Apple Hospitality REIT, Inc. Common Shares (APLE): Price and Financial Metrics

APLE Price/Volume Stats

| Current price | $14.99 | 52-week high | $17.90 |

| Prev. close | $14.64 | 52-week low | $13.95 |

| Day low | $14.72 | Volume | 1,712,200 |

| Day high | $15.05 | Avg. volume | 2,070,336 |

| 50-day MA | $14.53 | Dividend yield | 6.3% |

| 200-day MA | $15.74 | Market Cap | 3.63B |

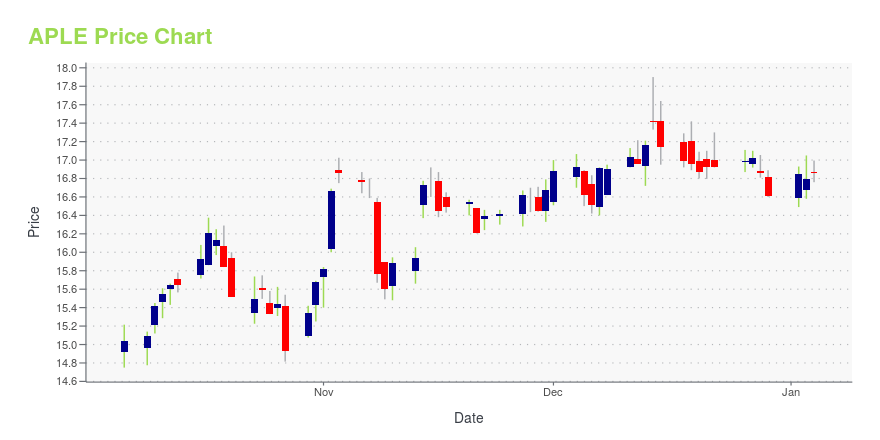

APLE Stock Price Chart Interactive Chart >

Apple Hospitality REIT, Inc. Common Shares (APLE) Company Bio

Apple Hospitality REIT owns portfolios of upscale, select service hotels in the United States. The company was founded in 2007 and is based in Richmond, Virginia.

Latest APLE News From Around the Web

Below are the latest news stories about APPLE HOSPITALITY REIT INC that investors may wish to consider to help them evaluate APLE as an investment opportunity.

Apple Hospitality REIT Acquires the SpringHill Suites by Marriott Las Vegas Convention CenterRICHMOND, Va., December 28, 2023--Apple Hospitality REIT Acquires the SpringHill Suites by Marriott Las Vegas Convention Center |

7 Unusual Options Activity Stocks That You Need to Pay Attention ToOne of the beautiful aspects of the derivatives market is that you don’t need to trade options to benefit from the underlying data; case in point is unusual options activity. |

Apple Hospitality REIT Publishes Annual Corporate Responsibility ReportRICHMOND, Va., December 22, 2023--Apple Hospitality REIT Publishes Annual Corporate Responsibility Report |

Apple Hospitality REIT Announces Dates for Fourth Quarter and Full Year 2023 Earnings Release and Conference CallRICHMOND, Va., December 20, 2023--Apple Hospitality REIT Announces Dates for Fourth Quarter and Full Year 2023 Earnings Release and Conference Call |

Apple Hospitality REIT Announces Monthly Distribution and Special Distribution for 2023RICHMOND, Va., December 19, 2023--Apple Hospitality REIT Announces Monthly Distribution and Special Distribution for 2023 |

APLE Price Returns

| 1-mo | 5.63% |

| 3-mo | 1.60% |

| 6-mo | -6.82% |

| 1-year | 5.71% |

| 3-year | 16.38% |

| 5-year | 16.18% |

| YTD | -7.33% |

| 2023 | 12.31% |

| 2022 | 2.41% |

| 2021 | 25.42% |

| 2020 | -18.91% |

| 2019 | 21.97% |

APLE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching APLE

Here are a few links from around the web to help you further your research on Apple Hospitality REIT Inc's stock as an investment opportunity:Apple Hospitality REIT Inc (APLE) Stock Price | Nasdaq

Apple Hospitality REIT Inc (APLE) Stock Quote, History and News - Yahoo Finance

Apple Hospitality REIT Inc (APLE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...