Canterbury Park Holding Corporation (CPHC): Price and Financial Metrics

CPHC Price/Volume Stats

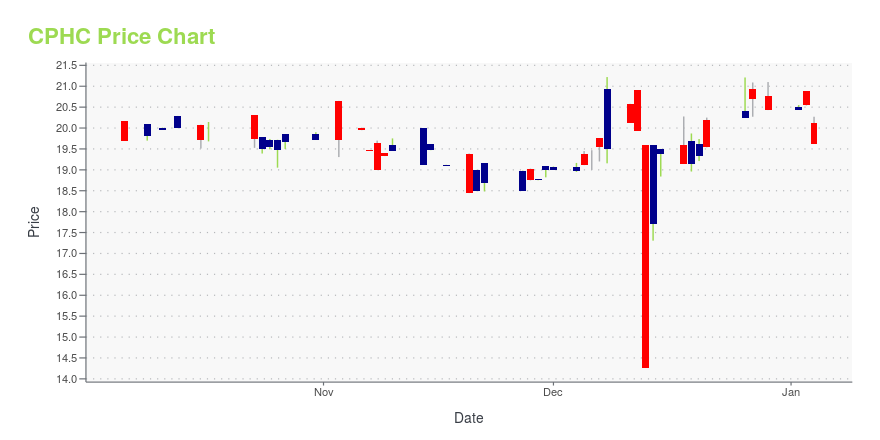

| Current price | $21.51 | 52-week high | $30.25 |

| Prev. close | $21.50 | 52-week low | $14.27 |

| Day low | $21.51 | Volume | 1,500 |

| Day high | $21.55 | Avg. volume | 4,522 |

| 50-day MA | $22.27 | Dividend yield | 1.28% |

| 200-day MA | $21.57 | Market Cap | 107.18M |

CPHC Stock Price Chart Interactive Chart >

Canterbury Park Holding Corporation (CPHC) Company Bio

Canterbury Park Holding Corporation hosts pari-mutuel wagering on horse races and unbanked card games at its Canterbury park racetrack and card casino facility in Shakopee, Minnesota. The company operates through four segments: Horse Racing, Card Casino, Food and Beverage, and Development. The Horse Racing segment operates year-round simulcasting of horse races and wagering on live thoroughbred; and quarter horse races on a seasonal basis. The Card Casino segment offers unbanked card games, such as poker and table games. The Food and Beverage segment operates concession stands, restaurants and buffets, bars, and other food venues; and café style restaurants and full service bars within the Card Casino and simulcast area. This segment also provides lounge services; buffet restaurant; various concession style food and beverages; and catering and events services. The Development segment engages in real estate development compatible with racetrack operations; and various development opportunities, such as office, restaurants, hotel, entertainment and retail operations. It is also involved in related services and activities, such as parking, advertising signage, publication sales, and other entertainment events and activities. The company was founded in 1994 and is based in Shakopee, Minnesota.

Latest CPHC News From Around the Web

Below are the latest news stories about CANTERBURY PARK HOLDING CORP that investors may wish to consider to help them evaluate CPHC as an investment opportunity.

Canterbury Park Holding (NASDAQ:CPHC) Has Announced A Dividend Of $0.07Canterbury Park Holding Corporation's ( NASDAQ:CPHC ) investors are due to receive a payment of $0.07 per share on 12th... |

Investing in Canterbury Park Holding (NASDAQ:CPHC) three years ago would have delivered you a 64% gainOne simple way to benefit from the stock market is to buy an index fund. But if you pick the right individual stocks... |

Canterbury Park Holding Corporation Announces Quarterly Cash DividendSHAKOPEE, Minn., Dec. 14, 2023 (GLOBE NEWSWIRE) -- Canterbury Park Holding Corporation (“Canterbury” or the “Company”) (NASDAQ: CPHC), today announced that the Company’s Board of Directors, pursuant to its dividend policy, approved a quarterly cash dividend of $0.07 per share that will be paid on January 12, 2024 to stockholders of record on December 29, 2023. At this quarterly rate, the annual dividend is equivalent to $0.28 per common share. About Canterbury Park Canterbury Park Holding Corpor |

Canterbury Park Holding Corporation Reports 2023 Third Quarter ResultsSHAKOPEE, Minn., Nov. 09, 2023 (GLOBE NEWSWIRE) -- Canterbury Park Holding Corporation (“Canterbury” or the “Company”) (NASDAQ: CPHC), today reported financial results for the three and nine months ended September 30, 2023. ($ in thousands, except per share data and percentages) Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 Change 2023 2022 ChangeNet revenues$19,269 $22,292 -13.6% $48,910 $53,705 -8.9% Net income$1,136 $2,921 -61.1% $9,199 $6,450 42.6% Adjusted EBITD |

Declining Stock and Solid Fundamentals: Is The Market Wrong About Canterbury Park Holding Corporation (NASDAQ:CPHC)?With its stock down 11% over the past three months, it is easy to disregard Canterbury Park Holding (NASDAQ:CPHC... |

CPHC Price Returns

| 1-mo | 0.93% |

| 3-mo | N/A |

| 6-mo | -8.83% |

| 1-year | -4.63% |

| 3-year | 41.92% |

| 5-year | 83.86% |

| YTD | 5.94% |

| 2023 | -33.81% |

| 2022 | 83.78% |

| 2021 | N/A |

| 2020 | 0.00% |

| 2019 | -8.88% |

CPHC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CPHC

Want to see what other sources are saying about Canterbury Park Holding Corp's financials and stock price? Try the links below:Canterbury Park Holding Corp (CPHC) Stock Price | Nasdaq

Canterbury Park Holding Corp (CPHC) Stock Quote, History and News - Yahoo Finance

Canterbury Park Holding Corp (CPHC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...