Cleveland-Cliffs Inc. (CLF): Price and Financial Metrics

CLF Price/Volume Stats

| Current price | $15.47 | 52-week high | $22.97 |

| Prev. close | $15.26 | 52-week low | $13.84 |

| Day low | $15.12 | Volume | 7,312,400 |

| Day high | $15.59 | Avg. volume | 8,964,345 |

| 50-day MA | $15.87 | Dividend yield | N/A |

| 200-day MA | $18.10 | Market Cap | 7.36B |

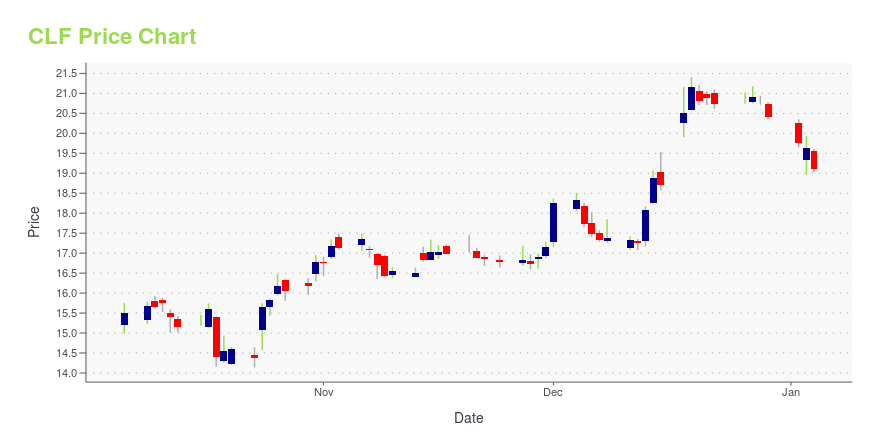

CLF Stock Price Chart Interactive Chart >

Cleveland-Cliffs Inc. (CLF) Company Bio

Cleveland-Cliffs Inc. is a mining and natural resources company in the United States. The Company is a major supplier of iron ore pellets to the North American steel industry. The company was founded in 1847 and is based in Cleveland, Ohio.

Latest CLF News From Around the Web

Below are the latest news stories about CLEVELAND-CLIFFS INC that investors may wish to consider to help them evaluate CLF as an investment opportunity.

Cleveland-Cliffs hikes prices on steel products for fifth straight monthMore on Cleveland-Cliffs |

12 Best Undervalued Stocks to Buy According to RedditIn this article, we discuss the 12 best undervalued stocks to buy according to Reddit. If you want to read about some more undervalued stocks, go directly to 5 Best Undervalued Stocks to Buy According to Reddit. Retail investors who often discuss their investment strategies on platforms like Reddit have become a dominant market force […] |

Jim Cramer Stock Portfolio: 12 Recent AdditionsIn this article, we discuss the 12 recent additions to the Jim Cramer stock portfolio. If you want to read about some more Cramer stocks, go directly to Jim Cramer Stock Portfolio: 5 Recent Additions. Jim Cramer, the host of Mad Money on CNBC, is one of the most well-known finance personalities on television. He […] |

Here's Why Cleveland-Cliffs (CLF) Fell More Than Broader MarketCleveland-Cliffs (CLF) concluded the recent trading session at $20.81, signifying a -1.61% move from its prior day's close. |

U.S. Steel Stock Has Soared. These Shares Are Better Bets Now.United States Steel has agreed to be purchased by Nippon Steel. Cleveland-Cliffs might be a more promising play for 2024. |

CLF Price Returns

| 1-mo | 3.62% |

| 3-mo | -13.48% |

| 6-mo | -16.02% |

| 1-year | -9.64% |

| 3-year | -30.50% |

| 5-year | 47.41% |

| YTD | -24.24% |

| 2023 | 26.75% |

| 2022 | -26.00% |

| 2021 | 49.52% |

| 2020 | 77.38% |

| 2019 | 12.72% |

Continue Researching CLF

Want to see what other sources are saying about Cleveland-Cliffs Inc's financials and stock price? Try the links below:Cleveland-Cliffs Inc (CLF) Stock Price | Nasdaq

Cleveland-Cliffs Inc (CLF) Stock Quote, History and News - Yahoo Finance

Cleveland-Cliffs Inc (CLF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...