Cronos Group Inc. - Common Share (CRON): Price and Financial Metrics

CRON Price/Volume Stats

| Current price | $2.42 | 52-week high | $3.14 |

| Prev. close | $2.42 | 52-week low | $1.64 |

| Day low | $2.40 | Volume | 401,699 |

| Day high | $2.45 | Avg. volume | 2,429,599 |

| 50-day MA | $2.47 | Dividend yield | N/A |

| 200-day MA | $2.24 | Market Cap | 925.12M |

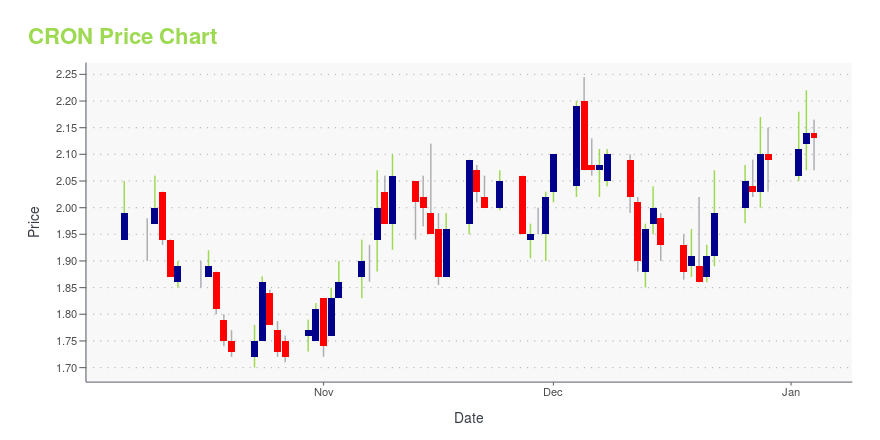

CRON Stock Price Chart Interactive Chart >

Cronos Group Inc. - Common Share (CRON) Company Bio

Cronos Group seeks to invest in companies either licensed, or actively seeking a license, to produce medical marijuana pursuant to Canada’s Marihuana for Medical Purposes Regulations. The firm typically invests in companies based in Canada. Cronos Group was founded in January, 2013 and is based in Toronto, Canada.

Latest CRON News From Around the Web

Below are the latest news stories about CRONOS GROUP INC that investors may wish to consider to help them evaluate CRON as an investment opportunity.

Low-Cost, High-Potential: 3 Stocks Under $5 with Surprising UpsideThese are the attractive stocks under $5 to buy for multibagger returns. |

12 Most Profitable Pot Stocks NowIn this piece, we will take a look at the 12 most profitable pot stocks now. If you want to skip our overview of the pot and cannabis industry, then you can skip ahead to 5 Most Profitable Pot Stocks Now. Pot, marijuana, or cannabis is one of the oldest drugs in the world. Since […] |

An Atrocious Year For Canadian Cannabis LP Stocks Index: Down 64% YTDThe Canadian Cannabis LP Stocks Index is DOWN 1% so far in December and is now down 64% YTD on top of a 71% decline in 2022 and a 61% decline in 2021. |

3 Stocks Under $3 That Can Trade in Double Digits by 2025These are under $3 stocks to buy as they have positive business catalysts that would translate into accelerated growth. |

Week in DeFi: Ledger Compromised AgainLedger’s Connect Kit library was exploited last week, causing outrage from Ledger users. Meanwhile, Rainbow Wallet launches Rainbow Points. Read on to get up to speed on the latest DeFi news! |

CRON Price Returns

| 1-mo | 4.31% |

| 3-mo | -6.56% |

| 6-mo | 23.47% |

| 1-year | 35.96% |

| 3-year | -66.06% |

| 5-year | -83.76% |

| YTD | 15.79% |

| 2023 | -17.72% |

| 2022 | -35.20% |

| 2021 | -43.52% |

| 2020 | -9.52% |

| 2019 | -26.18% |

Continue Researching CRON

Here are a few links from around the web to help you further your research on Cronos Group Inc's stock as an investment opportunity:Cronos Group Inc (CRON) Stock Price | Nasdaq

Cronos Group Inc (CRON) Stock Quote, History and News - Yahoo Finance

Cronos Group Inc (CRON) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...