Companhia Energetica de Minas Gerais-Cemig ADR (CIG): Price and Financial Metrics

CIG Price/Volume Stats

| Current price | $1.86 | 52-week high | $2.12 |

| Prev. close | $1.84 | 52-week low | $1.62 |

| Day low | $1.86 | Volume | 387,682 |

| Day high | $1.88 | Avg. volume | 2,598,283 |

| 50-day MA | $1.89 | Dividend yield | 9.25% |

| 200-day MA | $1.85 | Market Cap | 5.32B |

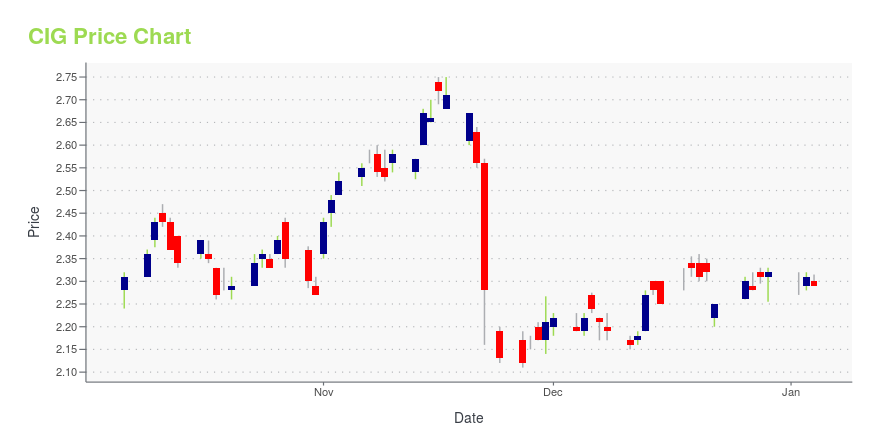

CIG Stock Price Chart Interactive Chart >

Companhia Energetica de Minas Gerais-Cemig ADR (CIG) Company Bio

Companhia Energética de Minas Gerais SA engages in the generation, transmission, distribution and sale of electricity, gas distribution, telecommunications and the provision of energy solutions. It operates through the following segments: Generation, Transmission, Distribution, and Other Businesses. The Generation segment engages in the generation of electricity through hydroelectric plants, thermoelectric plants and wind farms. The Transmission segment engages in the electric power transmission business, which consists of transporting electric power from the facilities where it broadcasted to the distribution networks for delivery to final users. The Distribution segment engages in the supply electricity to consumers in the state of Minas Gerais. The Other Businesses segment engages in the telecommunications, national and international energy solutions, and exploitation of natural gas. The company was founded by Juscelino Kubitschek de Oliveira on May 22, 1952 and is headquartered in Belo Horizonte, Brazil.

Latest CIG News From Around the Web

Below are the latest news stories about ENERGY CO OF MINAS GERAIS that investors may wish to consider to help them evaluate CIG as an investment opportunity.

15 Undervalued Defensive Stocks For 2024In this article, we discuss the 15 undervalued defensive stocks for 2024. To skip the detailed overview of the market and defensive stocks, go directly to the 5 Undervalued Defensive Stocks For 2024. Defensive stocks are shares of companies that remain relatively stable during economic downturns as opposed to cyclical stocks. Defensive stocks usually outperform […] |

Is Atmos Energy (ATO) Stock Outpacing Its Utilities Peers This Year?Here is how Atmos Energy (ATO) and Cemig (CIG) have performed compared to their sector so far this year. |

3 Reasons Growth Investors Will Love Cemig (CIG)Cemig (CIG) possesses solid growth attributes, which could help it handily outperform the market. |

Here is Why Growth Investors Should Buy Cemig (CIG) NowCemig (CIG) could produce exceptional returns because of its solid growth attributes. |

16 Most Profitable Penny Stocks NowIn this article, we will take a look at the 16 most profitable penny stocks now. To see more such companies, go directly to 5 Most Profitable Penny Stocks Now. Earlier this month investors cheered the latest inflation data report which showed the Fed’s battle against inflation might finally be working. Throughout 2023, investors and […] |

CIG Price Returns

| 1-mo | 1.87% |

| 3-mo | 2.34% |

| 6-mo | 7.56% |

| 1-year | 2.55% |

| 3-year | 74.57% |

| 5-year | 24.31% |

| YTD | 8.49% |

| 2023 | 24.60% |

| 2022 | 18.43% |

| 2021 | -8.50% |

| 2020 | -8.17% |

| 2019 | -1.69% |

CIG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CIG

Want to do more research on Energy Co Of Minas Gerais's stock and its price? Try the links below:Energy Co Of Minas Gerais (CIG) Stock Price | Nasdaq

Energy Co Of Minas Gerais (CIG) Stock Quote, History and News - Yahoo Finance

Energy Co Of Minas Gerais (CIG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...