Carnival Corporation (CCL): Price and Financial Metrics

CCL Price/Volume Stats

| Current price | $17.27 | 52-week high | $19.74 |

| Prev. close | $17.10 | 52-week low | $10.84 |

| Day low | $17.12 | Volume | 20,816,921 |

| Day high | $17.51 | Avg. volume | 30,782,053 |

| 50-day MA | $16.88 | Dividend yield | N/A |

| 200-day MA | $15.72 | Market Cap | 19.38B |

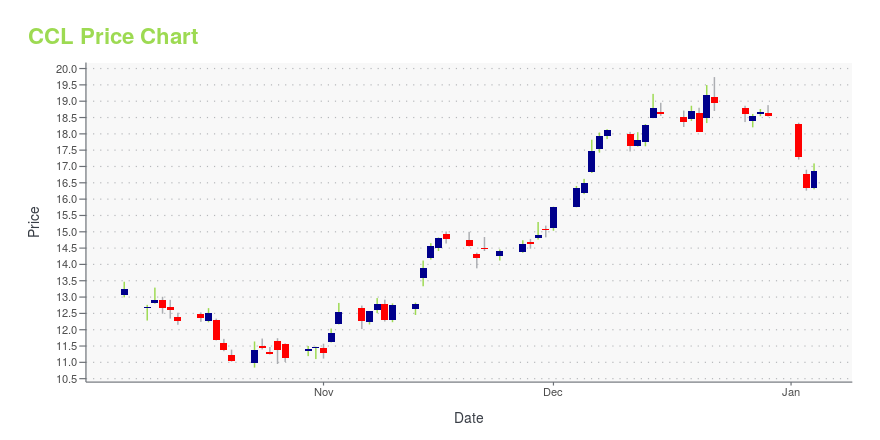

CCL Stock Price Chart Interactive Chart >

Carnival Corporation (CCL) Company Bio

Carnival Corporation offers cruise services under the Carnival Cruise Lines, Holland America Line, Princess Cruises, and Seabourn brand names in North America; and AIDA Cruises, Costa Cruises, Cunard, and P&O Cruises names in Europe, Australia, and Asia. The company was founded in 1972 and is based in Miami, Florida.

Latest CCL News From Around the Web

Below are the latest news stories about CARNIVAL CORP that investors may wish to consider to help them evaluate CCL as an investment opportunity.

2023's Biggest Winners In The Russell 1,000There was a somewhat elevated share of the S&P 500 experiencing gains of over 100%. Expanding to the Russell 1,000, there were 34 stocks with total returns of more than 100%. |

3 Tech Stocks to Make You the Millionaire Next Door: 2024 EditionThe tech sector outperformed in 2023, but it is time for a continuation and momentum with these tech stocks to make you a millionaire. |

7 Stocks to Buy if the Fed Goes Through With Interest Rate CutsWhile inflation may have been the theme of 2022, disinflation could be the defining label for the outgoing year, thus warranting a closer examination of stocks to buy for lower interest rates. |

Anchors Aweigh for Hot Cruise Line StocksIt was the perfect year to own cruise line stocks. Royal Caribbean, Carnival and Norwegian Cruise shares are all on pace for their best annual performance on record, according to Dow Jones Market Data. |

3 Reasons Carnival Stock Can Double Again in 2024The leading cruise line saw its stock soar 130% in 2023. Next year could be even better. |

CCL Price Returns

| 1-mo | -5.99% |

| 3-mo | 14.52% |

| 6-mo | 9.10% |

| 1-year | -5.21% |

| 3-year | -24.25% |

| 5-year | -62.20% |

| YTD | -6.85% |

| 2023 | 130.02% |

| 2022 | -59.94% |

| 2021 | -7.11% |

| 2020 | -56.89% |

| 2019 | 7.37% |

Continue Researching CCL

Want to do more research on Carnival Corp's stock and its price? Try the links below:Carnival Corp (CCL) Stock Price | Nasdaq

Carnival Corp (CCL) Stock Quote, History and News - Yahoo Finance

Carnival Corp (CCL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...