CIM Commercial Trust Corporation (CMCT): Price and Financial Metrics

CMCT Price/Volume Stats

| Current price | $2.27 | 52-week high | $4.87 |

| Prev. close | $2.31 | 52-week low | $2.06 |

| Day low | $2.26 | Volume | 3,400 |

| Day high | $2.42 | Avg. volume | 11,254 |

| 50-day MA | $2.69 | Dividend yield | 14.53% |

| 200-day MA | $3.45 | Market Cap | 51.73M |

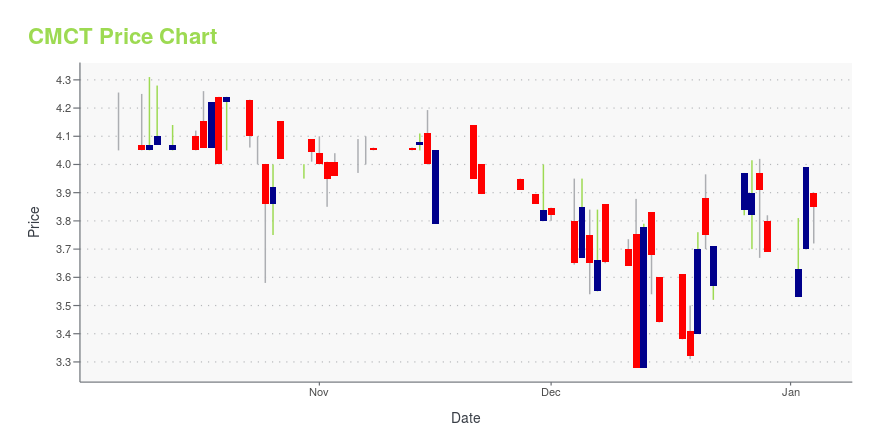

CMCT Stock Price Chart Interactive Chart >

CIM Commercial Trust Corporation (CMCT) Company Bio

CIM Commercial Trust Corp is a publicly owned real estate investment trust. The firm invests in the real estate markets of United States. It also engages in lending activities. CIM Commercial Trust Corp was founded in 1993 and is based in Dallas, Texas.

Latest CMCT News From Around the Web

Below are the latest news stories about CREATIVE MEDIA & COMMUNITY TRUST CORP that investors may wish to consider to help them evaluate CMCT as an investment opportunity.

Creative Media & Community Trust declares $0.085 dividendMore on Creative Media & Community Trust |

CMCT Declares Common Stock DividendDALLAS, December 20, 2023--CMCT announces quarterly dividend |

Creative Media & Community Trust Corporation (NASDAQ:CMCT) Q3 2023 Earnings Call TranscriptCreative Media & Community Trust Corporation (NASDAQ:CMCT) Q3 2023 Earnings Call Transcript November 16, 2023 Operator: Hello, and welcome to the Creative Media & Community Trust Third Quarter 2023 Earnings Call. All participants will be in a listen-only mode. [Operator Instructions] Please note this event is being recorded. I would now like to turn the […] |

Q3 2023 Creative Media & Community Trust Corporation Earnings CallQ3 2023 Creative Media & Community Trust Corporation Earnings Call |

Creative Media & Community Trust Corporation Reports 2023 Third Quarter ResultsDALLAS, November 14, 2023--CMCT reports operating results |

CMCT Price Returns

| 1-mo | -6.97% |

| 3-mo | -30.02% |

| 6-mo | -31.77% |

| 1-year | -47.26% |

| 3-year | -65.92% |

| 5-year | -84.03% |

| YTD | -35.10% |

| 2023 | -18.23% |

| 2022 | -29.70% |

| 2021 | -46.52% |

| 2020 | 0.98% |

| 2019 | 8.58% |

CMCT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CMCT

Want to see what other sources are saying about CIM Commercial Trust Corp's financials and stock price? Try the links below:CIM Commercial Trust Corp (CMCT) Stock Price | Nasdaq

CIM Commercial Trust Corp (CMCT) Stock Quote, History and News - Yahoo Finance

CIM Commercial Trust Corp (CMCT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...