Atento S.A. Ordinary Shares (ATTO): Price and Financial Metrics

ATTO Price/Volume Stats

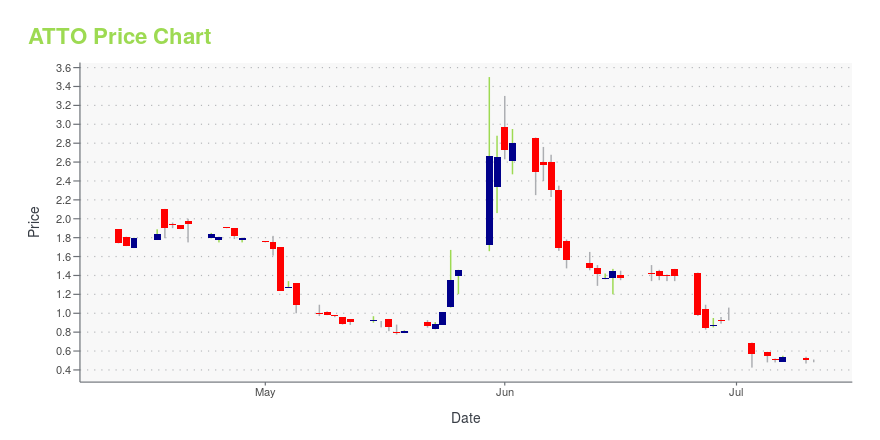

| Current price | $0.47 | 52-week high | $9.16 |

| Prev. close | $0.48 | 52-week low | $0.42 |

| Day low | $0.46 | Volume | 48,900 |

| Day high | $0.49 | Avg. volume | 480,965 |

| 50-day MA | $1.17 | Dividend yield | N/A |

| 200-day MA | $3.02 | Market Cap | 7.29M |

ATTO Stock Price Chart Interactive Chart >

Atento S.A. Ordinary Shares (ATTO) Company Bio

Atento SA offers customer relationship management and business process outsourcing services in Latin America. The company was founded in 1999 and is based in Luxembourg.

Latest ATTO News From Around the Web

Below are the latest news stories about ATENTO SA that investors may wish to consider to help them evaluate ATTO as an investment opportunity.

Atento enters into a restructuring support agreement with certain key financial stakeholdersAtento S.A. (NYSE: ATTO, "Atento" or the "Company"), one of the world's largest customer relationship management and business process outsourcing (CRM / BPO) service providers and an industry leader in Latin America, announces that, following its announcement on 23 June 2023 regarding its entry into a term sheet providing for a new interim financing of at least $30 million and a path to a comprehensive restructuring transaction to significantly deleverage its balance sheet, Atento has entered in |

Atento reaches agreement with certain key stakeholdersAtento S.A. (NYSE: ATTO, "Atento" or the "Company"), one of the world's largest customer relationship management and business process outsourcing (CRM / BPO) service providers and an industry leader in Latin America, reports on progress in the previously announced negotiations with certain key stakeholders for a transaction involving a recapitalization and deleveraging of Atento's balance sheet. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time for a look at the biggest pre-market stock movers on Tuesday morning with all the details traders need to know about! |

Favourable Signals For Atento: Numerous Insiders Acquired Stock \Generally, when a single insider buys stock, it is usually not a big deal. However, when several insiders are buying... |

Telefónica and Atento renew their Global Alliance until the end of 2025Atento, one of the world's largest providers and a leading company in customer relationship and business process outsourcing (CRM/BPO) services, today announced the renewal and extension of Telefónica's Master Services Agreement until December 31, 2025. |

ATTO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -98.10% |

| 5-year | -95.80% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -83.43% |

| 2021 | 87.72% |

| 2020 | -5.56% |

| 2019 | -28.18% |

Continue Researching ATTO

Want to do more research on Atento SA's stock and its price? Try the links below:Atento SA (ATTO) Stock Price | Nasdaq

Atento SA (ATTO) Stock Quote, History and News - Yahoo Finance

Atento SA (ATTO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...