Direct Digital Holdings Inc. (DRCT): Price and Financial Metrics

DRCT Price/Volume Stats

| Current price | $4.16 | 52-week high | $35.88 |

| Prev. close | $4.24 | 52-week low | $1.96 |

| Day low | $4.04 | Volume | 43,217 |

| Day high | $4.38 | Avg. volume | 304,647 |

| 50-day MA | $3.77 | Dividend yield | N/A |

| 200-day MA | $9.51 | Market Cap | 59.36M |

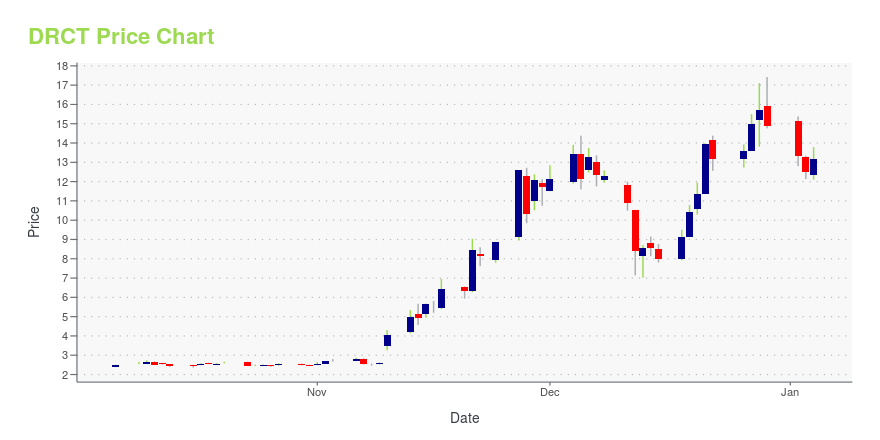

DRCT Stock Price Chart Interactive Chart >

Direct Digital Holdings Inc. (DRCT) Company Bio

Formed in 2018, Direct Digital Holdings provides both a demand-side ad platform (DSP) and a supply-side ad platform (SSP).

Latest DRCT News From Around the Web

Below are the latest news stories about DIRECT DIGITAL HOLDINGS INC that investors may wish to consider to help them evaluate DRCT as an investment opportunity.

Here's Why Momentum in Direct Digital Holdings, Inc. (DRCT) Should Keep goingDirect Digital Holdings, Inc. (DRCT) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen. |

Are Business Services Stocks Lagging Nu (NU) This Year?Here is how Nu Holdings Ltd. (NU) and Direct Digital Holdings, Inc. (DRCT) have performed compared to their sector so far this year. |

Direct Digital Holdings to Participate in the 2024 ICR ConferenceDirect Digital Holdings, Inc. (Nasdaq: DRCT) ("Direct Digital Holdings" or the "Company"), a leading advertising and marketing technology platform operating through its companies Colossus Media, LLC ("Colossus SSP"), Huddled Masses LLC ("Huddled Masses") and Orange142, LLC ("Orange142"), today announced that management will participate in the 2024 ICR Conference on January 8-10, 2024 at the Grande Lakes Resort in Orlando, FL. |

What Makes Direct Digital Holdings, Inc. (DRCT) a Strong Momentum Stock: Buy Now?Does Direct Digital Holdings, Inc. (DRCT) have what it takes to be a top stock pick for momentum investors? Let's find out. |

Is Copart (CPRT) Stock Outpacing Its Business Services Peers This Year?Here is how Copart, Inc. (CPRT) and Direct Digital Holdings, Inc. (DRCT) have performed compared to their sector so far this year. |

DRCT Price Returns

| 1-mo | 11.83% |

| 3-mo | -26.76% |

| 6-mo | -64.51% |

| 1-year | 67.74% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -72.04% |

| 2023 | 513.61% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...