Algoma Steel Group Inc. (ASTL): Price and Financial Metrics

ASTL Price/Volume Stats

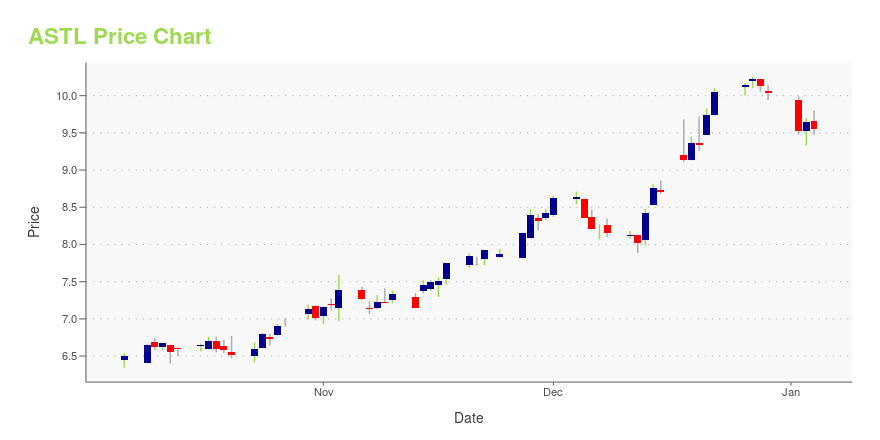

| Current price | $8.67 | 52-week high | $10.25 |

| Prev. close | $8.63 | 52-week low | $6.34 |

| Day low | $8.59 | Volume | 316,298 |

| Day high | $8.77 | Avg. volume | 520,683 |

| 50-day MA | $7.65 | Dividend yield | 2.25% |

| 200-day MA | $8.00 | Market Cap | 902.75M |

ASTL Stock Price Chart Interactive Chart >

Algoma Steel Group Inc. (ASTL) Company Bio

Algoma Steel Group Inc. produces and sells steel products primarily in North America. It provides flat/sheet steel products, including temper rolling, cold rolled, hot-rolled, floor plate, and cut-to-length products for the automotive industry; and plate steel products that consist of rolled, hot-rolled, and heat-treated for use in the construction or manufacture of railcars, buildings, bridges, off-highway equipment, storage tanks, ships, and military applications. Algoma Steel Group Inc. was founded in 1901 and is headquartered in Sault Ste. Marie, Canada.

Latest ASTL News From Around the Web

Below are the latest news stories about ALGOMA STEEL GROUP INC that investors may wish to consider to help them evaluate ASTL as an investment opportunity.

Algoma Steel expects Q3 total steel shipments to be ~515,000 tonsMore on Algoma Steel Group |

Algoma Steel Group Announces Director RetirementSAULT STE. MARIE, Ontario, Dec. 21, 2023 (GLOBE NEWSWIRE) -- Algoma Steel Group Inc. (NASDAQ: ASTL; TSX: ASTL) (“Algoma” or “the Company”), a leading Canadian producer of hot and cold rolled steel sheet and plate products, today announced that Andrew Schultz is retiring from the board of directors effective December 31, 2023. Mr. Schultz originally joined the board of Algoma Steel Holdings Inc., a predecessor to the Company, in connection with its acquisition of the assets of Essar Algoma Steel |

Algoma Steel Group Inc.'s (NASDAQ:ASTL) high institutional ownership speaks for itself as stock continues to impress, up 11% over last weekKey Insights Significantly high institutional ownership implies Algoma Steel Group's stock price is sensitive to their... |

Algoma Steel Announces Retirement of Vice President - SalesSAULT STE. MARIE, Ontario, Nov. 23, 2023 (GLOBE NEWSWIRE) -- Algoma Steel Group Inc. (NASDAQ: ASTL; TSX: ASTL) (“Algoma” or “the Company”), a leading Canadian producer of hot and cold rolled steel sheet and plate products, today announced its Vice President - Sales, Rory Brandow, has indicated his pending retirement effective December 1st, 2023. The Company has identified Chris Ford, Algoma’s current Director - US Sales and Customer Service, to succeed Rory as Vice President - Commercial. Michae |

Algoma Steel Group Reports Fiscal Second Quarter 2024 Financial ResultsSecond Quarter In line with Previously Announced Expectations Positive Momentum on EAF Power Supply Reiterated Outlook on Transformative EAF Project with $455.7 Million Invested to Date SAULT STE. MARIE, Ontario, Nov. 02, 2023 (GLOBE NEWSWIRE) -- (November 2, 2023) – Algoma Steel Group Inc. (NASDAQ: ASTL; TSX: ASTL) (“Algoma” or “the Company”), a leading Canadian producer of hot and cold rolled steel sheet and plate products, today announced results for its fiscal second quarter ended September |

ASTL Price Returns

| 1-mo | 27.12% |

| 3-mo | 11.11% |

| 6-mo | 2.13% |

| 1-year | 24.27% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -12.43% |

| 2023 | 62.47% |

| 2022 | -39.44% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

ASTL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...