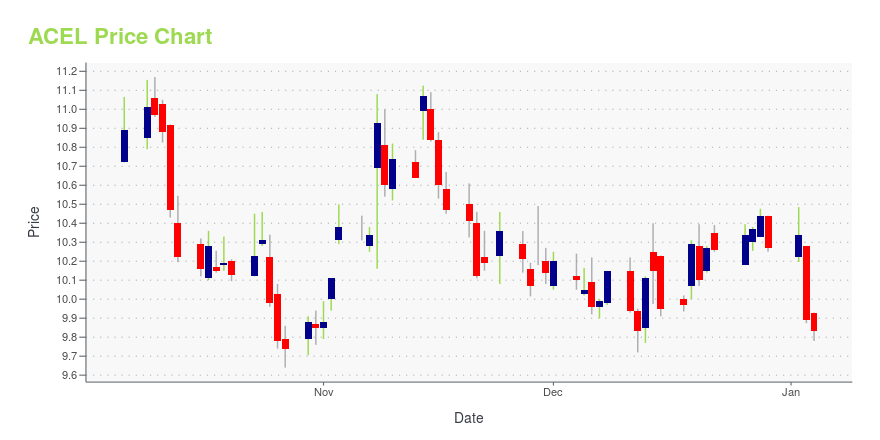

| Current price | $10.90 | 52-week high | $12.05 |

| Prev. close | $10.59 | 52-week low | $9.37 |

| Day low | $10.69 | Volume | 204,500 |

| Day high | $10.92 | Avg. volume | 265,825 |

| 50-day MA | $10.10 | Dividend yield | N/A |

| 200-day MA | $10.49 | Market Cap | 912.83M |

ACEL Stock Price Chart Interactive Chart >

Accel Entertainment, Inc. (ACEL) Company Bio

Accel Entertainment, Inc. operates as a distributed gaming operator in the United States. It is involved in the installation, maintenance, and operation of video game terminals (VGTs); redemption devices that disburse winnings and contain ATM functionality; and other amusement devices in authorized non-casino locations, such as restaurants, bars, taverns, convenience stores, liquor stores, truck stops, and grocery stores. It also operates stand-alone ATMs in gaming and non-gaming locations. As of June 30, 2020, the company operated 11,108 video gaming terminals across 2,335 locations in the State of Illinois. Accel Entertainment, Inc. is headquartered in Burr Ridge, Illinois.

Latest ACEL News From Around the Web

Below are the latest news stories about ACCEL ENTERTAINMENT INC that investors may wish to consider to help them evaluate ACEL as an investment opportunity.

Is Accel Entertainment (ACEL) Outperforming Other Consumer Discretionary Stocks This Year?Here is how Accel Entertainment (ACEL) and AMC Networks (AMCX) have performed compared to their sector so far this year. |

3 Gaming Stocks to Strengthen Your Portfolio in 2024Gaming stocks like Light & Wonder (LNW), Accel Entertainment (ACEL) and Churchill Downs (CHDN) benefit from expansion efforts and improving visitation. |

Accel Entertainment, Inc.'s (NYSE:ACEL) P/E Still Appears To Be ReasonableWhen close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may... |

5 Stocks to Boost Your Portfolio as Fed Keeps Rate UnchangedStocks like Accel Entertainment (ACEL), DoubleDown Interactive (DDI), Hooker Furnishings (HOFT), Lululemon Athletica (LULU) and Warner Music Group (WMG) are likely to benefit from Fed's decision to keep interest rates unchanged. |

Here's Why Accel Entertainment (ACEL) Is a Great 'Buy the Bottom' Stock NowAfter losing some value lately, a hammer chart pattern has been formed for Accel Entertainment (ACEL), indicating that the stock has found support. This, combined with an upward trend in earnings estimate revisions, could lead to a trend reversal for the stock in the near term. |

ACEL Price Returns

| 1-mo | 6.76% |

| 3-mo | -2.59% |

| 6-mo | 2.73% |

| 1-year | -3.11% |

| 3-year | -2.50% |

| 5-year | 5.83% |

| YTD | 6.13% |

| 2023 | 33.38% |

| 2022 | -40.86% |

| 2021 | 28.91% |

| 2020 | -19.20% |

| 2019 | 25.00% |

Loading social stream, please wait...