CuriosityStream Inc. (CURI): Price and Financial Metrics

CURI Price/Volume Stats

| Current price | $1.12 | 52-week high | $1.55 |

| Prev. close | $1.10 | 52-week low | $0.45 |

| Day low | $1.10 | Volume | 27,494 |

| Day high | $1.15 | Avg. volume | 477,957 |

| 50-day MA | $1.11 | Dividend yield | 8.77% |

| 200-day MA | $0.80 | Market Cap | 60.03M |

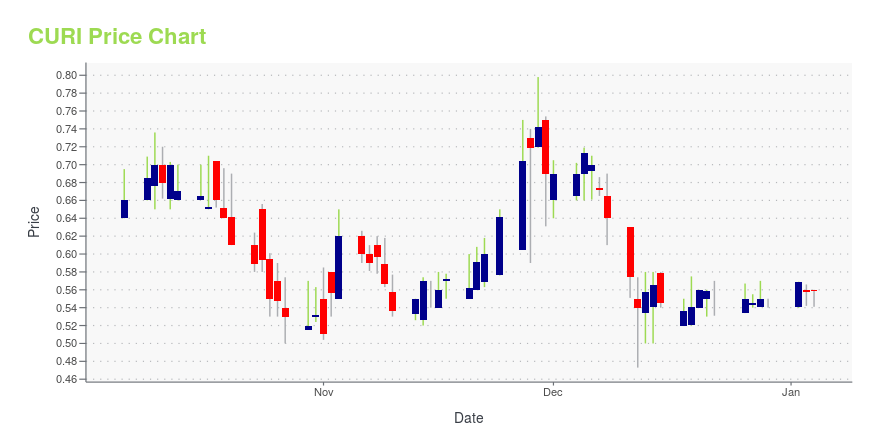

CURI Stock Price Chart Interactive Chart >

CuriosityStream Inc. (CURI) Company Bio

CuriosityStream Inc. operates as a media and entertainment company. It provides premium video programming services in various categories of factual entertainment, including science, history, society, nature, lifestyle, and technology through subscription video on-demand (SVoD) platforms, as well as through bundled content licenses for SVoD and linear offerings, partner bulk sales, brand partnerships, and content sales. The company was founded in 2008 and is based in Silver Spring, Maryland.

Latest CURI News From Around the Web

Below are the latest news stories about CURIOSITYSTREAM INC that investors may wish to consider to help them evaluate CURI as an investment opportunity.

Curiosity Taps International Media Industry Veteran Ludo Dufour as Vice President of LicensingSILVER SPRING, Md., November 28, 2023--Curiosity Inc. (NASDAQ: CURI), a leading global factual entertainment and media company, is delighted to announce the appointment of Ludo Dufour as Vice President of Licensing, effective immediately. In this newly created role, Dufour, an experienced international media executive, joins the team to lead and drive the global licensing of Curiosity’s large and growing portfolio of award-winning factual films, series, and specials. |

CuriosityStream Announces Third Quarter 2023 Financial ResultsSILVER SPRING, Md., November 09, 2023--CuriosityStream Inc. (NASDAQ: CURI), a global factual entertainment company, today announced its financial results for the third quarter ended September 30, 2023. |

CuriosityStream To Report Third Quarter 2023 Financial Results on November 9, 2023SILVER SPRING, Md., November 07, 2023--CuriosityStream Inc. (NASDAQ: CURI), the leading global factual media company, today announced that it will release financial results for the third quarter of 2023 on Thursday, November 9, 2023 after market close. The company will host a Q&A conference call to discuss these results at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) on the same day. Reporters are invited to join the call on a listen-only basis. Participants may dial in, toll-free at (888) 51 |

Journey Beyond: A Spectacular Week of Space Series and Specials Coming to Curiosity StreamSILVER SPRING, Md., August 15, 2023--Get ready to embark on an unforgettable exploration of the Universe as Curiosity Stream announces Space Week: Journey Beyond -- a week+ dedicated to captivating space documentaries and series. Space Week launches Thursday, August 31, 2023, with the world premiere of the Curiosity original special Search for Earth’s Lost Moon – examining an extraordinary discovery close to home that scientists are finding difficult to observe… and even harder to explain. |

CuriosityStream Announces Second Quarter 2023 Financial ResultsSILVER SPRING, Md., August 14, 2023--CuriosityStream Inc. (NASDAQ: CURI), a global factual entertainment company, today announced its financial results for the second quarter ended June 30, 2023. |

CURI Price Returns

| 1-mo | 0.41% |

| 3-mo | 3.12% |

| 6-mo | 96.94% |

| 1-year | 14.19% |

| 3-year | -89.06% |

| 5-year | N/A |

| YTD | 115.67% |

| 2023 | -52.63% |

| 2022 | -80.78% |

| 2021 | -57.49% |

| 2020 | N/A |

| 2019 | N/A |

CURI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...