Bluegreen Vacations Holding Corp. (BVH): Price and Financial Metrics

BVH Price/Volume Stats

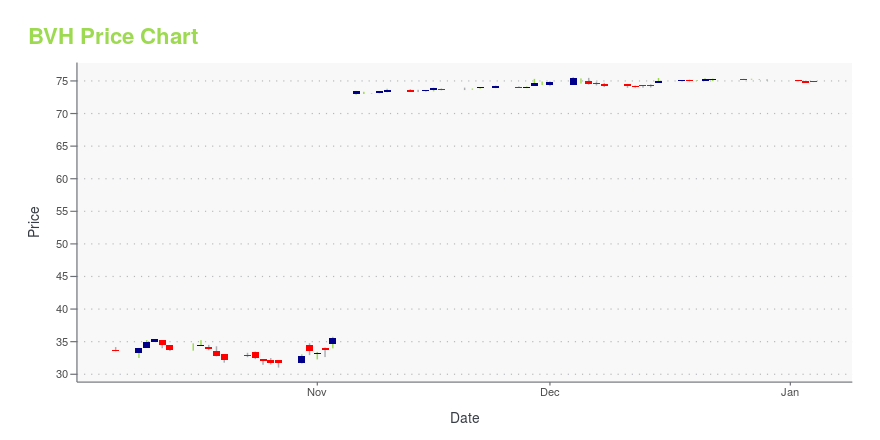

| Current price | $75.00 | 52-week high | $75.60 |

| Prev. close | $74.99 | 52-week low | $23.35 |

| Day low | $74.98 | Volume | 660,900 |

| Day high | $75.02 | Avg. volume | 291,140 |

| 50-day MA | $72.85 | Dividend yield | 1.07% |

| 200-day MA | $43.12 | Market Cap | 1.28B |

BVH Stock Price Chart Interactive Chart >

Bluegreen Vacations Holding Corp. (BVH) Company Bio

Bluegreen Vacations Holding Corporation operates as a vacation ownership company. It markets and sells vacation ownership interests (VOI); and manages resorts in leisure and urban destinations, including Orlando, Las Vegas, Myrtle Beach, and Charleston. The company also provides mortgage, VOI title, reservation, and construction design and development services; and financing to qualified VOI purchasers, as well as management services to the vacation club and homeowners' associations. Its resort network includes 45 club resorts and 23 club associate resorts. The company was founded in 1966 and is headquartered in Boca Raton, Florida.

Latest BVH News From Around the Web

Below are the latest news stories about BLUEGREEN VACATIONS HOLDING CORP that investors may wish to consider to help them evaluate BVH as an investment opportunity.

Bluegreen Vacations’ Board of Directors Declares Quarterly Cash DividendBOCA RATON, Fla., November 17, 2023--BLUEGREEN VACATIONS’ BOARD OF DIRECTORS DECLARES QUARTERLY CASH DIVIDEND |

Bluegreen Vacations Acquires Stonewater Cove Resort and ClubBOCA RATON, Fla., November 15, 2023--We have seen a persistent and strong demand for leisure travel, and our strategy is to meet this demand by enhancing our vacation ownership offerings. |

Bluegreen Vacations Named Runner Up in ICMI Global Contact Center AwardsBOCA RATON, Fla., November 14, 2023--This recognition is a testament to the dedication and hard work of our exceptional team |

Bluegreen Vacations Reports Financial Results for Third Quarter 2023BOCA RATON, Fla., November 07, 2023--BLUEGREEN VACATIONS REPORTS FINANCIAL RESULTS FOR THIRD QUARTER 2023 |

Wall Street Clings To Last Week's RallyWall Street is slightly higher this afternoon, looking to build on last week's rally as more corporate earnings roll in. |

BVH Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 101.29% |

| 3-year | 358.28% |

| 5-year | N/A |

| YTD | -0.16% |

| 2023 | 207.10% |

| 2022 | -27.52% |

| 2021 | 159.42% |

| 2020 | -43.12% |

| 2019 | N/A |

BVH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...