BuzzFeed, Inc., (BZFD): Price and Financial Metrics

BZFD Price/Volume Stats

| Current price | $2.80 | 52-week high | $4.56 |

| Prev. close | $2.74 | 52-week low | $0.64 |

| Day low | $2.73 | Volume | 293,775 |

| Day high | $2.81 | Avg. volume | 1,463,304 |

| 50-day MA | $2.64 | Dividend yield | N/A |

| 200-day MA | $1.62 | Market Cap | 102.51M |

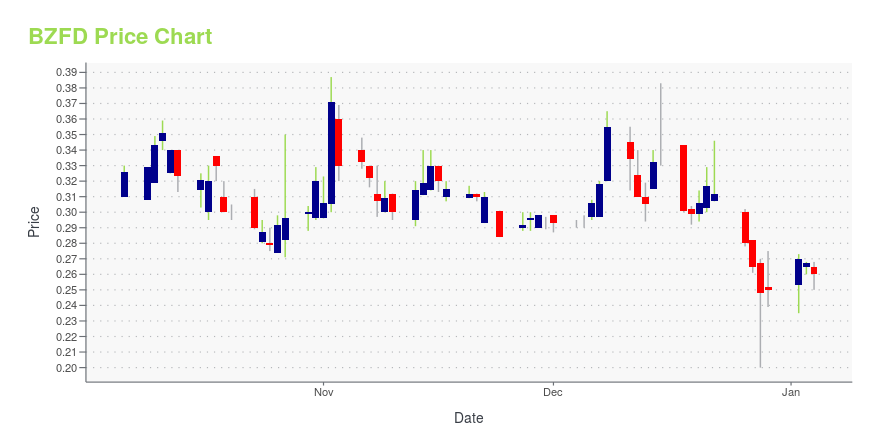

BZFD Stock Price Chart Interactive Chart >

BuzzFeed, Inc., (BZFD) Company Bio

BuzzFeed, Inc., a tech-powered media company, provides breaking news, original reporting, entertainment, and videos across the social Web to its global audience. It also provides cross-platform network such as BuzzFeed Originals, which creates articles, lists, quizzes, and videos; BuzzFeed Media, comprises a portfolio of identity-driven lifestyle brands that includes Nifty, Goodful, As/Is, and Tasty; BuzzFeed Studios, that produces original content across broadcast, cable, film, and digital platforms; BuzzFeed News, which includes reporting and investigative journalism; and BuzzFeed Commerce, which develops social commerce products and experiences, licensing, and other strategic partnerships. The company is based in Rye, New York.

Latest BZFD News From Around the Web

Below are the latest news stories about BUZZFEED INC that investors may wish to consider to help them evaluate BZFD as an investment opportunity.

BuzzFeed, Inc. (NASDAQ:BZFD) Q3 2023 Earnings Call TranscriptBuzzFeed, Inc. (NASDAQ:BZFD) Q3 2023 Earnings Call Transcript November 5, 2023 Operator: Good day, and thank you for standing by. Welcome to the BuzzFeed, Inc. Third Quarter 2023 Earnings Conference Call. [Operator Instructions] Please be advised that today’s conference is being recorded. I would now like to hand the conference over to your speaker, Amita […] |

BuzzFeed, Inc.'s (NASDAQ:BZFD) Price Is Right But Growth Is LackingBuzzFeed, Inc.'s ( NASDAQ:BZFD ) price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now... |

BuzzFeed Studios And Acast Launch New Podcast, "I Know That’s Right" Presented By HuffPostNEW YORK, November 03, 2023--BuzzFeed Studios And Acast Launch New Podcast, "I Know That’s Right" Presented By HuffPost |

BuzzFeed, Inc. Announces Third Quarter 2023 Financial ResultsNEW YORK, November 02, 2023--BuzzFeed, Inc. ("BuzzFeed" or the "Company") (Nasdaq: BZFD), a premier digital media company for the most diverse, most online, and most socially engaged generations the world has ever seen, today announced financial results for the third quarter ended September 30, 2023. |

First We Feast Wins New York Emmy For ‘Hungry For More: The Movement To Save New York’s Chinatown’NEW YORK, October 31, 2023--First We Feast is proud to announce that it has won a New York Emmy for the documentary, Hungry For More: The Movement to Save New York’s Chinatown. The documentary won a New York Emmy in the category for Human Interest – Long Form Content. |

BZFD Price Returns

| 1-mo | -11.95% |

| 3-mo | 81.02% |

| 6-mo | 253.54% |

| 1-year | 14.57% |

| 3-year | -92.91% |

| 5-year | N/A |

| YTD | 180.00% |

| 2023 | -63.75% |

| 2022 | -87.06% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...