Alset EHome International Inc. (AEI): Price and Financial Metrics

AEI Price/Volume Stats

| Current price | $1.19 | 52-week high | $2.05 |

| Prev. close | $1.08 | 52-week low | $0.46 |

| Day low | $1.08 | Volume | 24,703 |

| Day high | $1.20 | Avg. volume | 84,456 |

| 50-day MA | $1.13 | Dividend yield | N/A |

| 200-day MA | $1.03 | Market Cap | 10.99M |

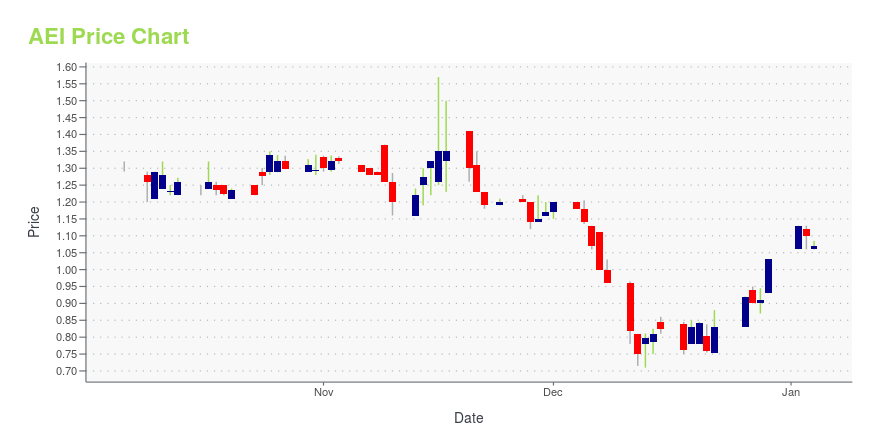

AEI Stock Price Chart Interactive Chart >

Alset EHome International Inc. (AEI) Company Bio

Alset EHome International, Inc. is a holding company, which engages in land development, technology, and health business. The Property Development segment develops property and participates in third-party projects. The Digital Transformation Technology segment involves in mobile application product development; and offering information technology services to end-users, service providers, and other commercial users. The Biohealth segment includes funding research and selling products that promote a healthy lifestyle. The Other segment refers to corporate strategy and business development services, asset management services, corporate restructuring, and leveraged buy-out expertise. The company was founded by Heng Fai Chan in March 7, 2018 and is headquartered in Bethesda, MD.

Latest AEI News From Around the Web

Below are the latest news stories about ALSET INC that investors may wish to consider to help them evaluate AEI as an investment opportunity.

Aegis Capital Corp. Acted as Sole Bookrunner on a $3.8 Million Underwritten Public Offering for Alset Inc. (NASDAQ:AEI).Aegis Capital Corp. acted as Sole Bookrunner on a $3.8 Million Underwritten Public Offering for Alset Inc. (NASDAQ:AEI). |

Alset Inc. Closes $3.8 Million Underwritten Public Offering of Common StockAlset Inc. (NASDAQ:AEI) (the "Company" or "AEI"), a diversified company engaged through its subsidiaries in the development of EHome communities and other real estate, financial services, digital transformation technologies, biohealth activities and consumer products with operations in the United States, Singapore, Hong Kong and South Korea, announced the closing of an underwritten public offering with gross proceeds to the Company of approximately |

Alset Inc. Prices $3.8 Million Underwritten Public Offering of Common StockAlset Inc. (NASDAQ:AEI) (the "Company" or "AEI"), a diversified company engaged through its subsidiaries in the development of EHome communities and other real estate, financial services, digital transformation technologies, biohealth activities and consumer products with operations in the United States, Singapore, Hong Kong and South Korea, today announced the pricing of an underwritten public offering with gross proceeds to the Company expected |

Alset Inc. Announces Proposed Underwritten Public Offering of Common StockAlset Inc. (NASDAQ:AEI) (the "Company" or "AEI"), a diversified company engaged through its subsidiaries in the development of EHome communities and other real estate, financial services, digital transformation technologies, biohealth activities and consumer products with operations in the United States, Singapore, Hong Kong and South Korea, today announced that it intends to offer shares of its common stock in a firm commitment public offering. |

AEI Price Returns

| 1-mo | -16.78% |

| 3-mo | 101.73% |

| 6-mo | 0.85% |

| 1-year | -30.81% |

| 3-year | -98.26% |

| 5-year | N/A |

| YTD | 15.53% |

| 2023 | -55.22% |

| 2022 | -79.39% |

| 2021 | -90.67% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...