Arthur J. Gallagher & Co. (AJG): Price and Financial Metrics

AJG Price/Volume Stats

| Current price | $283.58 | 52-week high | $283.90 |

| Prev. close | $273.97 | 52-week low | $214.13 |

| Day low | $267.00 | Volume | 1,161,100 |

| Day high | $283.90 | Avg. volume | 850,743 |

| 50-day MA | $261.11 | Dividend yield | 0.88% |

| 200-day MA | $244.77 | Market Cap | 61.96B |

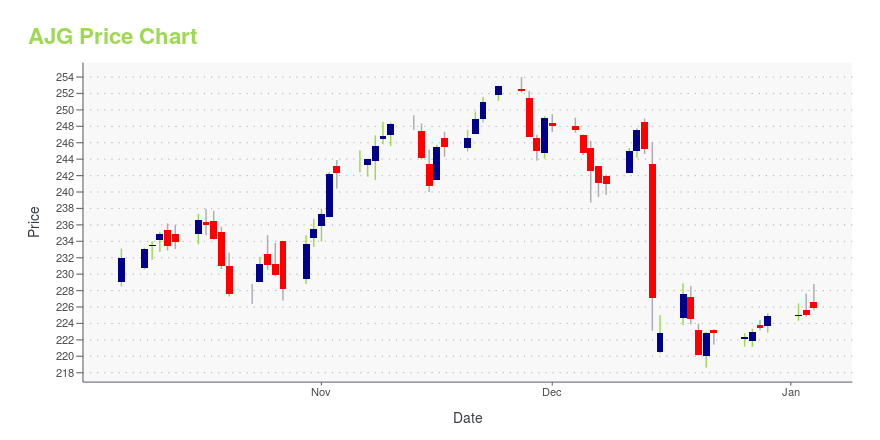

AJG Stock Price Chart Interactive Chart >

Arthur J. Gallagher & Co. (AJG) Company Bio

Arthur J. Gallagher & Co. (AJG) is an American global insurance brokerage and risk management services firm headquartered in Rolling Meadows, Illinois (a suburb of Chicago). The firm was established in 1927 and is one of the largest insurance brokers in the world. (Source:Wikipedia)

Latest AJG News From Around the Web

Below are the latest news stories about ARTHUR J GALLAGHER & CO that investors may wish to consider to help them evaluate AJG as an investment opportunity.

Brown & Brown (BRO) Expands in Florida With Caton-Hosey BuyoutBrown & Brown (BRO) signs an agreement to acquire Caton-Hosey, boosting its presence in Florida. |

Arthur J. Gallagher's (NYSE:AJG) earnings growth rate lags the 28% CAGR delivered to shareholdersThe worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put... |

Marsh & McLennan's (MMC) Unit Divests Atlas to Stoch AnalyticsMarsh & McLennan's (MMC) Oliver Wyman sells its Atlas Software business to Stoch Analytics, aiming to serve its clients better with an independent software company. |

Institutional investors may overlook Arthur J. Gallagher & Co.'s (NYSE:AJG) recent US$3.9b market cap drop as long-term gains remain positiveKey Insights Given the large stake in the stock by institutions, Arthur J. Gallagher's stock price might be vulnerable... |

Transamerica Selected as Recordkeeper for Gallagher's New 401(k) Choice Pooled Solutions, Designed for Small and Large CompaniesTransamerica, a leading retirement and life insurance company, is proud to announce its selection as the recordkeeper for Gallagher's new 401(k) Choice Pooled SolutionsSM. Through a single contract, an employer can select either the Gallagher 401(k) Group Retirement Plans or the Gallagher 401(k) Choice Pooled Employer PlanSM. This strategic move marks a significant milestone in the employee benefits industry, offering small and large employers the choice to join the group retirement plans or a p |

AJG Price Returns

| 1-mo | 9.01% |

| 3-mo | 21.42% |

| 6-mo | 24.55% |

| 1-year | 32.40% |

| 3-year | 113.19% |

| 5-year | 229.53% |

| YTD | 26.71% |

| 2023 | 20.51% |

| 2022 | 12.44% |

| 2021 | 39.02% |

| 2020 | 32.12% |

| 2019 | 31.79% |

AJG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AJG

Want to do more research on Arthur J Gallagher & Co's stock and its price? Try the links below:Arthur J Gallagher & Co (AJG) Stock Price | Nasdaq

Arthur J Gallagher & Co (AJG) Stock Quote, History and News - Yahoo Finance

Arthur J Gallagher & Co (AJG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...