Better Choice Co Inc. (BTTR): Price and Financial Metrics

BTTR Price/Volume Stats

| Current price | $3.34 | 52-week high | $25.52 |

| Prev. close | $3.31 | 52-week low | $2.87 |

| Day low | $3.32 | Volume | 6,640 |

| Day high | $3.43 | Avg. volume | 221,821 |

| 50-day MA | $3.74 | Dividend yield | N/A |

| 200-day MA | $7.84 | Market Cap | 2.99M |

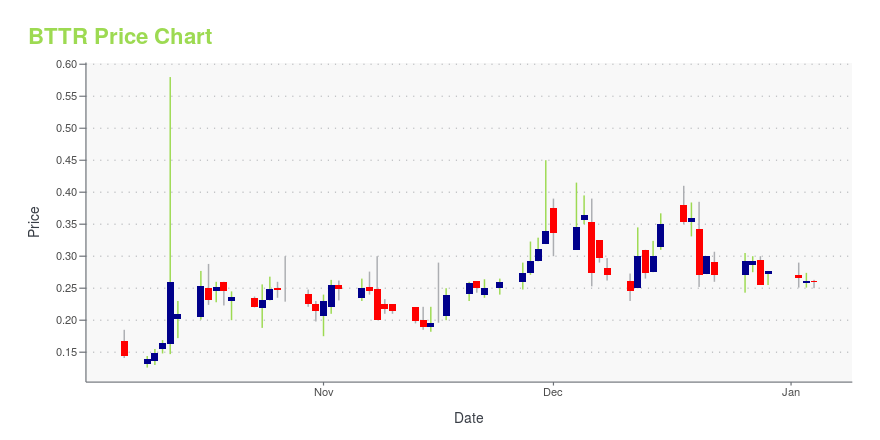

BTTR Stock Price Chart Interactive Chart >

Better Choice Co Inc. (BTTR) Company Bio

Better Choice Company Inc. operates as an animal health and wellness company. It offers raw-diet dog food and treats, naturally formulated premium kibble and canned dog and cat food, freeze-dried raw dog food and treats, vegan dog food and treats, oral care products, supplements, and grooming aids. The company provides its products for dogs, cats, and pet parents under the Halo, TruDog, and Rawgo! brand names. Better Choice Company Inc. primarily sells its products through its online portal, as well as through online retailers and pet specialty stores. It has operations in the United States, Canada, Australia, and Asia. The company was founded in 1986 and is headquartered in Oldsmar, Florida.

Latest BTTR News From Around the Web

Below are the latest news stories about BETTER CHOICE CO INC that investors may wish to consider to help them evaluate BTTR as an investment opportunity.

Better Choice Research Partner, Aimia Pet HealthCo Inc., Signs Second R&D Partnership Agreement with KGK Science for Development of GLP1 Supplement for PetsTAMPA, Fla., Nov. 16, 2023 (GLOBE NEWSWIRE) -- Better Choice Company (NYSE: BTTR) (“Better Choice” or the “Company”), a pet health and wellness company, today announced its research partner, Aimia Pet HealthCo. Inc. (APH), has signed a memorandum of understanding (MOU) with KGK Science Inc. (KGK) for the development of a GLP1 supplement for pets. The MOU sets out the basis for KGK to commence research and development of a GLP1 supplement for use in companion animals. Combining a GLP1 supplement |

BETTER CHOICE COMPANY, INC. ANNOUNCES THIRD QUARTER 2023 RESULTSThird Quarter 2023 Revenue Grew 11% Year-Over-Year to $13.1 millionAdjusted EBITDA Growth of 95% Year-Over-Year EPS Growth of 77% Year-Over-Year TAMPA, FLORIDA, Nov. 13, 2023 (GLOBE NEWSWIRE) -- Better Choice Company, Inc. (“Better Choice” or the “Company”) (NYSE American: BTTR), a pet health and wellness company, today announced its results for the third quarter ended September 30, 2023 (“Q3 2023”). THIRD QUARTER 2023 FINANCIAL HIGHLIGHTS Revenue increased 24% from second quarter 2023, and 11% |

Better Choice Research Partner, Aimia Pet HealthCo Inc., Signs R&D Partnership Agreement for Development of GLP1 Supplement for PetsTAMPA, Fla., Nov. 08, 2023 (GLOBE NEWSWIRE) -- Better Choice Company (NYSE: BTTR) (“Better Choice” or the “Company”), a pet health and wellness company, and its research partner, Aimia Pet HealthCo Inc. (APH), today announced that APH has signed a memorandum of understanding (MOU) with Dr. Nadia Crosignani for the development of a GLP1 supplement for pets. The MOU sets out the basis for Dr. Crosignani to commence research and development of a GLP1 supplement for use in companion animals. Combini |

Better Choice Announces Partnership with Aimia Pet Health to Develop a GLP1 Supplement for its Halo Brand to Combat Obesity in Dogs and CatsTAMPA, Fla., Oct. 12, 2023 (GLOBE NEWSWIRE) -- Better Choice Company (NYSE: BTTR) (“Better Choice” or “the Company”), a pet health and wellness company, today announced it has signed a research and development partnership with Aimia Pet Health to develop a GLP1 supplement for overweight pets under its Halo brand. More than half of all dogs and cats worldwide are classified as overweight or obese and can suffer from the same weight-related health complications as humans – including arthritis, dia |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayPre-market stock movers are rising and falling on Thursday as we check out all of the latest news worth knowing about this morning! |

BTTR Price Returns

| 1-mo | -19.90% |

| 3-mo | -47.36% |

| 6-mo | -70.46% |

| 1-year | -68.37% |

| 3-year | -97.82% |

| 5-year | -99.76% |

| YTD | -72.56% |

| 2023 | -48.68% |

| 2022 | -83.31% |

| 2021 | -57.61% |

| 2020 | -52.96% |

| 2019 | -75.85% |

Loading social stream, please wait...