Armada Hoffler Properties, Inc. (AHH): Price and Financial Metrics

AHH Price/Volume Stats

| Current price | $7.08 | 52-week high | $12.46 |

| Prev. close | $7.09 | 52-week low | $6.10 |

| Day low | $7.03 | Volume | 363,858 |

| Day high | $7.13 | Avg. volume | 979,562 |

| 50-day MA | $7.03 | Dividend yield | 7.9% |

| 200-day MA | $0.00 | Market Cap | 717.35M |

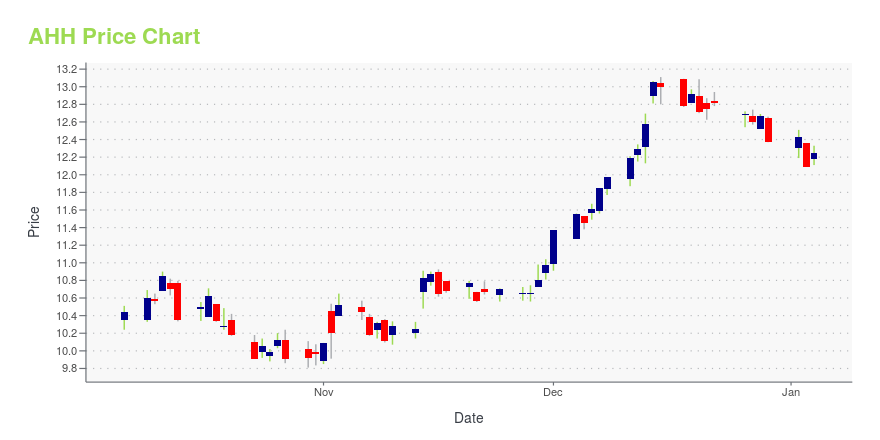

AHH Stock Price Chart Interactive Chart >

Armada Hoffler Properties, Inc. (AHH) Company Bio

Armada Hoffler Properties is a full service real estate company focused on developing, building, owning and managing institutional-grade office, retail and multifamily properties in markets throughout the Mid-Atlantic United States. The company is founded in 2102 and is based in Virginia Beach, Virginia.

AHH Price Returns

| 1-mo | 4.10% |

| 3-mo | N/A |

| 6-mo | -24.62% |

| 1-year | -34.25% |

| 3-year | -34.43% |

| 5-year | -0.03% |

| YTD | -28.08% |

| 2024 | -10.80% |

| 2023 | 15.05% |

| 2022 | -19.88% |

| 2021 | 42.16% |

| 2020 | -35.91% |

AHH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AHH

Want to see what other sources are saying about Armada Hoffler Properties Inc's financials and stock price? Try the links below:Armada Hoffler Properties Inc (AHH) Stock Price | Nasdaq

Armada Hoffler Properties Inc (AHH) Stock Quote, History and News - Yahoo Finance

Armada Hoffler Properties Inc (AHH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...