APi Group Corporation (APG): Price and Financial Metrics

APG Price/Volume Stats

| Current price | $37.19 | 52-week high | $39.98 |

| Prev. close | $36.49 | 52-week low | $24.61 |

| Day low | $36.75 | Volume | 995,379 |

| Day high | $37.46 | Avg. volume | 1,785,025 |

| 50-day MA | $37.14 | Dividend yield | N/A |

| 200-day MA | $34.37 | Market Cap | 10.20B |

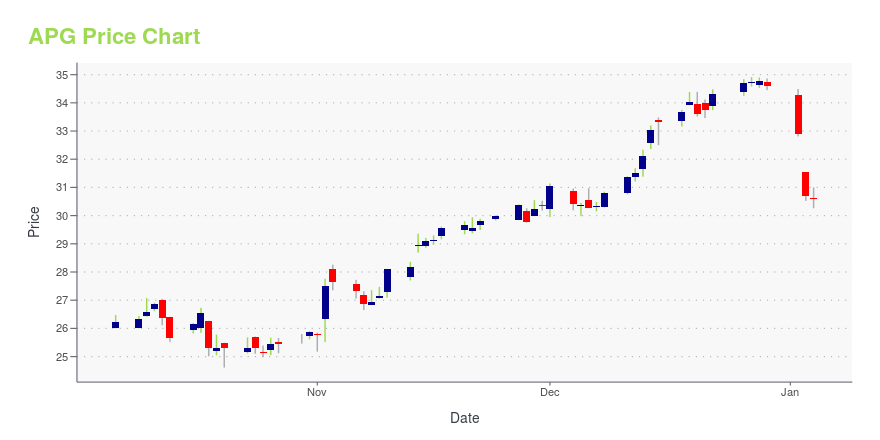

APG Stock Price Chart Interactive Chart >

APi Group Corporation (APG) Company Bio

APi Group Corporation provides commercial life safety solutions and industrial specialty services primarily in the United States. It operates through three segments: Safety Services, Specialty Services, and Industrial Services. The Safety Services segment offers safety solutions focusing on end-to-end integrated occupancy systems, such as fire protection solutions, and HVAC and entry systems, which include the design, installation, inspection, and service of these integrated systems. It also provides mission critical services, including life safety, emergency communication systems, and specialized mechanical services. The Specialty Services segment offers diversified, single-source infrastructure, and specialty contractor solutions focusing on infrastructure services and specialized industrial plant solutions, including maintenance and repair of water, sewer, and telecom infrastructure. The Industrial Services segment provides specialty contracting services and solutions comprising oil and gas pipeline infrastructure, access and road construction, supporting facilities, and integrity management and maintenance to the energy industry focused on transmission and distribution. The company serves customers in the public and private sectors, including commercial, industrial, manufacturing, retail, education, healthcare, communications, utilities, energy, and high tech and governmental markets. The company was formerly known as J2 Acquisition Limited and changed its name to APi Group Corporation in October 2019. APi Group Corporation was founded in 1926 and is headquartered in New Brighton, Minnesota.

Latest APG News From Around the Web

Below are the latest news stories about API GROUP CORP that investors may wish to consider to help them evaluate APG as an investment opportunity.

APi Group Announces Debt PaydownNEW BRIGHTON, Minn., December 19, 2023--APi Group Corporation (NYSE: APG) ("APi" or the "Company"), a global, market-leading business services provider of life safety, security and specialty services, today announced that the Company has recently paid down an additional $175 million on its Term Loan due 2026, leaving $330 million outstanding. APi has repaid a total of $475 million of debt year to date and expects to end 2023 below its targeted net leverage ratio of 2.5x. |

APi Group Provides Update on Chubb Value Capture ProgressNEW BRIGHTON, Minn., November 27, 2023--APi Group Corporation (NYSE: APG) ("APi" or the "Company"), a global, market-leading business services provider of life safety, security and specialty services, today provided an update on the strategic initiatives relating to the Chubb business announced one year ago at the Company’s Investor Day meeting in New York City. |

Why Fast-paced Mover APi (APG) Is a Great Choice for Value InvestorsAPi (APG) could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices. It is one of the several stocks that made it through our 'Fast-Paced Momentum at a Bargain' screen. |

What Makes APi (APG) a New Buy StockAPi (APG) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. |

APi Group Reports Third Quarter 2023 Financial ResultsNEW BRIGHTON, Minn., November 02, 2023--APi Group Corporation (NYSE: APG) ("APi" or the "Company") today reported its financial results for the three and nine months ended September 30, 2023. |

APG Price Returns

| 1-mo | -1.54% |

| 3-mo | -2.36% |

| 6-mo | 15.14% |

| 1-year | 32.07% |

| 3-year | 67.07% |

| 5-year | N/A |

| YTD | 7.49% |

| 2023 | 83.94% |

| 2022 | -27.01% |

| 2021 | 41.98% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...