Civeo Corp. (CVEO): Price and Financial Metrics

CVEO Price/Volume Stats

| Current price | $24.92 | 52-week high | $28.00 |

| Prev. close | $24.86 | 52-week low | $17.98 |

| Day low | $24.87 | Volume | 24,083 |

| Day high | $25.40 | Avg. volume | 51,874 |

| 50-day MA | $24.18 | Dividend yield | 4.04% |

| 200-day MA | $23.42 | Market Cap | 364.33M |

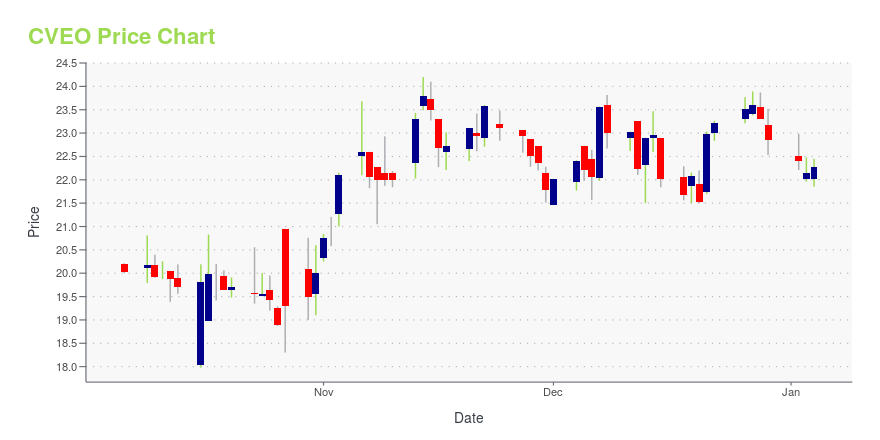

CVEO Stock Price Chart Interactive Chart >

Civeo Corp. (CVEO) Company Bio

Civeo Corporation provides remote site accommodation, logistics, and facility management services to the natural resource industry in Australia, Canada, and the United States. The company develops lodges and villages, open camps, and mobile assets, including modular, skid-mounted accommodation, and central facilities that provide long-term and temporary work force accommodations. It also provides catering and food services, housekeeping, laundry, water and wastewater treatment, power generation, communications, and personnel logistics services, as well as sewage hauling services. The company is based in Houston, Texas.

Latest CVEO News From Around the Web

Below are the latest news stories about CIVEO CORP that investors may wish to consider to help them evaluate CVEO as an investment opportunity.

Zacks.com featured highlights include EMCOR Group, Arcos Dorados, Photronics and CiveoEMCOR Group, Arcos Dorados, Photronics and Civeo are part of the Zacks Screen of the Week article. |

4 Stocks Riding High on Increasing Cash Flow to Buy NowAnalyzing a company's cash position can be rewarding because it reveals its true financial health. EME, ARCO, PLAB and CVEO are worth buying, given their rising cash flows. |

Should Value Investors Buy Civeo (CVEO) Stock?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

The Zacks Analyst Blog Highlights Civeo, Hilton Grand Vacations and InterContinental HotelsCiveo, Hilton Grand Vacations and InterContinental Hotels are part of the Zacks top Analyst Blog. |

Civeo (CVEO)'s Technical Outlook is Bright After Key Golden CrossIs it a good or bad thing when a stock experiences a golden cross technical event? |

CVEO Price Returns

| 1-mo | 0.00% |

| 3-mo | 0.70% |

| 6-mo | 11.65% |

| 1-year | 38.51% |

| 3-year | 23.24% |

| 5-year | 30.72% |

| YTD | 11.41% |

| 2023 | -24.85% |

| 2022 | 62.23% |

| 2021 | 37.91% |

| 2020 | -10.21% |

| 2019 | -9.79% |

CVEO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CVEO

Want to see what other sources are saying about Civeo Corp's financials and stock price? Try the links below:Civeo Corp (CVEO) Stock Price | Nasdaq

Civeo Corp (CVEO) Stock Quote, History and News - Yahoo Finance

Civeo Corp (CVEO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...