Golden Minerals Company (AUMN): Price and Financial Metrics

AUMN Price/Volume Stats

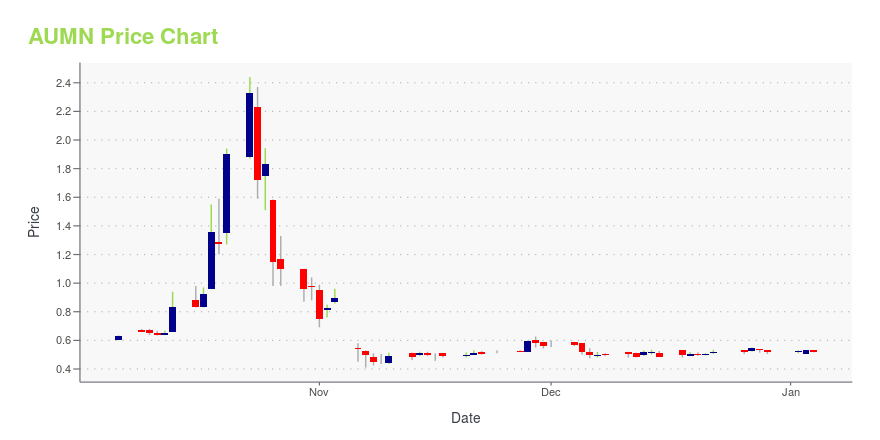

| Current price | $0.39 | 52-week high | $2.44 |

| Prev. close | $0.41 | 52-week low | $0.26 |

| Day low | $0.39 | Volume | 76,610 |

| Day high | $0.42 | Avg. volume | 255,734 |

| 50-day MA | $0.44 | Dividend yield | N/A |

| 200-day MA | $0.54 | Market Cap | 5.75M |

AUMN Stock Price Chart Interactive Chart >

Golden Minerals Company (AUMN) Company Bio

Golden Minerals Company, a precious metals exploration and development company, mines, constructs, and explores for mineral properties containing precious metals. It explores for gold, silver, zinc, lead, and other minerals. The company holds a 100% interest in the Velardeña and Chicago precious metals mining properties and associated oxide and sulfide processing plants located in the State of Durango, Mexico. It also holds interests in the El Quevar advanced exploration silver property situated in the province of Salta, Argentina; and diversified portfolio of precious metals and other mineral exploration properties located in Mexico, Argentina, and Nevada. The company was formerly known as Apex Silver Mines Limited and changed its name to Golden Minerals Company in March 2009 as a result of reorganization. The company was founded in 1996 and is headquartered in Golden, Colorado.

Latest AUMN News From Around the Web

Below are the latest news stories about GOLDEN MINERALS CO that investors may wish to consider to help them evaluate AUMN as an investment opportunity.

Golden Minerals Completes Sale of Santa Maria Gold-Silver PropertyGOLDEN, Co., December 05, 2023--Golden Minerals Company ("Golden Minerals," "Golden" or the "Company") (NYSE-A: AUMN and TSX: AUMN) is pleased to announce that on December 1, 2023, it completed the previously-announced sale of its interests in the Santa Maria gold-silver property located in Chihuahua State, Mexico to Transformaciones y Servicios Metalurgicos S.A. DE C.V. ("TSM"). |

Golden Minerals Begins Producing Gold-Bearing Pyrite Concentrate at VelardeñaGOLDEN, Colo., November 21, 2023--Golden Minerals Company ("Golden Minerals," "Golden" or the "Company") (NYSE-A: AUMN and TSX: AUMN) is pleased to announce it has begun producing gold-bearing pyrite flotation concentrate from its Velardeña Properties in Durango State, Mexico. |

Golden Minerals Reports Third Quarter 2023 Financial ResultsGOLDEN, Colo., November 10, 2023--Golden Minerals Company ("Golden Minerals," "Golden" or the "Company") (NYSE-A: AUMN and TSX: AUMN) has today released financial results and a business summary for the quarter ending September 30, 2023. (All figures are in approximate U.S. dollars.) |

Golden Minerals Announces Closing of US$4.2 Million Public OfferingGOLDEN, Colo., November 08, 2023--Golden Minerals Company ("Golden Minerals", "Golden" or the "Company") (NYSE American: AUMN and TSX: AUMN) is pleased to announce the closing of its previously announced public offering of an aggregate of 6,000,000 shares of its common stock (or common stock equivalents in lieu thereof), Series A warrants to purchase up to 6,000,000 shares of common stock and Series B warrants to purchase up to 3,000,000 shares of common stock, at a public offering price of $0.7 |

Golden Minerals Announces US$4.2 Million Public OfferingGOLDEN, Colo., November 06, 2023--Golden Minerals Company ("Golden Minerals", "Golden" or the "Company") (NYSE American: AUMN and TSX: AUMN) is pleased to announce the pricing of its public offering of an aggregate of 6,000,000 shares of its common stock (or common stock equivalents in lieu thereof), Series A warrants to purchase up to 6,000,000 shares of common stock and Series B warrants to purchase up to 3,000,000 shares of common stock, at a public offering price of $0.70 per share of common |

AUMN Price Returns

| 1-mo | -9.05% |

| 3-mo | -30.85% |

| 6-mo | -11.80% |

| 1-year | -70.00% |

| 3-year | -97.11% |

| 5-year | -93.58% |

| YTD | -24.99% |

| 2023 | -92.42% |

| 2022 | -21.44% |

| 2021 | -54.04% |

| 2020 | 145.16% |

| 2019 | 40.91% |

Continue Researching AUMN

Want to do more research on Golden Minerals Co's stock and its price? Try the links below:Golden Minerals Co (AUMN) Stock Price | Nasdaq

Golden Minerals Co (AUMN) Stock Quote, History and News - Yahoo Finance

Golden Minerals Co (AUMN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...