AdTheorent Holding Company, Inc. (ADTH): Price and Financial Metrics

ADTH Price/Volume Stats

| Current price | $3.20 | 52-week high | $3.98 |

| Prev. close | $3.20 | 52-week low | $1.11 |

| Day low | $3.20 | Volume | 737,100 |

| Day high | $3.21 | Avg. volume | 1,201,410 |

| 50-day MA | $3.23 | Dividend yield | N/A |

| 200-day MA | $2.27 | Market Cap | 294.27M |

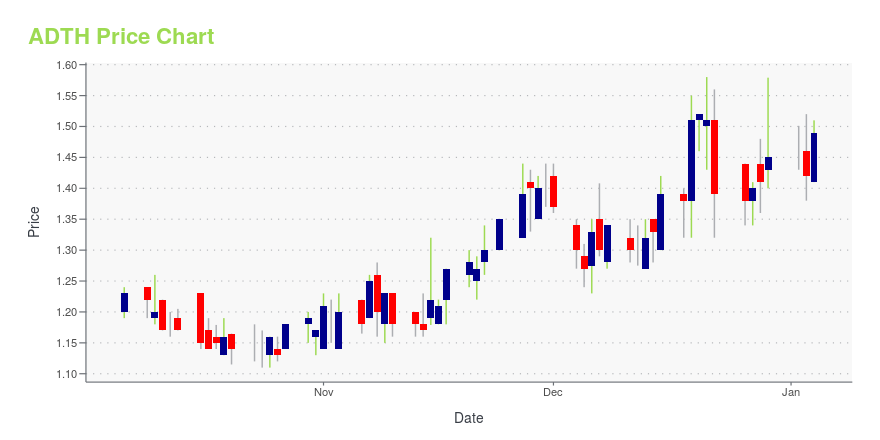

ADTH Stock Price Chart Interactive Chart >

AdTheorent Holding Company, Inc. (ADTH) Company Bio

AdTheorent Holding Company, Inc. provides machine learning platform for advertisers and marketers in the United States and Canada. The company offers predictive targeting, geo-intelligence, and audience extension solutions, as well as Studio A\T. The company was founded in 2012 and is headquartered in New York, New York.

Latest ADTH News From Around the Web

Below are the latest news stories about ADTHEORENT HOLDING COMPANY INC that investors may wish to consider to help them evaluate ADTH as an investment opportunity.

AdTheorent Unveils Results from Joint Research with Advertiser Perceptions on the State of the Open-Web Programmatic Advertising IndustryAdTheorent Holding Company, Inc. (Nasdaq: ADTH), a machine-learning pioneer and industry leader using privacy-forward solutions to deliver measurable value for programmatic advertisers, today announced the results from a study with Advertiser Perceptions, the leading provider of research-based strategic market intelligence to the media, advertising, and ad tech industries. The research examines the state of the open-web programmatic advertising industry with the goal of understanding how brand a |

AdTheorent Health Audiences, Powered by HABi™, Earn Neutronian's NQI Certification for Data Quality, Privacy and TransparencyAdTheorent Health, a division of AdTheorent Holding Company, Inc. (Nasdaq: ADTH), a programmatic digital advertising leader using advanced machine learning and privacy-forward solutions to drive advertiser outcomes, today announced that it has earned Neutronian's NQI Data Quality certification, awarded to companies that maintain the highest standards of data quality, privacy, and transparency. AdTheorent Health received Neutronian's NQI Data Quality certification for its groundbreaking algorithm |

AdTheorent to Present at NobleCon 19NEW YORK, Nov. 30, 2023 (GLOBE NEWSWIRE) -- AdTheorent Holding Company, Inc. (Nasdaq: ADTH) (“AdTheorent” or “the Company”), a machine-learning pioneer and industry leader using privacy-forward solutions to deliver measurable value for programmatic advertisers, today announced that its CFO, Patrick Elliott, will present at the 19th Annual Noble Capital Markets Emerging Growth Equity Conference. Date: December 4, 2023Time: 4:00 p.m. Eastern TimeArchived replay will be made available on https://in |

Hero Media Partners with AdTheorent to Create the First ML-Powered Black-Owned DSP in Programmatic AdvertisingAdTheorent Holding Company, Inc. (Nasdaq: ADTH), a machine-learning pioneer and industry leader using privacy-forward solutions to deliver measurable value for programmatic advertisers, and Hero Media, a next-generation Black-owned media and ad tech company, today announced that they have partnered to create the first ML-Powered Black-owned DSP in programmatic advertising, Hero One. Hero One, powered by AdTheorent, combines AdTheorent's award-winning machine learning-powered media-buying and aud |

Some Investors May Be Worried About AdTheorent Holding Company's (NASDAQ:ADTH) Returns On CapitalDid you know there are some financial metrics that can provide clues of a potential multi-bagger? One common approach... |

ADTH Price Returns

| 1-mo | N/A |

| 3-mo | -1.54% |

| 6-mo | 12.28% |

| 1-year | 117.69% |

| 3-year | -67.45% |

| 5-year | N/A |

| YTD | 120.69% |

| 2023 | -12.65% |

| 2022 | -71.72% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...