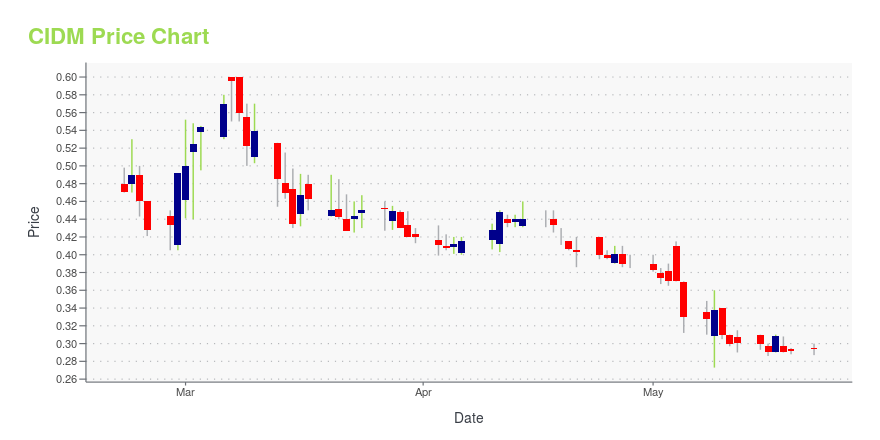

Cinedigm Corp - (CIDM): Price and Financial Metrics

CIDM Price/Volume Stats

| Current price | $0.29 | 52-week high | $0.79 |

| Prev. close | $0.29 | 52-week low | $0.27 |

| Day low | $0.29 | Volume | 1,112,300 |

| Day high | $0.30 | Avg. volume | 710,288 |

| 50-day MA | $0.40 | Dividend yield | N/A |

| 200-day MA | $0.48 | Market Cap | 55.05M |

CIDM Stock Price Chart Interactive Chart >

Cinedigm Corp - (CIDM) Company Bio

Cinedigm Corp., together with its subsidiaries, operates as distributor and aggregator of independent movie, television, and other short form content in the United States, Canada, and New Zealand. The company operates through two segments, Cinema Equipment Business and Content and Entertainment Business. It manages a library of distribution rights to various titles and episodes released across digital, physical, and home and mobile entertainment platforms, as well as services digital cinema assets on approximately 12,000 domestic and foreign movie screens. The company distributes its products for various brands, such as Hallmark, Televisa, ITV, Nelvana, ZDF, Shout! Factory, NFL, NHL and Scholastic, as well as international and domestic content creators, movie producers, television producers, and other short form digital content producers. It also collaborates with producers, various brands, and other content owners to market, source, curate, and distribute content to targeted audiences through existing and emerging digital home entertainment platforms, including Apple, Amazon Prime, Netflix, Hulu, Xbox, PlayStation, Sony, and cable/satellite video-on-demand; and distributes DVD and Blu-ray discs to wholesalers and retailers with sales coverage to approximately 60,000 brick and mortar storefronts, including Walmart, Target, Best Buy, and Amazon. In addition, the company operates various branded and curated over-the-top (OTT) entertainment channels, including Docurama, CONtv, and Dove Channel; and Matchpoint, a software-as-a-service platform to automate the distribution of streaming content and OTT channels. Cinedigm Corp. has a strategic alliance with Starrise Media Holdings Limited to release films in China theatrically and to digital platforms. The company was formerly known as Cinedigm Digital Cinema Corp. and changed its name to Cinedigm Corp. in September 2013. Cinedigm Corp. was founded in 2000 and is headquartered in New York, New York.

Latest CIDM News From Around the Web

Below are the latest news stories about CINEDIGM CORP that investors may wish to consider to help them evaluate CIDM as an investment opportunity.

Cinedigm changes name to CineverseThe company says the rebranding reflects its evolution into a streaming content and technology provider. |

Cinedigm Rebrands to CineverseCinedigm Corp. (NASDAQ: CIDM) today announced it is rebranding to Cineverse, a global streaming technology and entertainment company with one of the world's largest portfolios of owned and operated streaming channels. |

Cinedigm Acquires All North American Rights to 'Shaky Shivers,' an 80s-Inspired Horror/Comedy Directed by Sung Kang, Star of the 'Fast X' FranchiseCinedigm has acquired all North American rights to the 80s-inspired horror comedy Shaky Shivers, from director Sung Kang, known for his role as Han in Fast X which hits theaters this Friday. The Company plans to release Shaky Shivers in theaters this fall, followed by an exclusive release on its horror streaming platform SCREAMBOX. |

Cinedigm and The Conjuring creator Tony DeRosa-Grund Join Forces to Develop 'The Haunted,' a Spine-Chilling, Real-Life Paranormal FranchiseCinedigm announced today that the Company will be partnering with horror heavyweight Tony DeRosa-Grund, creator of The Conjuring (over $2 billion in box office to date), to develop The Haunted, a new paranormal horror franchise based on verifiable actual events. While the story details are being kept under wraps, Cinedigm can confirm that The Haunted franchise starts with one family's dark and terrifying real-life preternatural experiences which intersect with historical facts and legends surrou |

3 Penny Stocks That Could Make You a Millionaire by 2025These are the best penny stocks to buy if you are targeting multibagger returns by 2025 with high price targets by analysts. |

CIDM Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -80.67% |

| 5-year | -75.72% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -66.58% |

| 2021 | 79.90% |

| 2020 | -7.89% |

| 2019 | 22.81% |

Continue Researching CIDM

Want to see what other sources are saying about Cinedigm Corp's financials and stock price? Try the links below:Cinedigm Corp (CIDM) Stock Price | Nasdaq

Cinedigm Corp (CIDM) Stock Quote, History and News - Yahoo Finance

Cinedigm Corp (CIDM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...