CanoHealth (CANO): Price and Financial Metrics

CANO Price/Volume Stats

| Current price | $2.29 | 52-week high | $190.00 |

| Prev. close | $2.30 | 52-week low | $1.74 |

| Day low | $2.29 | Volume | 159,142 |

| Day high | $2.29 | Avg. volume | 423,785 |

| 50-day MA | $5.53 | Dividend yield | N/A |

| 200-day MA | $61.64 | Market Cap | 12.38M |

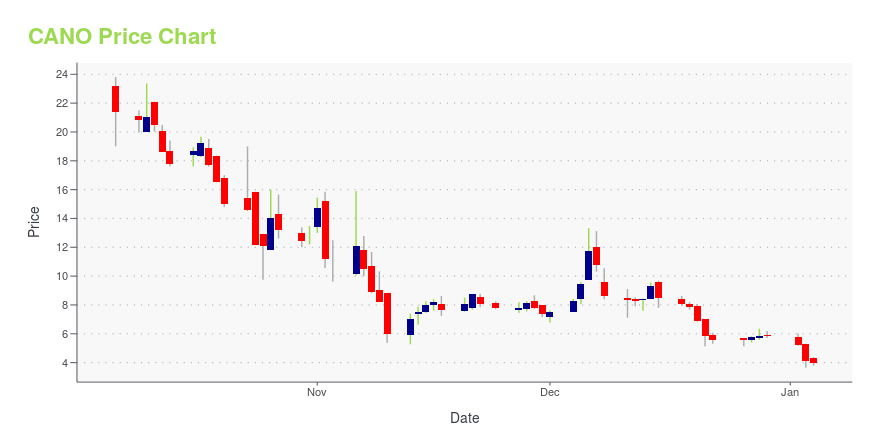

CANO Stock Price Chart Interactive Chart >

CanoHealth (CANO) Company Bio

Cano Health operates primary care centers and supports affiliated medical practices in Florida, Texas, Nevada, and Puerto Rico that specialize in value-based care for seniors. As part of its care coordination strategy, Cano Health provides high-touch population health management programs such as wellness activities, pharmacy services, home visits, telehealth, transition of care, and high-risk and complex care management. The Company’s personalized patient care and proactive approach to wellness and preventive care is what sets it apart from competitors. In August 2020, Cano Health was ranked the 6th fastest growing healthcare company in the country on the Inc. 5000 list.

Latest CANO News From Around the Web

Below are the latest news stories about CANO HEALTH INC that investors may wish to consider to help them evaluate CANO as an investment opportunity.

Dow, Nasdaq Back Up Again As Treasury Yields TumbleThough the major indexes yesterday came back down to earth, snapping impressive win streaks amid a selloff, they are on their way up again this afternoon. |

Cano Health Announces Appointment of Two New Independent DirectorsCano Health, Inc. ("Cano Health" or the "Company") (NYSE: CANO), a leading value-based primary care provider and population health company, today announced the appointment of Patricia Ferrari and Carol Flaton to its Board of Directors. Ms. Ferrari and Ms. Flaton bring broad business experience and deep financial expertise, with proven track records of advising companies on strategies to improve operations and financial performance, as well as strengthening their capital structures. |

Cano Health, Inc. (NYSE:CANO) Q3 2023 Earnings Call TranscriptCano Health, Inc. (NYSE:CANO) Q3 2023 Earnings Call Transcript November 9, 2023 Operator: Good afternoon, and welcome to Cano Health’s Third Quarter 2023 Earnings Call. Currently, all participants are in listen-only mode. After the speakers’ presentation, there will be a question-and-answer session. Please be advised that today’s conference is being recorded. Joining us on today’s […] |

Q3 2023 Cano Health Inc Earnings CallQ3 2023 Cano Health Inc Earnings Call |

Cano Health reduced its workforce by 21% in Q3The struggling primary care chain, which is still seeking a buyer, has exited from several state markets. |

CANO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -13.91% |

| 1-year | -98.25% |

| 3-year | -99.78% |

| 5-year | N/A |

| YTD | -60.99% |

| 2023 | -95.72% |

| 2022 | -84.62% |

| 2021 | -33.56% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...