Air T, Inc. (AIRT): Price and Financial Metrics

AIRT Price/Volume Stats

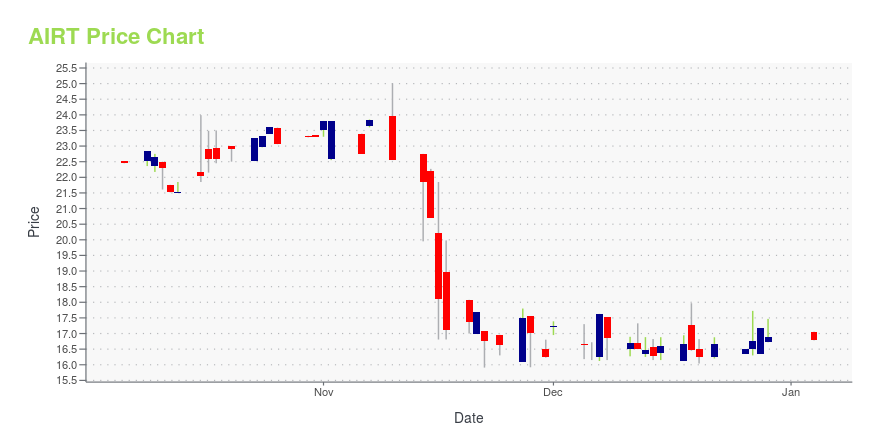

| Current price | $24.12 | 52-week high | $30.60 |

| Prev. close | $24.48 | 52-week low | $12.53 |

| Day low | $24.06 | Volume | 44,700 |

| Day high | $25.39 | Avg. volume | 14,723 |

| 50-day MA | $24.25 | Dividend yield | N/A |

| 200-day MA | $20.93 | Market Cap | 66.57M |

AIRT Stock Price Chart Interactive Chart >

Air T, Inc. (AIRT) Company Bio

Air T, Inc., through its subsidiaries, provides overnight air cargo, ground equipment sale, commercial jet engines and parts, and printing equipment and maintenance services in the United States and internationally. The company's Overnight Air Cargo segment offers air express delivery services. As of March 31, 2020, this segment had 69 aircraft under the dry-lease agreements with FedEx. Its Ground Equipment Sales segment manufactures, sells, and services aircraft deicers, scissor-type lifts, military and civilian decontamination units, flight-line tow tractors, glycol recovery vehicles, and other specialized equipment. This segment sells its products to passenger and cargo airlines, ground handling companies, the United States Air Force, airports, and industrial customers. Its Commercial Jet Engines and Parts segment offers commercial aircraft trading, leasing, and parts solutions; commercial aircraft storage, storage maintenance, and aircraft disassembly/part-out services; commercial aircraft parts sales, exchanges, procurement services, consignment programs, and overhaul and repair services; and aircraft instrumentation, avionics, and a range of electrical accessories for civilian, military transport, regional/commuter and business/commercial jet, and turboprop aircraft. This segment also provides composite aircraft structures, and repair and support services. Its Printing Equipment and Maintenance segment designs, manufactures, and sells digital print production equipment, spare parts, supplies, and consumable items, as well as provides maintenance contracts. Air T, Inc. was founded in 1980 and is based in Denver, North Carolina.

Latest AIRT News From Around the Web

Below are the latest news stories about AIR T INC that investors may wish to consider to help them evaluate AIRT as an investment opportunity.

Air T, Inc. Announces Completion of $4.0 million Private Placement of Trust Preferred SecuritiesCHARLOTTE, NC / ACCESSWIRE / November 28, 2023 / Today The Company announces the completion of a private placement of $4.0 million of its 8% Trust Preferred Securities (NASDAQ:AIRTP) at a price of $17.00 per share for a 12.1% yield to maturity. This ... |

Air T, Inc. Reports Second Quarter Fiscal 2024 ResultsCHARLOTTE, NC / ACCESSWIRE / November 13, 2023 / Air T, Inc. (NASDAQ:AIRT) is an industrious American company with a portfolio of businesses, each of which is independent yet interrelated. We seek dynamic individuals and teams to operate companies ... |

Air T, Inc. Reports First Quarter Fiscal 2024 ResultsAir T, Inc. (NASDAQ:AIRT) is an industrious American company with a portfolio of businesses, each of which is independent yet interrelated. We seek dynamic individuals and teams to operate companies using processes that increase value over time. |

Air T, Inc. Announces Webcast Availability for 2023 Annual Meeting of Stockholders/ AIR T, INC (NASDAQ:AIRT) announced today that the Company's 2023 Annual Meeting of Stockholders (the "Annual Meeting") will be available to attendees via webcast as well as in person. As previously announced, the Annual Meeting will be held on Wednesday, August 16, 2023, at 8:30 AM, Central Time. Stockholders will be able to physically attend the Annual Meeting or participate via webcast. |

Investing in Air T (NASDAQ:AIRT) three years ago would have delivered you a 89% gainAir T, Inc. ( NASDAQ:AIRT ) shareholders might be concerned after seeing the share price drop 13% in the last quarter... |

AIRT Price Returns

| 1-mo | 1.22% |

| 3-mo | -0.41% |

| 6-mo | 43.57% |

| 1-year | 5.33% |

| 3-year | -17.69% |

| 5-year | 28.30% |

| YTD | 42.73% |

| 2023 | -31.64% |

| 2022 | -1.71% |

| 2021 | 1.00% |

| 2020 | 23.57% |

| 2019 | 23.37% |

Continue Researching AIRT

Here are a few links from around the web to help you further your research on Air T Inc's stock as an investment opportunity:Air T Inc (AIRT) Stock Price | Nasdaq

Air T Inc (AIRT) Stock Quote, History and News - Yahoo Finance

Air T Inc (AIRT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...