Cadiz, Inc. (CDZI): Price and Financial Metrics

CDZI Price/Volume Stats

| Current price | $3.37 | 52-week high | $4.30 |

| Prev. close | $3.36 | 52-week low | $2.12 |

| Day low | $3.33 | Volume | 104,743 |

| Day high | $3.46 | Avg. volume | 193,213 |

| 50-day MA | $3.19 | Dividend yield | N/A |

| 200-day MA | $2.88 | Market Cap | 228.47M |

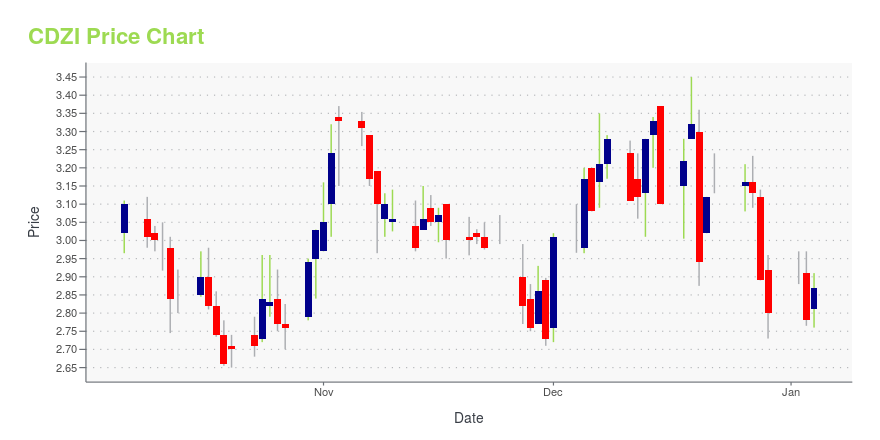

CDZI Stock Price Chart Interactive Chart >

Cadiz, Inc. (CDZI) Company Bio

Cadiz Inc. operates as a land and water resource development company in the United States. It engages in the water resource, and land and agricultural development activities in San Bernardino County properties. The company was founded in 1983 and is based in Los Angeles, California.

Latest CDZI News From Around the Web

Below are the latest news stories about CADIZ INC that investors may wish to consider to help them evaluate CDZI as an investment opportunity.

Cadiz Inc. Declares Quarterly Dividend for Q4 2023 on Series A Cumulative Perpetual Preferred StockCadiz, Inc. (NASDAQ: CDZI, NASDAQ: CDZIP) (the "Company") today announced that its Board of Directors has declared the following cash dividend on Cadiz's 8.875% Series A Cumulative Perpetual Preferred Stock (the "Series A Preferred Stock").Holders of Series A Preferred Stock will receive a cash dividend equal to $560.00 per whole share. Holders of depositary shares, each representing a 1/1000 fractional interest in a share of Series A Preferred Stock (Nasdaq: CDZIP), will receive a cash dividend |

/C O R R E C T I O N -- Cadiz, Inc./Cadiz, Inc. (NASDAQ: CDZI/CDZIP, the "Company") is pleased to announce that today the U.S. Bureau of Land Management ("BLM") issued a final decision approving the assignment of a Mineral Leasing Act right-of-way ("ROW") grant to Cadiz for the Company's Northern Pipeline. BLM's approval of the ROW grant to Cadiz completes the Company's acquisition of the 220-mile pipeline from El Paso Natural Gas ("EPNG") and will allow the company to advance project development on several fronts. |

Cadiz to Expand Executive Team in 2024Cadiz, Inc. (NASDAQ: CDZI/CDZIP, the "Company") is pleased to announce today that Susan Kennedy, Executive Chair of the Board of Directors, will step into a full-time role as the Company's Chief Executive Officer ("CEO") beginning January 1, 2024. Scott Slater, who has served as President and CEO of Cadiz since 2011, plans to continue to serve as a senior advisor to the Company. The Company also plans to create two new executive positions in 2024, one focused on development and operation of the |

Cadiz Inc.'s (NASDAQ:CDZI) top owners are private companies with 35% stake, while 33% is held by institutionsKey Insights The considerable ownership by private companies in Cadiz indicates that they collectively have a greater... |

Cadiz Marks One Year Anniversary of ATEC AcquisitionToday, Cadiz, Inc. (NASDAQ: CDZI/CDZIP) is pleased to mark the one-year anniversary of its acquisition of our water treatment operating subsidiary ATEC Water Systems, L.L.C. ("ATEC"), a leading producer of specialized water filtration solutions for contaminated groundwater sources. Since Cadiz acquired the business in Q4 2022, ATEC has secured contracts and begun production on projects expected to generate significant revenues beginning in FY 2024. ATEC segment revenues are expected to total app |

CDZI Price Returns

| 1-mo | 9.06% |

| 3-mo | 49.78% |

| 6-mo | 22.55% |

| 1-year | -13.59% |

| 3-year | -75.53% |

| 5-year | -68.21% |

| YTD | 20.36% |

| 2023 | 12.00% |

| 2022 | -35.23% |

| 2021 | -63.76% |

| 2020 | -3.36% |

| 2019 | 6.99% |

Continue Researching CDZI

Here are a few links from around the web to help you further your research on Cadiz Inc's stock as an investment opportunity:Cadiz Inc (CDZI) Stock Price | Nasdaq

Cadiz Inc (CDZI) Stock Quote, History and News - Yahoo Finance

Cadiz Inc (CDZI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...