Centene Corp. (CNC): Price and Financial Metrics

CNC Price/Volume Stats

| Current price | $73.10 | 52-week high | $81.42 |

| Prev. close | $67.40 | 52-week low | $60.83 |

| Day low | $69.30 | Volume | 9,686,500 |

| Day high | $74.71 | Avg. volume | 3,466,414 |

| 50-day MA | $69.55 | Dividend yield | N/A |

| 200-day MA | $73.46 | Market Cap | 39.01B |

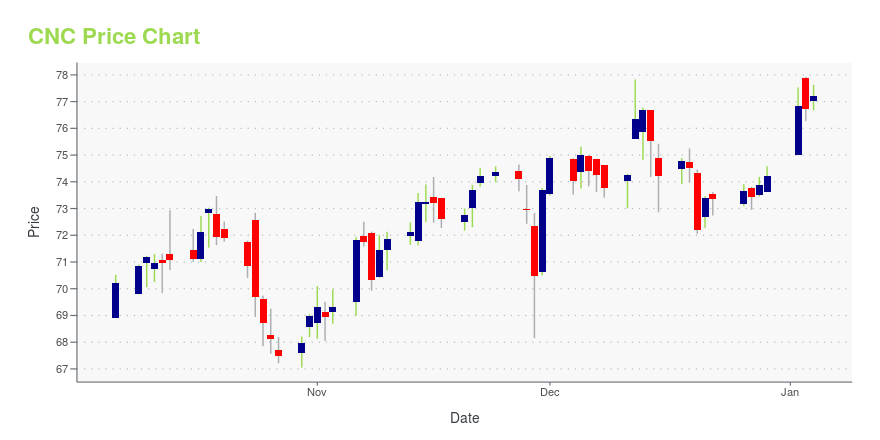

CNC Stock Price Chart Interactive Chart >

Centene Corp. (CNC) Company Bio

Centene Corporation is a publicly traded managed care company based in St. Louis, Missouri. It serves as an intermediary for government-sponsored and privately insured health care programs. Centene ranked No. 24 on the 2021 Fortune 500 . (Source:Wikipedia)

Latest CNC News From Around the Web

Below are the latest news stories about CENTENE CORP that investors may wish to consider to help them evaluate CNC as an investment opportunity.

CENTENE TO PRESENT AT 42ND ANNUAL J. P. MORGAN HEALTHCARE CONFERENCECentene Corporation (NYSE: CNC) announced today it will present at the 42nd Annual J. P. Morgan Healthcare Conference, to be held Monday, January 8 – Thursday, January 11, 2024, in San Francisco. |

Zacks.com featured highlights Park Hotels & Resorts, Centene, Solo Brands and AZZPark Hotels & Resorts, Centene, Solo Brands and AZZ have been highlighted in this Screen of The Week article. |

4 Low Price-to-Cash Flow Stocks to Navigate the Market in 2024Value investing is essentially about selecting stocks that are usually cheap but fundamentally sound. Park Hotels & Resorts (PK), Centene (CNC), Solo Brands (DTC) and AZZ Inc. (AZZ) boast low P/CF ratios. |

4 Low Price-to-Book Stocks to Buy in the New YearThe P/B ratio helps to identify low-priced stocks with high growth prospects. Solo Brands (DTC), Park Hotels & Resorts (PK), Centene (CNC) and Deluxe Corporation (DLX) are some such stocks. |

The Zacks Analyst Blog Highlights UnitedHealth, Humana, Centene and Molina HealthcareUnitedHealth, Humana, Centene and Molina Healthcare are included in this Analyst Blog. |

CNC Price Returns

| 1-mo | 8.51% |

| 3-mo | -1.22% |

| 6-mo | -1.30% |

| 1-year | 10.46% |

| 3-year | 4.83% |

| 5-year | 35.77% |

| YTD | -1.50% |

| 2023 | -9.51% |

| 2022 | -0.47% |

| 2021 | 37.26% |

| 2020 | -4.52% |

| 2019 | 9.05% |

Continue Researching CNC

Want to do more research on Centene Corp's stock and its price? Try the links below:Centene Corp (CNC) Stock Price | Nasdaq

Centene Corp (CNC) Stock Quote, History and News - Yahoo Finance

Centene Corp (CNC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...