Broadstone Net Lease Inc. (BNL): Price and Financial Metrics

BNL Price/Volume Stats

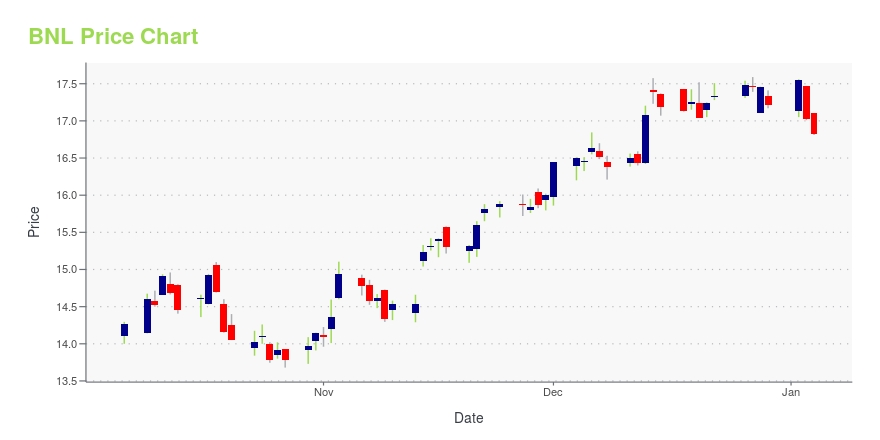

| Current price | $18.02 | 52-week high | $18.08 |

| Prev. close | $17.67 | 52-week low | $13.68 |

| Day low | $17.72 | Volume | 1,005,159 |

| Day high | $18.08 | Avg. volume | 1,206,841 |

| 50-day MA | $15.94 | Dividend yield | 6.56% |

| 200-day MA | $15.60 | Market Cap | 3.40B |

BNL Stock Price Chart Interactive Chart >

Broadstone Net Lease Inc. (BNL) Company Bio

BNL is an internally-managed REIT that acquires, owns, and manages primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. BNL utilizes an investment strategy underpinned by strong fundamental credit analysis and prudent real estate underwriting. As of June 30, 2020, BNL's diversified portfolio consisted of 632 properties in 41 U.S. states and one property in Canada across the industrial, healthcare, restaurant, office, and retail property types, with an aggregate gross asset value of approximately $4.0 billion.

Latest BNL News From Around the Web

Below are the latest news stories about BROADSTONE NET LEASE INC that investors may wish to consider to help them evaluate BNL as an investment opportunity.

JP Morgan Upgrades Six REITs To Start The WeekWith real estate investment trusts (REITs) showing strength following the Federal Reserve's recent announcement of three possible rate cuts in 2024, analysts are scurrying to update their ratings on REITs. A positive start to the week was solidified by two analysts at JP Morgan upgrading six REITs from a cross-section of REIT subsectors. All six REITs were upgraded from Neutral to Overweight. Take a look at the six REITs receiving upgrades this week. EPR Properties (NYSE:EPR) is a Kansas City, M |

With 82% institutional ownership, Broadstone Net Lease, Inc. (NYSE:BNL) is a favorite amongst the big gunsKey Insights Significantly high institutional ownership implies Broadstone Net Lease's stock price is sensitive to... |

Broadstone Net Lease, Inc. (NYSE:BNL) Q3 2023 Earnings Call TranscriptBroadstone Net Lease, Inc. (NYSE:BNL) Q3 2023 Earnings Call Transcript November 3, 2023 Operator: Hello, and welcome to Broadstone Net Lease’s Third Quarter 2023 Earnings Conference Call. My name is Cole and I’ll be the moderator for today’s call. Please note that today’s call is being recorded. I will now turn the call over to […] |

Favourable Signals For Broadstone Net Lease: Numerous Insiders Acquired StockGenerally, when a single insider buys stock, it is usually not a big deal. However, when several insiders are buying... |

Broadstone Net Lease Inc (BNL) Announces Q3 2023 Earnings: Net Income of $52.1 MillionInvestment Activity and Operating Results Highlighted in the Report |

BNL Price Returns

| 1-mo | 17.98% |

| 3-mo | 28.10% |

| 6-mo | 14.50% |

| 1-year | 14.98% |

| 3-year | -15.21% |

| 5-year | N/A |

| YTD | 8.64% |

| 2023 | 14.00% |

| 2022 | -30.75% |

| 2021 | 32.67% |

| 2020 | N/A |

| 2019 | N/A |

BNL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...