Charter Communications Inc. Cl A (CHTR): Price and Financial Metrics

CHTR Price/Volume Stats

| Current price | $367.62 | 52-week high | $458.30 |

| Prev. close | $315.23 | 52-week low | $236.08 |

| Day low | $355.00 | Volume | 4,962,700 |

| Day high | $378.01 | Avg. volume | 1,473,375 |

| 50-day MA | $292.34 | Dividend yield | N/A |

| 200-day MA | $329.16 | Market Cap | 52.95B |

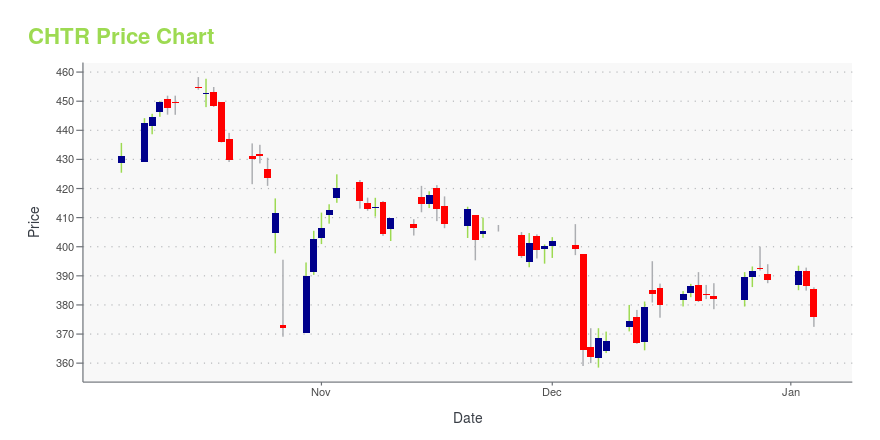

CHTR Stock Price Chart Interactive Chart >

Charter Communications Inc. Cl A (CHTR) Company Bio

Charter Communications, Inc., is an American telecommunications and mass media company with services branded as Charter Spectrum. With over 26 million customers in 41 states,[1] it is the second-largest cable operator in the United States by subscribers, just behind Comcast, and third-largest pay TV operator behind Comcast and AT&T.[6] Charter is the fifth-largest telephone provider based on number of residential lines. (Source:Wikipedia)

Latest CHTR News From Around the Web

Below are the latest news stories about CHARTER COMMUNICATIONS INC that investors may wish to consider to help them evaluate CHTR as an investment opportunity.

How to Find Strong Consumer Discretionary Stocks Slated for Positive Earnings SurprisesWhy investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates. |

7 Undervalued Nasdaq-100 Stocks for Bargain HuntersUnderstandably, with the innovation sector printing a remarkable performance, all eyes have centered on Nasdaq-100 stocks. |

Charter (CHTR) Spectrum Launches Services in Cleveland CountyCharter's (CHTR) Spectrum has launched Spectrum Internet, Mobile, TV and Voice services to nearly 230 homes and small businesses in Cleveland County. |

Warren Buffett and Hedge Funds Love These 11 StocksIn this article, we will take a detailed look at the Warren Buffett and Hedge Funds Love These 11 Stocks. For a quick overview of such stocks, read our article Warren Buffett and Hedge Funds Love These 5 Stocks. Market volatility of 2023 forced smart money managers to practice discipline in stock picking. In November, data from […] |

This Warren Buffett Stock Could Be a Big Winner in 2024Charter Communications stands to benefit from an increase in advertising dollars next year. |

CHTR Price Returns

| 1-mo | 26.07% |

| 3-mo | 44.39% |

| 6-mo | -2.51% |

| 1-year | -8.32% |

| 3-year | -49.42% |

| 5-year | -7.82% |

| YTD | -5.42% |

| 2023 | 14.62% |

| 2022 | -47.99% |

| 2021 | -1.45% |

| 2020 | 36.38% |

| 2019 | 70.22% |

Continue Researching CHTR

Here are a few links from around the web to help you further your research on Charter Communications Inc's stock as an investment opportunity:Charter Communications Inc (CHTR) Stock Price | Nasdaq

Charter Communications Inc (CHTR) Stock Quote, History and News - Yahoo Finance

Charter Communications Inc (CHTR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...