Benson Hill, Inc. (BHIL): Price and Financial Metrics

BHIL Price/Volume Stats

| Current price | $0.25 | 52-week high | $8.51 |

| Prev. close | $0.42 | 52-week low | $0.22 |

| Day low | $0.22 | Volume | 2,119,300 |

| Day high | $0.39 | Avg. volume | 483,047 |

| 50-day MA | $1.26 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 1.52M |

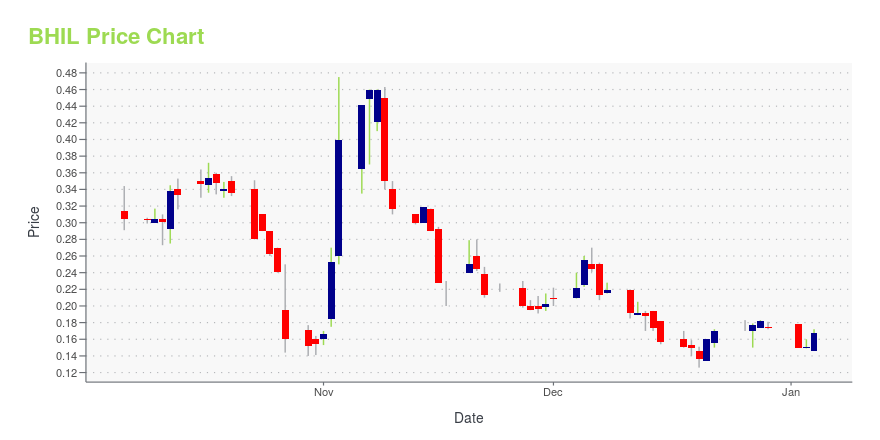

BHIL Stock Price Chart Interactive Chart >

Benson Hill, Inc. (BHIL) Company Bio

Benson Hill, Inc. operates as a food technology company unlocking the natural genetic diversity of plants. The company offers CropOS, a technology platform, which uses artificial intelligence, data, and various advanced breeding techniques that combine data, plant, and food sciences to deliver crops optimized for nutrition, flavor, and yield. The company's technology is applied in soybeans and yellow peas. It serves breeders and seed producers, farmers, logistics/consolidates, processors/wholesale suppliers, food/beverage companies, food service providers/retailers, and consumers. The company was formerly known as Benson Hill Biosystems, Inc. Benson Hill, Inc. was incorporated in 2012 and is based in Saint Louis, Missouri.

BHIL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -85.47% |

| 1-year | -96.30% |

| 3-year | -99.75% |

| 5-year | N/A |

| YTD | -87.31% |

| 2024 | -67.61% |

| 2023 | -93.18% |

| 2022 | -65.02% |

| 2021 | N/A |

| 2020 | N/A |

Loading social stream, please wait...