Ashford Hospitality Trust Inc (AHT): Price and Financial Metrics

AHT Price/Volume Stats

| Current price | $1.02 | 52-week high | $4.03 |

| Prev. close | $1.00 | 52-week low | $0.77 |

| Day low | $0.99 | Volume | 230,849 |

| Day high | $1.03 | Avg. volume | 517,236 |

| 50-day MA | $1.07 | Dividend yield | N/A |

| 200-day MA | $1.57 | Market Cap | 43.25M |

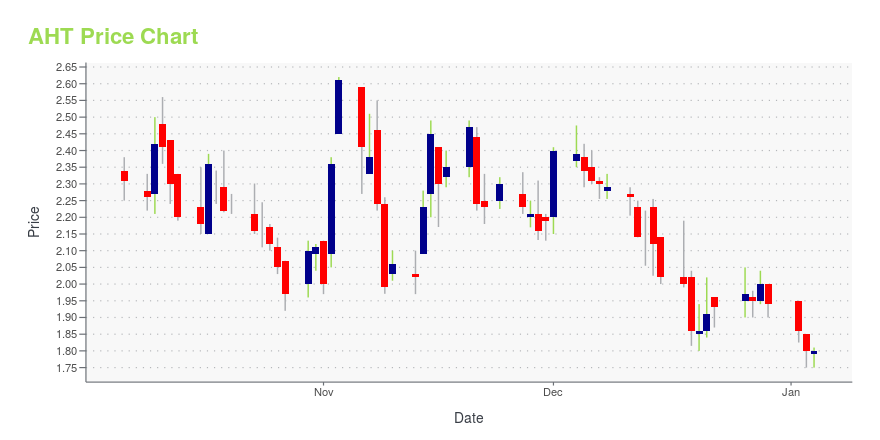

AHT Stock Price Chart Interactive Chart >

Ashford Hospitality Trust Inc (AHT) Company Bio

Ashford Hospitality Trust is focused on investing opportunistically in the hospitality industry in upper upscale, full-service hotels. The company was founded in 1968 and is based in Dallas, Texas.

Latest AHT News From Around the Web

Below are the latest news stories about ASHFORD HOSPITALITY TRUST INC that investors may wish to consider to help them evaluate AHT as an investment opportunity.

ASHFORD TRUST SETS FOURTH QUARTER EARNINGS RELEASE AND CONFERENCE CALL DATESAshford Hospitality Trust, Inc. (NYSE: AHT) ("Ashford Trust" or the "Company") today announced details for the release of its results for the fourth quarter ended December 31, 2023. |

ASHFORD HOSPITALITY TRUST PROVIDES UPDATE ON STATUS OF LOAN POOLSAshford Hospitality Trust, Inc. (NYSE: AHT) ("Ashford Trust" or the "Company") today announced that it has completed the transfer of ownership of the KEYS F loan pool to the mortgage lender. The hotels in the KEYS F loan pool that were transferred to the mortgage lender include: |

Analysts Slashing Price Targets During A Quiet WeekThanksgiving week is usually quiet yet positive for stocks, and 2023 was no exception. Still, despite recent gains in the real estate investment trust (REIT) sector, analysts were busy sharpening their Thanksgiving knives this week on the price targets of several REITs. Take a look at four REITs whose current ratings were maintained this week but still experienced significant carvings on their price targets. NetSTREIT Corp. (NYSE:NTST) is a Dallas-based retail REIT with 547 properties across 45 |

What Makes Ashford Hospitality Trust (AHT) a New Buy StockAshford Hospitality Trust (AHT) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy). |

5 REITs Under $5 Making Huge Gains This MonthAn entire stock sector may experience a significant decline in value at certain points during market cycles. But as the sector begins to rebound, some of the worst performers may outperform the rest of the group. This trend has borne out in recent weeks as real estate investment trusts (REITs) have bounced off their lows and have been performing exceptionally well. When stocks as a group move higher, lower-priced stocks will often make the biggest percentage gains. One reason is that it's easier |

AHT Price Returns

| 1-mo | 16.01% |

| 3-mo | -15.00% |

| 6-mo | -27.66% |

| 1-year | -72.13% |

| 3-year | -94.03% |

| 5-year | -99.59% |

| YTD | -47.42% |

| 2023 | -56.60% |

| 2022 | -53.44% |

| 2021 | -62.93% |

| 2020 | -90.72% |

| 2019 | -23.00% |

Continue Researching AHT

Want to do more research on Ashford Hospitality Trust Inc's stock and its price? Try the links below:Ashford Hospitality Trust Inc (AHT) Stock Price | Nasdaq

Ashford Hospitality Trust Inc (AHT) Stock Quote, History and News - Yahoo Finance

Ashford Hospitality Trust Inc (AHT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...