AirNet Technology Inc. (ANTE): Price and Financial Metrics

ANTE Price/Volume Stats

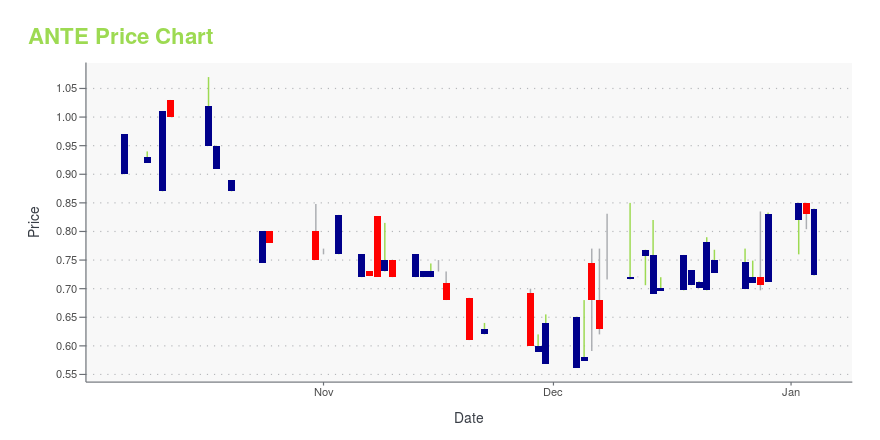

| Current price | $1.36 | 52-week high | $1.95 |

| Prev. close | $1.05 | 52-week low | $0.56 |

| Day low | $1.05 | Volume | 19,661 |

| Day high | $1.36 | Avg. volume | 36,509 |

| 50-day MA | $1.05 | Dividend yield | N/A |

| 200-day MA | $0.99 | Market Cap | 19.46M |

ANTE Stock Price Chart Interactive Chart >

AirNet Technology Inc. (ANTE) Company Bio

AirNet Technology Inc. operates out-of-home advertising platforms in the People's Republic of China. The company operates a network of digital (television) TV screens on planes operated by 7 airlines; and gas station media network, as well as other outdoor media advertising platforms in gas stations. It also displays non-advertising content, such as weather, sports, comedy clips, local attractions, documentaries, commentaries, and reality shows. In addition, the company holds concession rights to install and operate Wi-Fi systems on railway administration bureaus, long-haul buses, and airlines; and operates advertising platforms, such as light boxes, billboards, and LED screens. Further, it operates CIBN-AirMedia channel to broadcast network TV programs to air travelers. The company was formerly known as AirMedia Group Inc. AirNet Technology Inc. was founded in 2005 and is headquartered in Beijing, the People's Republic of China.

Latest ANTE News From Around the Web

Below are the latest news stories about AIRNET TECHNOLOGY INC that investors may wish to consider to help them evaluate ANTE as an investment opportunity.

AirNet Technology Inc. Announces Unaudited Financial Results for the First Half of 2023BEIJING, Dec. 26, 2023 (GLOBE NEWSWIRE) -- AirNet Technology Inc., formerly known as AirMedia Group Inc. (“AirNet” or the “Company”) (Nasdaq: ANTE), today announced its unaudited financial results for the first half of 2023. AIRNET TECHNOLOGY INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (In U.S. dollars in thousands, except share and per share data) As of December 31, As of June 30, 2022 2023 (Unaudited) Assets Current assets: Cash and cash equivalents $2,700 $132 Accounts receivable, ne |

AirNet Announces Receipt of Minimum Bid Price Notice from NasdaqBEIJING, Dec. 01, 2023 (GLOBE NEWSWIRE) -- AirNet Technology Inc., formerly known as AirMedia Group Inc. (“AirNet” or the “Company”) (Nasdaq: ANTE), today announced that it received a notification letter (the “Notification Letter”) from the Listing Qualifications Department of The Nasdaq Stock Market Inc. (“Nasdaq”) dated on November 27, 2023 indicating that the Company is no longer in compliance with the minimum bid price requirement set forth in Rule 5550(a)(2) of the Nasdaq Listing Rules as t |

AirNet Announces Termination of Investment AgreementAirNet Technology Inc., formerly known as AirMedia Group Inc. ("AirNet" or the "Company") (Nasdaq: ANTE), today announced that it has entered into a termination agreement (the "Termination Agreement") on June 21, 2023 with Unistar Group Holdings Ltd. ("Unistar Group"), Northern Shore Group Limited ("Northern Shore"), Mr. Herman Man Guo, chairman of the Company, and Mrs. Dan Shao, chief executive officer of the Company to terminate the investment agreement (the "Investment Agreement") entered int |

AirNet Regains Compliance with Nasdaq Minimum Bid Price RequirementAirNet Technology Inc., formerly known as AirMedia Group Inc. ("AirNet" or the "Company") (Nasdaq: ANTE), today announced that it received a notification letter (the "Notification Letter on Compliance") from the Listing Qualifications Department of The Nasdaq Stock Market Inc. ("Nasdaq") on December 27, 2022, indicating that the Company has regained compliance with the minimum bid price requirement set forth in Rule 5550(a)(2) of the Nasdaq Listing Rules. |

ANTE Price Returns

| 1-mo | 32.04% |

| 3-mo | 3.03% |

| 6-mo | N/A |

| 1-year | -4.23% |

| 3-year | -84.96% |

| 5-year | -76.39% |

| YTD | 63.88% |

| 2023 | -24.55% |

| 2022 | -81.91% |

| 2021 | -30.59% |

| 2020 | 120.10% |

| 2019 | -20.40% |

Loading social stream, please wait...