American Public Education, Inc. (APEI): Price and Financial Metrics

APEI Price/Volume Stats

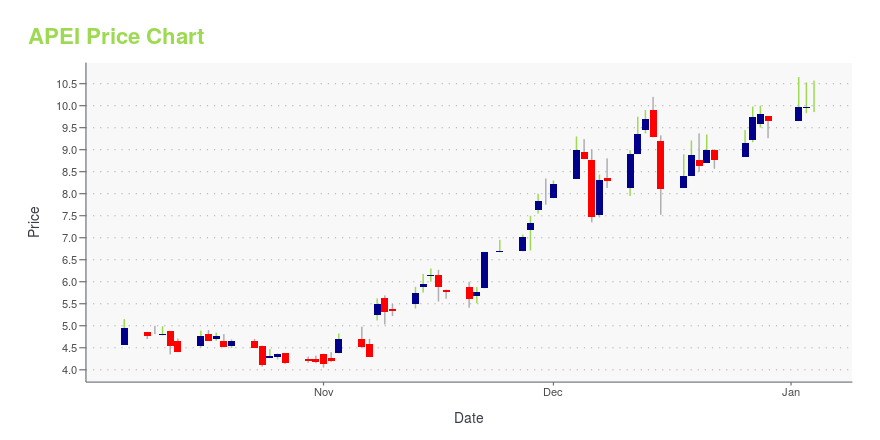

| Current price | $20.33 | 52-week high | $21.04 |

| Prev. close | $19.38 | 52-week low | $4.05 |

| Day low | $19.51 | Volume | 224,024 |

| Day high | $20.45 | Avg. volume | 205,797 |

| 50-day MA | $17.65 | Dividend yield | N/A |

| 200-day MA | $12.14 | Market Cap | 357.30M |

APEI Stock Price Chart Interactive Chart >

American Public Education, Inc. (APEI) Company Bio

American Public Education, Inc. provides online and campus-based postsecondary education. The company was founded in 1991 and is based in Charles Town, West Virginia.

Latest APEI News From Around the Web

Below are the latest news stories about AMERICAN PUBLIC EDUCATION INC that investors may wish to consider to help them evaluate APEI as an investment opportunity.

The Zacks Analyst Blog Highlights American Public Education, Affirm, Barrett Business Services and 8x8American Public Education, Affirm, Barrett Business Services and 8x8 are part of the Zacks top Analyst Blog. |

4 Stocks to Make the Most of the Santa Claus RallyAs we are lined up for a strong year-end rally, investing in growth stocks such as American Public Education (APEI), Affirm (AFRM), Barrett Business Services (BBSI) and 8x8 (EGHT) seems prudent. |

Should Value Investors Buy American Public Education (APEI) Stock?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Rasmussen University Appoints Matthew Yale as Board Chairman and Welcomes Dr. Claire Zangerle to its Board of DirectorsRasmussen University today announced changes to its Board of Directors, including the appointment of a new chairman and public member. Most notably, longtime chairman Dr. Henry S. Bienen has stepped down but will remain an integral part of the Board as a public member and chair of the Board's Academic Affairs Committee. Matthew Yale, who has been a public member of Rasmussen's Board since 2020, will assume the position of chairman effective immediately. |

American Public's (APEI) APUS Unveils 3-Year Bachelor ProgramAmerican Public University System, a subsidiary institution of American Public (APEI), announces the launch of a new three-year Bachelor of Science degree in Cybersecurity. |

APEI Price Returns

| 1-mo | 25.80% |

| 3-mo | 42.27% |

| 6-mo | 71.42% |

| 1-year | 341.00% |

| 3-year | -28.62% |

| 5-year | -37.27% |

| YTD | 110.67% |

| 2023 | -21.48% |

| 2022 | -44.76% |

| 2021 | -27.00% |

| 2020 | 11.28% |

| 2019 | -3.76% |

Continue Researching APEI

Want to do more research on American Public Education Inc's stock and its price? Try the links below:American Public Education Inc (APEI) Stock Price | Nasdaq

American Public Education Inc (APEI) Stock Quote, History and News - Yahoo Finance

American Public Education Inc (APEI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...