Aeva Technologies, Inc., (AEVA): Price and Financial Metrics

AEVA Price/Volume Stats

| Current price | $32.23 | 52-week high | $38.80 |

| Prev. close | $30.68 | 52-week low | $2.36 |

| Day low | $30.21 | Volume | 3,175,500 |

| Day high | $33.24 | Avg. volume | 1,639,864 |

| 50-day MA | $22.98 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 1.77B |

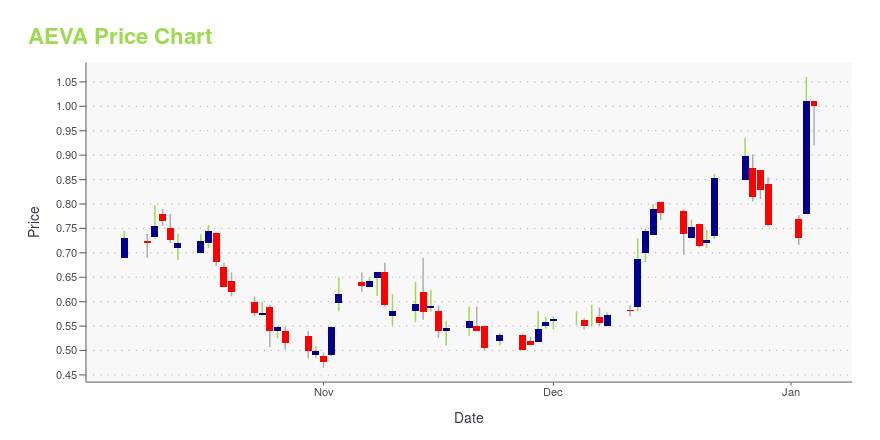

AEVA Stock Price Chart Interactive Chart >

Aeva Technologies, Inc., (AEVA) Company Bio

AEVA, INC. operates as a machine vision company engages in development of optical-based sensors for the automotive industry. It builds lidar, a laser guidance sensor that are expected to be a key component of self-driving vehicles. The company was incorporated in 2016 and is based in Palo Alto, California.

AEVA Price Returns

| 1-mo | 28.25% |

| 3-mo | 411.99% |

| 6-mo | 621.03% |

| 1-year | 879.64% |

| 3-year | 69.19% |

| 5-year | -36.18% |

| YTD | 578.53% |

| 2024 | 25.38% |

| 2023 | -44.29% |

| 2022 | -82.01% |

| 2021 | -48.01% |

| 2020 | N/A |

Loading social stream, please wait...