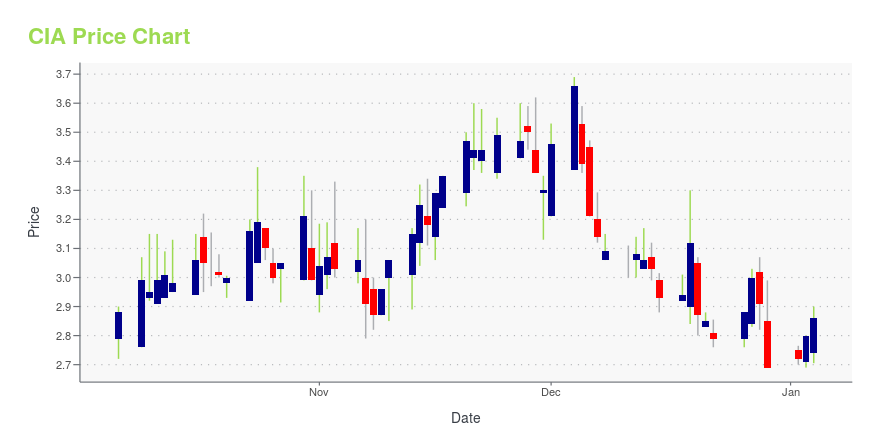

Citizens, Inc. ($1.00 Par) (CIA): Price and Financial Metrics

CIA Price/Volume Stats

| Current price | $2.82 | 52-week high | $3.69 |

| Prev. close | $2.76 | 52-week low | $1.78 |

| Day low | $2.73 | Volume | 37,400 |

| Day high | $2.88 | Avg. volume | 54,566 |

| 50-day MA | $2.82 | Dividend yield | N/A |

| 200-day MA | $2.73 | Market Cap | 139.79M |

CIA Stock Price Chart Interactive Chart >

Citizens, Inc. ($1.00 Par) (CIA) Company Bio

Citizens, Inc. provides life insurance products in the United States and internationally. The companys Life Insurance segment offers ordinary whole-life, burial insurance, pre-need, and accident and health related policies in the Midwest and southern United States, as well as ordinary whole-life policies and endowment policies to non-U.S. residents. The company was founded in 1969 and is based in Austin, Texas.

Latest CIA News From Around the Web

Below are the latest news stories about CITIZENS INC that investors may wish to consider to help them evaluate CIA as an investment opportunity.

Citizens, Inc. Announces Plans for Upcoming Investor ConferencesSingular Research 18th Annual "Best of the Uncovered" Conference on December 7, 2023Emerging Growth Virtual Conference on December 7, 2023Austin, Texas--(Newsfile Corp. - December 4, 2023) - Citizens, Inc. (NYSE: CIA), a leading diversified financial services company specializing in life, living benefits, and final expense insurance, today announced management's plan for participation in upcoming investor conferences.Singular Research "Best of the Uncovered" on December 7, 2023Singular Research |

Investors in Citizens (NYSE:CIA) have unfortunately lost 62% over the last five yearsWe think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big... |

Citizens, Inc. Reports Third Quarter 2023 Financial ResultsAustin, Texas--(Newsfile Corp. - November 6, 2023) - Citizens, Inc. (NYSE: CIA), a leading diversified financial services company specializing in life, living benefits, and final expense insurance, today reported financial results for the third quarter ended September 30, 2023. Third Quarter 2023 Financial HighlightsTotal revenues increased to $59.4 million in Q3 2023, from $56.2 million in the year-ago quarter.First year life and A&H premiums increased 15% in Q3 2023, the fourth consecutive qua |

Presenting on the Emerging Growth Conference 63 Day 2 on October 5 Register NowMIAMI, Oct. 04, 2023 (GLOBE NEWSWIRE) -- EmergingGrowth.com a leading independent small cap media portal announces the schedule of Day 2 of the 63rd Emerging Growth Conference on October 5th, 2023. The Emerging Growth Conference identifies companies in a wide range of growth sectors, with strong management teams, innovative products & services, focused strategy, execution, and the overall potential for long-term growth. Register for the conference here. Submit Questions for any of the presenting |

Presenting on the Emerging Growth Conference on September 6 and 7 Register NowMIAMI, Sept. 05, 2023 (GLOBE NEWSWIRE) -- EmergingGrowth.com a leading independent small cap media portal announces the schedule of the 62nd Emerging Growth Conference on September 6 & 7, 2023. The Emerging Growth Conference identifies companies in a wide range of growth sectors, with strong management teams, innovative products & services, focused strategy, execution, and the overall potential for long-term growth. Register for the conference here. Submit Questions for any of the presenting com |

CIA Price Returns

| 1-mo | 5.62% |

| 3-mo | 35.58% |

| 6-mo | -1.40% |

| 1-year | 10.16% |

| 3-year | -48.82% |

| 5-year | -62.40% |

| YTD | 4.83% |

| 2023 | 26.29% |

| 2022 | -59.89% |

| 2021 | -7.33% |

| 2020 | -15.11% |

| 2019 | -10.24% |

Continue Researching CIA

Want to see what other sources are saying about Citizens Inc's financials and stock price? Try the links below:Citizens Inc (CIA) Stock Price | Nasdaq

Citizens Inc (CIA) Stock Quote, History and News - Yahoo Finance

Citizens Inc (CIA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...