Clover Health Investments Corp. Cl A (CLOV): Price and Financial Metrics

CLOV Price/Volume Stats

| Current price | $1.73 | 52-week high | $1.78 |

| Prev. close | $1.64 | 52-week low | $0.61 |

| Day low | $1.67 | Volume | 3,172,163 |

| Day high | $1.75 | Avg. volume | 7,482,027 |

| 50-day MA | $1.24 | Dividend yield | N/A |

| 200-day MA | $0.98 | Market Cap | 858.84M |

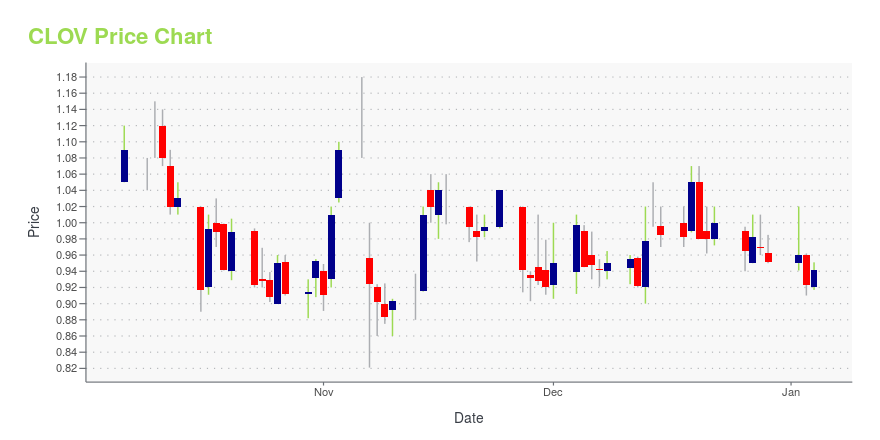

CLOV Stock Price Chart Interactive Chart >

Clover Health Investments Corp. Cl A (CLOV) Company Bio

Clover Health Investments, Corp. provides health insurance services. The company was founded in 2012 and is based in Franklin, Tennessee.

Latest CLOV News From Around the Web

Below are the latest news stories about CLOVER HEALTH INVESTMENTS CORP that investors may wish to consider to help them evaluate CLOV as an investment opportunity.

CLOV Stock Alert: Clover Health Announces CFO DepartureClover Health Investments stock is on the rise Thursday as investors in CLOV shares react to news of the company's CFO departing next month. |

Morgan Stanley Says Salesforce (CRM) Is Headed for Record HighSalesforce stock is on the rise today as investors in CRM react to an upgrade and price target increaser from a Morgan Stanley analyst. |

Why Is Smart for Life (SMFL) Stock Up 238% Today?Smart for Life stock is taking off on Thursday as SMFL investors react to news of the company preparing for a hearing meeting in March 2024. |

Clover Health Announces Departure of Chief Financial Officer; Reiterates Most Recently Issued Financial Guidance for 2023Lee A. Shapiro, Clover Audit Committee Chair, will lead the search for the next Clover CFOFRANKLIN, Tenn., Dec. 21, 2023 (GLOBE NEWSWIRE) -- Clover Health Investments, Corp. (Nasdaq: CLOV) (“Clover” or the “Company”) a physician enablement company committed to bringing access to great healthcare to everyone on Medicare, today announced that Scott J. Leffler, its Chief Financial Officer, will be leaving the Company on January 26, 2024 in order to pursue another professional opportunity. Mr. Leffl |

Clover Health to Present at 42nd Annual J.P. Morgan Healthcare Conference on January 11, 2024FRANKLIN, Tenn., Dec. 18, 2023 (GLOBE NEWSWIRE) -- Clover Health Investments, Corp. (NASDAQ: CLOV) (“Clover,” “Clover Health” or the “Company”), a physician enablement company committed to bringing access to great healthcare to everyone on Medicare, today announced that its CEO, Andrew Toy, will present at the 42nd Annual J.P. Morgan Healthcare Conference on Thursday, January 11, 2024, at 12:00 p.m. Eastern Time. A live webcast of the presentation will be accessible from Clover Health's investor |

CLOV Price Returns

| 1-mo | 35.16% |

| 3-mo | 154.41% |

| 6-mo | 80.17% |

| 1-year | 58.72% |

| 3-year | -78.51% |

| 5-year | N/A |

| YTD | 81.70% |

| 2023 | 2.43% |

| 2022 | -75.01% |

| 2021 | -77.82% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...