American Resources Corporation (AREC): Price and Financial Metrics

AREC Price/Volume Stats

| Current price | $0.62 | 52-week high | $1.94 |

| Prev. close | $0.63 | 52-week low | $0.59 |

| Day low | $0.62 | Volume | 184,752 |

| Day high | $0.66 | Avg. volume | 330,012 |

| 50-day MA | $0.91 | Dividend yield | N/A |

| 200-day MA | $1.33 | Market Cap | 49.35M |

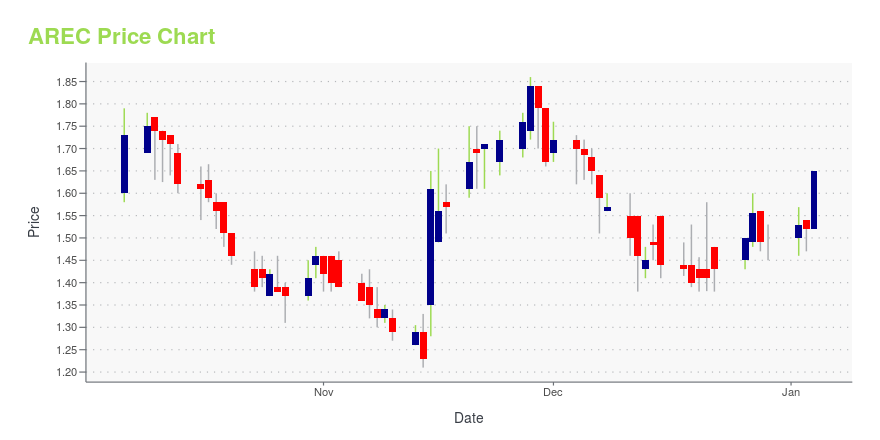

AREC Stock Price Chart Interactive Chart >

American Resources Corporation (AREC) Company Bio

American Resources Corporation supplies raw materials for the global infrastructure marketplace. The company focuses on the extraction and processing of metallurgical carbon used in steelmaking. It has a portfolio of operations located in the Central Appalachian basin of eastern Kentucky and southern West Virginia. The company was founded in 2006 and is headquartered in Fishers, Indiana.

Latest AREC News From Around the Web

Below are the latest news stories about AMERICAN RESOURCES CORP that investors may wish to consider to help them evaluate AREC as an investment opportunity.

Is American Resources (AREC) Outperforming Other Basic Materials Stocks This Year?Here is how American Resources Corporation (AREC) and Axalta Coating Systems (AXTA) have performed compared to their sector so far this year. |

Individual investors account for 58% of American Resources Corporation's (NASDAQ:AREC) ownership, while private companies account for 18%Key Insights The considerable ownership by individual investors in American Resources indicates that they collectively... |

American Resources Corporation’s and Royalty Management Holding Corporation’s Investment In Advanced Magnetic Labs, Inc Results in Commercial Manufacturing of Permanent MagnetsAdvanced Magnetic Labs is evaluating multiple sites for commercial-scale manufacturing expansion within the United States following a successful year of technology advancement American Resources and Royalty Management have jointly participated in ... |

Royalty Management Holding Corporation’s and American Resources Corporation’s Investment In Advanced Magnetic Labs, Inc. Results in Commercial Manufacturing of Permanent MagnetsAdvanced Magnetic Labs is evaluating multiple sites for commercial-scale manufacturing expansion within the United States following a successful year of technology advancementAmerican Resources and Royalty Management have jointly participated in funding ... |

American Resources Corporation's Subsidiary, ReElement Technologies Corporation, Partners with TECHGULF Ghana to Launch Africa’s First Lithium Processing Plant in GhanaPartnership showcases Reelement's value-added attributes as a scalable, low cost and clean critical mineral refining platformGhanaian, commercial-scale facility will be built with initial refining capacity to produce 30,000 metric tons of battery-cell-grade ... |

AREC Price Returns

| 1-mo | -12.18% |

| 3-mo | -60.00% |

| 6-mo | -58.11% |

| 1-year | -65.75% |

| 3-year | -71.30% |

| 5-year | -79.54% |

| YTD | -58.39% |

| 2023 | 12.88% |

| 2022 | -26.67% |

| 2021 | -7.69% |

| 2020 | 209.52% |

| 2019 | N/A |

Continue Researching AREC

Here are a few links from around the web to help you further your research on American Resources Corp's stock as an investment opportunity:American Resources Corp (AREC) Stock Price | Nasdaq

American Resources Corp (AREC) Stock Quote, History and News - Yahoo Finance

American Resources Corp (AREC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...