Citi Trends, Inc. (CTRN): Price and Financial Metrics

CTRN Price/Volume Stats

| Current price | $18.76 | 52-week high | $32.90 |

| Prev. close | $18.69 | 52-week low | $18.25 |

| Day low | $18.64 | Volume | 96,061 |

| Day high | $19.21 | Avg. volume | 114,551 |

| 50-day MA | $21.41 | Dividend yield | N/A |

| 200-day MA | $24.85 | Market Cap | 161.24M |

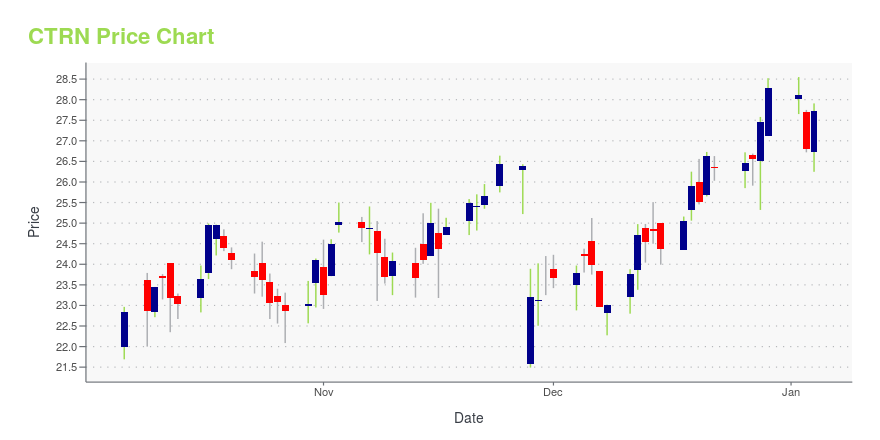

CTRN Stock Price Chart Interactive Chart >

Citi Trends, Inc. (CTRN) Company Bio

Citi Trends operates as a retailer of urban fashion apparel and accessories. The company was founded in 1946 and is based in Savannah, Georgia.

Latest CTRN News From Around the Web

Below are the latest news stories about CITI TRENDS INC that investors may wish to consider to help them evaluate CTRN as an investment opportunity.

Citi Trends Adopts Limited Duration Stockholder Rights PlanSAVANNAH, Ga., December 06, 2023--Citi Trends, Inc. (NASDAQ: CTRN) ("Citi Trends" or the "Company") today announced that its Board of Directors (the "Board") has unanimously adopted a limited duration stockholder rights plan (the "Rights Plan"). |

Citi Trends, Inc. (NASDAQ:CTRN) Q3 2023 Earnings Call TranscriptCiti Trends, Inc. (NASDAQ:CTRN) Q3 2023 Earnings Call Transcript November 28, 2023 Citi Trends, Inc. misses on earnings expectations. Reported EPS is $-0.56 EPS, expectations were $-0.17. Operator: Greetings, and welcome to the Citi Trends Third Quarter 2023 Earnings Conference Call [Operator Instructions]. As a reminder, this conference is being recorded on Tuesday, November 28, […] |

Q3 2023 Citi Trends Inc Earnings CallQ3 2023 Citi Trends Inc Earnings Call |

Wall Street's Rally Resumes As Consumer Confidence SoarsWall Street's rally is resuming this afternoon, after U.S. consumer confidence improved this past month. |

Why Citi Trends Stock Trended Down TodayAfter the company reported an earnings miss this morning, investors need to prepare for another miss in three months. |

CTRN Price Returns

| 1-mo | -13.94% |

| 3-mo | -16.70% |

| 6-mo | -33.00% |

| 1-year | 2.40% |

| 3-year | -76.74% |

| 5-year | 28.89% |

| YTD | -33.66% |

| 2023 | 6.80% |

| 2022 | -72.05% |

| 2021 | 90.72% |

| 2020 | 115.75% |

| 2019 | 15.46% |

Continue Researching CTRN

Want to do more research on Citi Trends Inc's stock and its price? Try the links below:Citi Trends Inc (CTRN) Stock Price | Nasdaq

Citi Trends Inc (CTRN) Stock Quote, History and News - Yahoo Finance

Citi Trends Inc (CTRN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...