Bally's Corporation (BALY): Price and Financial Metrics

BALY Price/Volume Stats

| Current price | $17.82 | 52-week high | $23.20 |

| Prev. close | $18.25 | 52-week low | $10.00 |

| Day low | $16.62 | Volume | 25,299 |

| Day high | $18.00 | Avg. volume | 27,781 |

| 50-day MA | $16.81 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 864.45M |

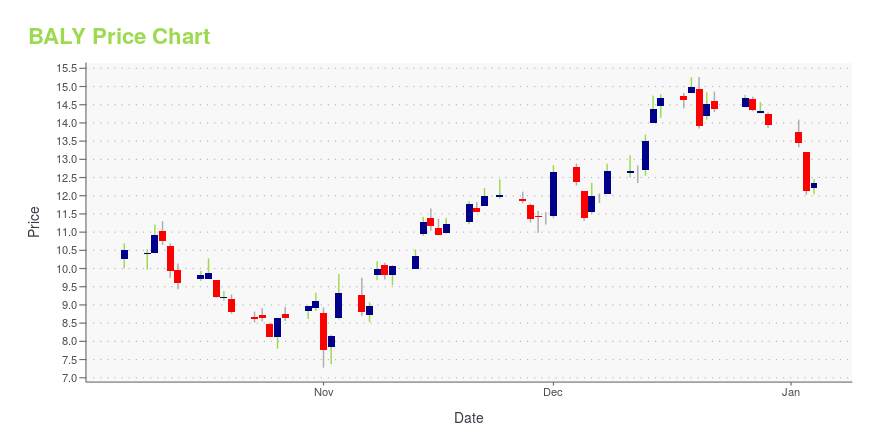

BALY Stock Price Chart Interactive Chart >

Bally's Corporation (BALY) Company Bio

Bally's Corporation owns and operates gaming and racing facilities in the United States. Its gaming and racing facilities include slot machines and various casino table games, and restaurant and hotel facilities. The company owns and manages Twin River Casino Hotel in Lincoln, Rhode Island; Tiverton Casino Hotel in Tiverton, Rhode Island; Hard Rock Hotel & Casino in Biloxi, Mississippi; Casino Vicksburg in Vicksburg, Mississippi; Dover Downs Hotel & Casino in Dover, Delaware; Casino KC in Kansas City, Missouri; Golden Gates, Golden Gulch, and Mardi Gras casinos in Black Hawk, Colorado; and Arapahoe Park racetrack and 13 off-track betting licenses in Aurora, Colorado. As of December 23, 2020, it owned and operated 11 casinos that comprise 13,260 slot machines, 459 game tables, and 2,941 hotel rooms, as well as a horse racetrack across seven states. The company was formerly known as Twin River Worldwide Holdings, Inc. and changed its name to Bally's Corporation in November 2020. Bally's Corporation was founded in 2004 and is headquartered in Providence, Rhode Island.

BALY Price Returns

| 1-mo | 9.66% |

| 3-mo | 6.87% |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -41.38% |

| 5-year | 36.76% |

| YTD | -3.52% |

| 2024 | 32.50% |

| 2023 | -28.07% |

| 2022 | -49.08% |

| 2021 | -24.23% |

| 2020 | 95.83% |

Loading social stream, please wait...