AltaGas Ltd. (ATGFF): Price and Financial Metrics

ATGFF Price/Volume Stats

| Current price | $23.76 | 52-week high | $23.87 |

| Prev. close | $23.65 | 52-week low | $17.84 |

| Day low | $23.61 | Volume | 18,483 |

| Day high | $23.84 | Avg. volume | 50,400 |

| 50-day MA | $22.51 | Dividend yield | 4.53% |

| 200-day MA | $21.07 | Market Cap | N/A |

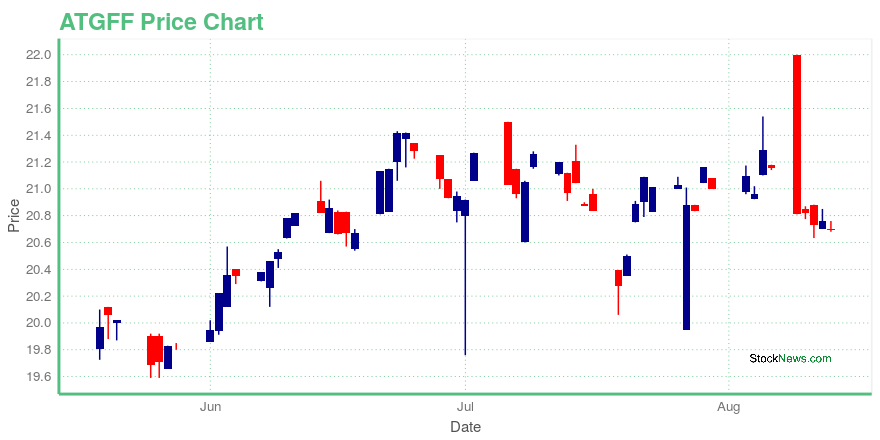

ATGFF Stock Price Chart Interactive Chart >

AltaGas Ltd. (ATGFF) Company Bio

AltaGas Ltd. operates as a diversified energy infrastructure company in North America. The company operates through three segments: Utilities, Midstream, and Power. The Utilities segment owns and operates regulated natural gas distribution utilities in Michigan, Alaska, the District of Columbia, Maryland, and Virginia; and two regulated natural gas storage utilities in the United States serving approximately 1.7 million customers. This segment also provides interstate natural gas transportation and storage services. It serves homes and businesses. The Midstream segment engages in the natural gas gathering and processing; natural gas liquids (NGL) extraction and fractionation, transmission, and storage; natural gas and NGL marketing; and gas retail marketing activities. This segment owns approximately 1.4 billion cubic feet per day (Bcf/d) of natural gas extraction processing capacity and holds interests in regulated pipelines in the Marcellus/Utica gas formation in the northeastern United States. It serves residential, commercial, and industrial customers primarily in the Western Canada Sedimentary Basin. The Power segment is involved in the generation and sale of electricity; and provision of energy storage and retail power marketing, and ancillary services in Alberta, California, and Colorado. It has 710 megawatt of operational gross capacity from natural gas-fired, biomass, solar, and distributed energy. This segment serves residential, commercial, and industrial users. AltaGas Ltd. was founded in 1994 and is headquartered in Calgary, Canada.

Latest ATGFF News From Around the Web

Below are the latest news stories about AltaGas Ltd that investors may wish to consider to help them evaluate ATGFF as an investment opportunity.

TFSA Investors: This Dividend Growth Stock Is Dirt CheapAltagas stock is a great addition to your TFSA portfolio, as dividend growth will be driven by its mix of stability and growth. The post TFSA Investors: This Dividend Growth Stock Is Dirt Cheap appeared first on The Motley Fool Canada . |

News Flash: Analysts Just Made A Sizeable Upgrade To Their AltaGas Ltd. (TSE:ALA) ForecastsShareholders in AltaGas Ltd. ( TSE:ALA ) may be thrilled to learn that the analysts have just delivered a major upgrade... |

AltaGas Ltd. Just Beat Analyst Forecasts, And Analysts Have Been Updating Their PredictionsAltaGas Ltd. ( TSE:ALA ) just released its latest second-quarter results and things are looking bullish. Statutory... |

AltaGas Q2 Revenue Nearly DoublesAltaGas Ltd. (ALA) posted strong Q2 results on Thursday, beating earnings estimates. AltaGas is a Canadian natural gas transportation and distribution company based in Calgary. Revenue came in at C$2.01 billion for the quarter ended June 30, an increase of 89.6% from C$1.06 billion in the prior-year quarter. Meanwhile, net income amounted to C$24 million (C$0.09 per share) in Q2 2021, an improvement from C$21 million (C$0.08 per share) in Q2 2020. Normalized EPS were C$0.08 in the quarter, up 33% from C$0.06 a year earlier. Analysts on average were expecting C$0.01. Normalized funds from operations reached C$0.56 in the quarter, compared to C$0.51 in the second quarter of 2020. |

AltaGas Announces Strong Second Quarter ResultsOperating Performance Reflects AltaGas Continued Focus on Optimizing the Platform to Generate Strong Value Creation and Drive Better Outcomes for all Stakeholders CALGARY, AB, July 29, 2021 /CNW/ AltaGas Ltd. (AltaGas or the Company) (TSX: ALA) today reported second quarter 2021 financial results and provided an update on the Companys operations. HIGHLIGHTS (all financial figures are unaudited and in Canadian dollars Read more The post AltaGas Announces Strong Second Quarter Results appeared first on Energy News for the Canadian Oil & Gas Industry | EnergyNow.ca . |

ATGFF Price Returns

| 1-mo | 7.48% |

| 3-mo | 7.67% |

| 6-mo | 12.53% |

| 1-year | 26.38% |

| 3-year | 13.79% |

| 5-year | 52.61% |

| YTD | 13.79% |

| 2023 | 21.40% |

| 2022 | -20.52% |

| 2021 | 47.01% |

| 2020 | -3.25% |

| 2019 | 49.99% |

ATGFF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...