DocuSign Inc. (DOCU): Price and Financial Metrics

DOCU Price/Volume Stats

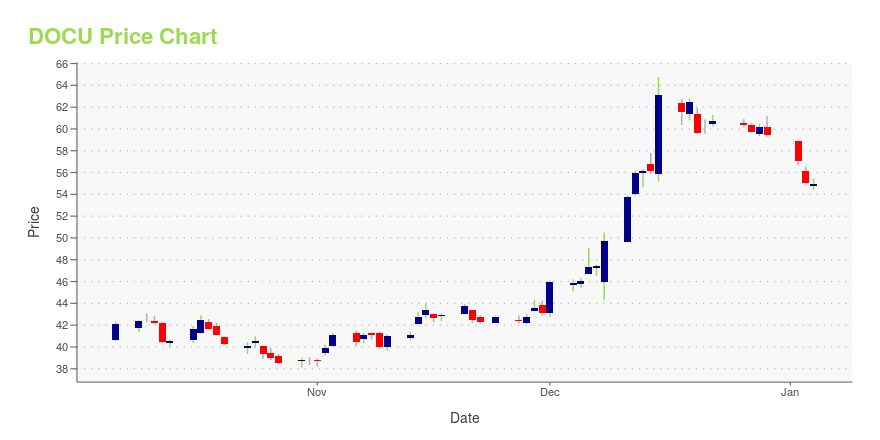

| Current price | $55.90 | 52-week high | $64.76 |

| Prev. close | $55.10 | 52-week low | $38.11 |

| Day low | $55.30 | Volume | 1,008,900 |

| Day high | $56.50 | Avg. volume | 2,837,145 |

| 50-day MA | $54.74 | Dividend yield | N/A |

| 200-day MA | $53.41 | Market Cap | 11.44B |

DOCU Stock Price Chart Interactive Chart >

DocuSign Inc. (DOCU) Company Bio

DocuSign, Inc. is an American company headquartered in San Francisco, California, that allows organizations to manage electronic agreements. As part of the DocuSign Agreement Cloud, DocuSign offers eSignature, a way to sign electronically on different devices. DocuSign has over 1 million customers and hundreds of millions of users in more than 180 countries. Signatures processed by DocuSign are compliant with the US ESIGN Act and the European Union's eIDAS regulation, including EU Advanced and EU, Qualified Signatures. (Source:Wikipedia)

Latest DOCU News From Around the Web

Below are the latest news stories about DOCUSIGN INC that investors may wish to consider to help them evaluate DOCU as an investment opportunity.

3 Stocks to Profit as ‘Remote Work’ Is Here to StayWork-from home and remote work jobs are rising, lending undervalued work-from-home stocks the necessary latitude to surge. |

1 Spectacular Growth Stock Down 80% to Buy Hand Over Fist for 2024This growth stock helps individuals and businesses streamline an inconvenient process. |

DocuSign Inc CFO Blake Grayson Sells 7,018 SharesDocuSign Inc (NASDAQ:DOCU), a company that provides electronic signature solutions, has reported an insider sell according to a recent SEC filing. |

DocuSign's Rebound Spurred by Sale Rumors, Strong ResultsHow the company's recent financial performance and sale speculation signal a potential 60% increase in value |

DocuSign Inc President and CEO Allan Thygesen Sells 92,750 SharesAllan Thygesen, President and CEO of DocuSign Inc (NASDAQ:DOCU), executed a sale of 92,750 shares in the company on December 19, 2023. |

DOCU Price Returns

| 1-mo | 6.09% |

| 3-mo | -2.27% |

| 6-mo | -11.76% |

| 1-year | 5.75% |

| 3-year | -81.66% |

| 5-year | 3.71% |

| YTD | -5.97% |

| 2023 | 7.27% |

| 2022 | -63.61% |

| 2021 | -31.48% |

| 2020 | 199.96% |

| 2019 | 84.91% |

Continue Researching DOCU

Want to do more research on Docusign Inc's stock and its price? Try the links below:Docusign Inc (DOCU) Stock Price | Nasdaq

Docusign Inc (DOCU) Stock Quote, History and News - Yahoo Finance

Docusign Inc (DOCU) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...